June 4, 2015

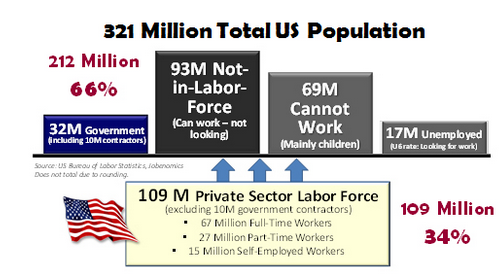

Last month a record 93,194,000 Americans were counted as not being in the labor force. Counted might be the wrong word since this group is largely erased from any employment figures. In fact, this is a large reason why the unemployment rate has fallen so dramatically. Yet one grim financial reality remains. That reality includes the fact that 1 out of 3 Americans is carrying the country financially by working in the private sector. There needs to be a better balance and the working class is already getting slammed in this so-called recovery. If things were so great, why is the battle cry for the 2016 election all about the working and middle class? The stock market is near a peak. Too bad most Americans own no stocks. Housing values are rising. Too bad more home purchases are going to investors versus single families. Debt is more accessible. Too bad it is for items like cars that depreciate immediately once the vehicle is driven off the lot. The employment situation in the US is largely looking like an inverted pyramid.

1 out of 3

In baseball, getting a hit once out of every three at bats would be a good thing. But life and the economy is not a baseball game. Batting .300 is weak when it comes to employment. So it is interesting that we give so little attention to the 93.2 million Americans that now make up the “not in the labor force” category.

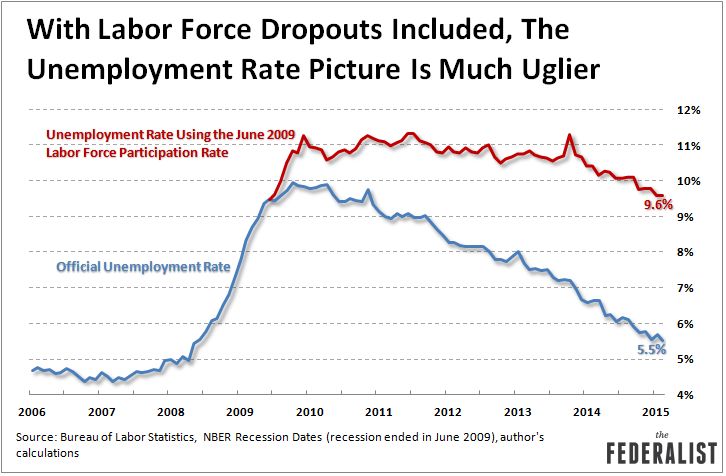

The unemployment rate actually looks really good right now because the participation rate has fallen so dramatically. The math is simple. Count fewer people in the labor force and all of a sudden the unemployment rate looks good. Also, many of the new jobs being added are coming in the form of low wage labor.

The math is rather clear here:

The numbers show an interesting situation. You have 321 million Americans. 109 million work in the private labor force. 69 million can’t work and this group is mostly made up by children. However, that 93.2 million group of not in the labor force is large and is a mix bag of data. This is where the funny math shows up.

Take a look at the unemployment rate in context of the participation rate:

There is a gigantic difference between 9 percent unemployment and 5 percent. Of course when you keep adding people to the not in the labor force category, the unemployment rate simply looks a lot better. One argument we get is that many Americans are simply hitting retirement age. It is one thing to hit retirement age and another thing to stop working completely. We’ve discussed this before and highlight that many older Americans are broke and are living on the edge. Social Security is the one thing keeping many from being destitute on the streets.

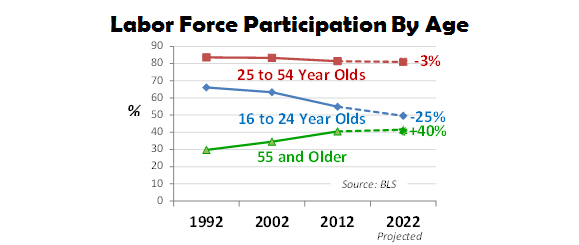

In fact, the labor force participation rate has fallen for nearly everyone 55 and younger:

So much for the old wealthy retiree argument. Many older people have to work not by choice. What is happening is that more wealth is being aggregated in the hands of the few. A large portion of this wealth is part of the “debt machinery” that is causing large inflation across the economy. Those telling you that inflation doesn’t exist are like the group saying there is no large “not in the labor force” category. The cost of the following items has soared since 2000:

-College tuition-Housing-Health care-Food-Energy-Automobiles

Yet somehow, inflation doesn’t exist. What is troubling is this trend is going to continue. We have 1 out of 3 people in the US supporting the rest. As I just mentioned, most older workers (a growing portion of the population) are depending on Social Security for their livelihood. This means more younger workers are needed. Yet many younger workers are part of the low wage job sector. You see how this is setting up for a tough situation in a few years. But like most things, we will simply kick the can down the road until the next crisis hits.