January 5, 2012

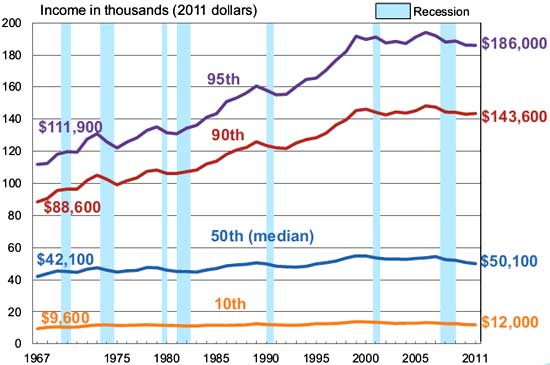

There may be a temporary jubilee with the notion that the fiscal cliff has been deferred for a few months. The media is quick to accept anything for a victory but very little has been done to stop our marching path onward on this massive debt spiral. Many Americans continue to live in poverty with no visible exit. The latest figures show over 47 million Americans on food assistance. Many Americans as they enter their golden years are coming to fully rely on Social Security, a system that was on the table for being cut in the recent debates. Since the Fed is creating asset bubbles and destroying fixed income investments, many older Americans are realizing that retirement is no longer a viable option given the rising costs in food, healthcare, and once again housing. I see this on a monthly basis where you can spot older Americans in non-traditional and many times, temporary employment roles. None of this intervention is ending up in household income. In fact, when we examine real wealth the net worth of American’s is down to the lowest levels since 1969 when adjusting for inflation.

A return home

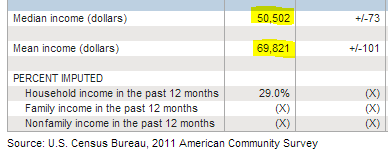

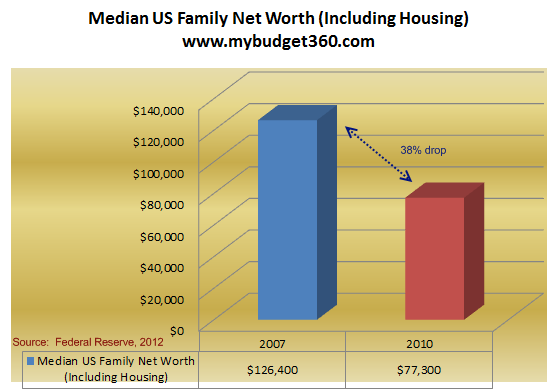

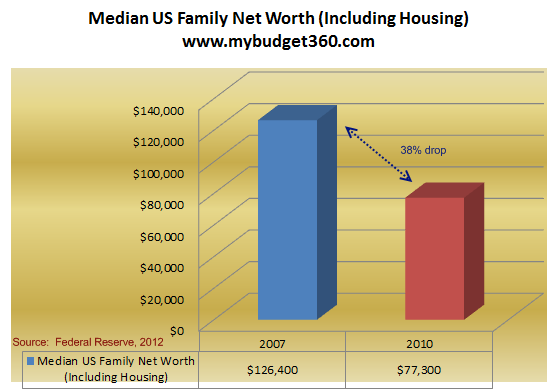

Many baby boomers are being greeted with a grim reality. Retirement may not be an option. A recent paper from New York University highlights some dramatic figures for net worth data from 1983 to 2010. The study found that 2010 median net worth in the United States hit its lowest point since 1969. This research aligns with other figures we have found from the Fed Consumer Finance Survey:

The data shows a crushing blow to the finances for most Americans. The net worth of many Americans fell by nearly 40 percent between 2007 and 2010. A large part of this has to do with the collapse in the housing market. The Fed is trying its best to inflate that market once again but it is coming at a cost. Many retirees rely on fixed income investments and these are taking a beating with quantitative easing. Take a look at bond rates and CD rates and you will realize what a negative interest rate environment looks like.

The problem is that while many retirees have fixed incomes, the cost of items like food and healthcare continue to go up. This becomes a major problem. Keep in mind that most Americans have their wealth tied up in their housing. The only way to unleash this wealth is by selling your property. But then what? The Fed with artificially low interest rates is pushing up home values and rents as well. So a retiree will cash out and then chase the slow eroding power of inflation.

