November 14, 2012

The probabilities of the US slipping into another official recession are growing. Don’t tell this to the 50 million people that are reportedly at the poverty level according to a new US Census report. This trend isn’t something new and it certainly is not going to be resolved overnight. We have nearly 47 million Americans receiving food stamps so the probability of slipping into another recession should not come as a shock. The fiscal cliff is not a surprise. We’ve known that unsustainable debt growth would ultimately lead to a day of reckoning. There are now rumors that a patch work for one year is going to be applied to kick the can down deeper into the future. Look at how well this approach is working in Europe. The core problem of this debt crisis has yet to be resolved. Let us examine the recession probability further.

Recession probabilities grow

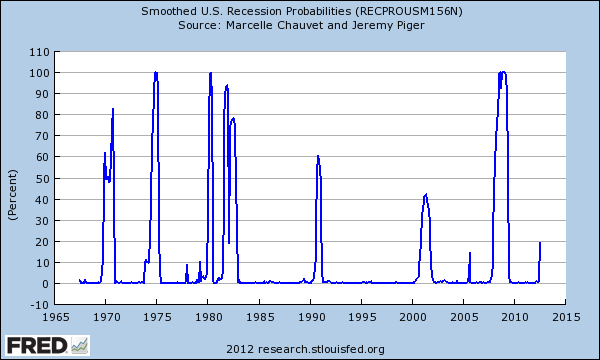

An interesting chart looking at four key economic metrics is put out examining the probability of a future recession:

What does this chart examine?

-1. Non-farm payroll employment-2. Industrial Production-3. Real personal income excluding transfer payments-4. Real manufacturing and trade sales

The recent spike is largely coming from weak income growth and also the tepid manufacturing data. If you broke down the above you would find that this is a fairly solid measure. We are looking at jobs but also how well are households doing in terms of income. There is a growing number of working poor and also a large portion of our society now works in temporary limbo. Many young Americans find that they are being trapped by deep college debt and career paths that are not leading them into any long-term employment.

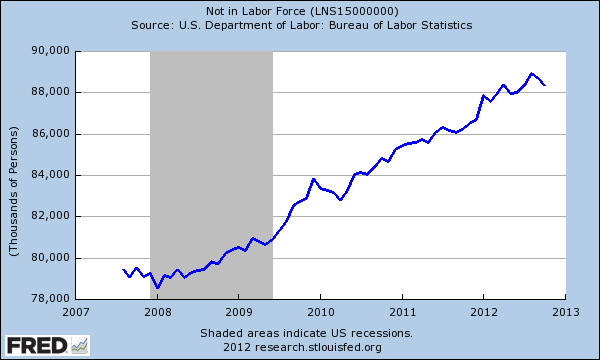

The number of Americans not participating in the labor force is rather large:

This figure will grow with population growth however it has spiked because of the recent deep recession. We’ve added roughly 10,000,000 people into the “not in labor force” category since 2008. What is interesting is that this figure has accelerated even after the recession ended. Part of this also has to do with many older Americans opting out of the employment segment of the economy. You also have many staying or going back to school during tough economic times so this figure grows.

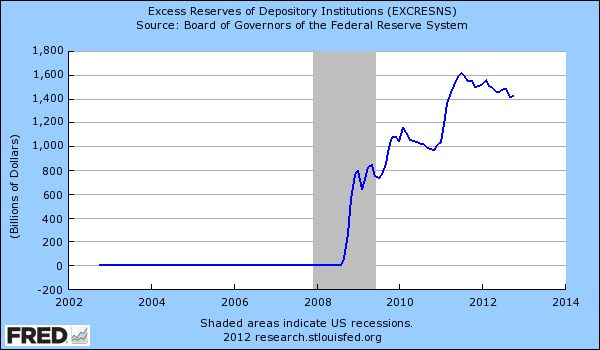

Bank lending?

Banks are also holding onto a large amount of excess reserves:

With banks at the front lines you realize that many are not lending because the economy is still weak. Banks are using this bailout to shore up their own weak balance sheets instead of lending to cash strapped Americans. With interest rates so low, you would expect banks to lend out to consumers to turn a profit. Yet without steady income, it will be hard to repay any sort of loan. The Census figures released this week shed a deeper light on the problems of our economy:

“(WaPo) Based on the revised formula, the number of poor people exceeded the 49 million, or 16 percent of the population, who were living below the poverty line in 2010. That came as more people in the slowly improving economy picked up low-wage jobs last year but still struggled to pay living expenses. The revised poverty rate of 16.1 percent also is higher than the record 46.2 million, or 15 percent, that the government’s official estimate reported in September.”

The recession probability chart is telling and demonstrates that we are still not out of the woods. The sad reality is that 50 million Americans are at or near the poverty level. How can we claim this is a true recovery? Who is really recovering here? This is larger than one political party. The working and middle class largely do not have a voice on the mainstream press. There is some heavy lifting that needs to be done. We have half of our young college graduates in jobs that don’t require college degrees or many are in a worse position, unemployed. The recession probability is 100 percent for tens of millions of Americans.

No comments:

Post a Comment