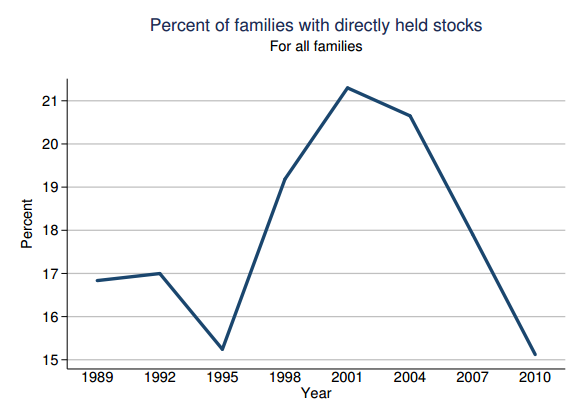

In reality very few families actually own stocks. Only 1 out of 3 Americans actually have any savings so stocks might seem out of the question. Hard to see those 47 million Americans on food stamps investing in the stock market. Below is some data on stock ownership among American families:

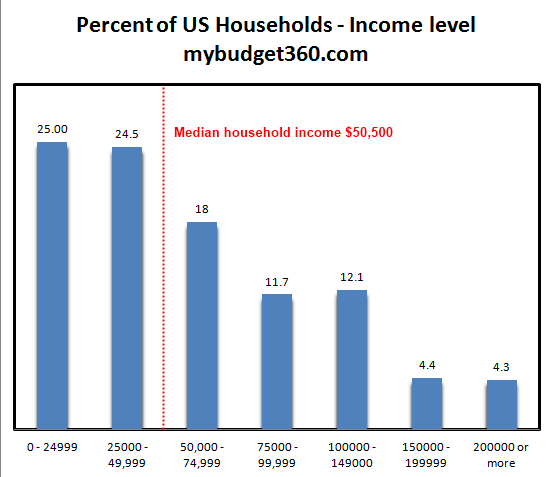

Only about 15 percent of all US families actually own stock outright. So it should come as little surprise that the recent stock rally has had little impact on the income figures for most US households. Many US companies now derive a large portion of their income abroad so they have in many ways decoupled from the US economy. During the recession, many profitable companies used the recession as a time to cut back and push forward on a path of low wage capitalism. This strategy will certainly hurt those planning for retirement.

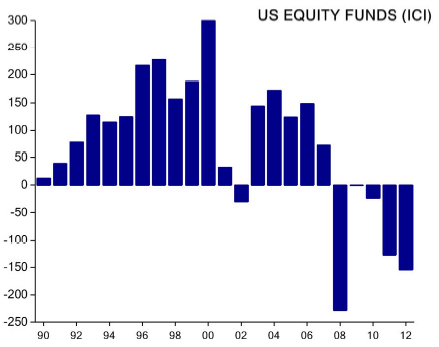

Contrary to popular belief and the 2012 rally, retail investors are pulling money out of equity funds:

Source: ICI

$154 billion was pulled out in 2012. There are a variety of reasons for this including lower cost ETFs but also, for those that built portfolios with funds many have to sell to provide for retirement. We are now seeing 10,000 baby boomers per day reaching retirement age. This is the first time in history that we have had some large group of people save up for retirement in a retail fashion. But now they must sell. After all, there is a purpose to saving for 30 or 40 years. This is to provide for a retirement (and clearly the vast majority did not, or could not). Yet those that did will have to sell and age does not stop for market speculation.

The fact that we have a younger less affluent generation is also going to create some issues. Younger Americans are entering a weak work force and have little illusions about a cushy retirement. In fact, many are not expecting Social Security to be around when their time comes yet today, during more prosperous times many rely on Social Security as their primary source of retirement funding. Are we to expect human behavior is going to change moving forward?

The study found that median US households saw their wealth drop by 18 percent over the studied time period but those in the top one percent saw a gain of 71 percent. The middle class is being squeezed tighter and tighter and the concept of retirement is being turned on its head. There may be no retirement for the middle class but a combination of low wage work supplemented with what is left of Social Security. So far, that seems to be the plan for millions.