October 13, 2012

There is certainly a cost to a falling US dollar. Many Americans are living the consequences of this multi-decade long trend. The Federal Reserve has only added fuel to this trend but many families are now realizing that there does come a cost to unrelenting debt based solutions to fiscal problems. Shopping at the local grocery store I’ve noticed that some items have doubled in the last few years. Fueling up is also more expensive. The issue with living on a low dollar policy is that eventually, you end up in a low wage capitalist system. The easy money slowly inflates away especially on global items. We are seeing this in the US in various arenas especially with higher education. The end result is that the standard of living for the vast majority of Americans has fallen dramatically in the last few decades.

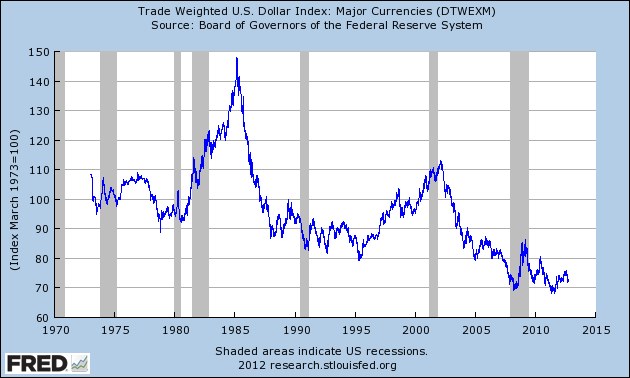

US dollar trend

Think about what this has done in a more practical sense:

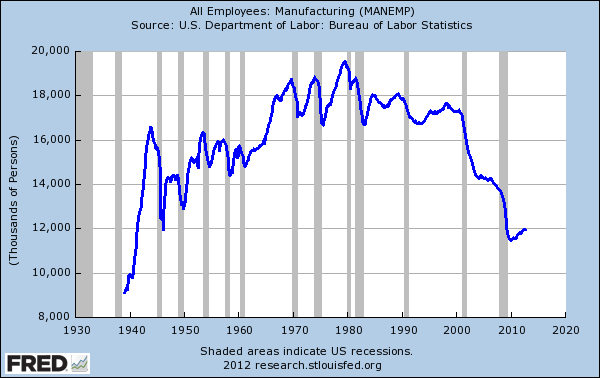

-Energy is more expensive because it is traded on a global market (you are trying to compete with others with a declining currency)-Education. Massive debt has devalued the dollars even further. Very few families can actually afford to pay the sticker price of tuition and need to go into debt just to finance college. Most of the middle class jobs are now in fields that require degrees since the jobs are not growing in manufacturing (that is, making actual things):-Food gets more expensive since you are also competing globally here. Take a look at your grocery bill and compare it to your bill from 10 years ago. This stands in stark contrast to household income that has been stagnant for over a decade.

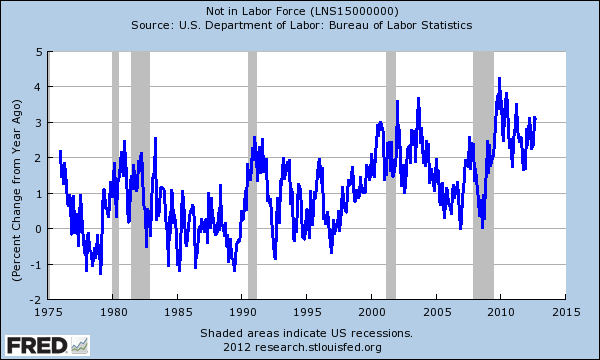

We rarely hear about the massive decline in the US dollar in the mainstream press. This is not likely to come up in any of the campaigns because the Fed and government realize they need to inflate our debt away. Who in their right mind thinks we are ever going to pay off that growing $16 trillion debt? The middle class in the US is a shrinking group. We now have over 46 million Americans on food stamps, a record percentage. We also have a growing number of Americans that do not participate in the labor force:

This is a very important chart to understand. The rate at which people are entering the “not in the labor force” category is growing at record speeds given our demographics. From 1975 to 2000 not once did we touch an annualized 3 percent rate. That was reached. Then when the debt bubble burst, we actually reached a stunning 4 percent annualized rate. Things are dramatically shifting and given that many older Americans rely on Social Security, that declining standard of living is felt even more deeply.

Another outcome of a falling dollar is rising commodity prices. Ultimately you are competing on a global market with a currency that is worth less relative to other currencies. If the Fed with their banking allies and the government are willing to go into massive debt, at what point do other people stop lending? We already see this with our internal mortgage market. The Fed is basically the mortgage market now because no one in their right mind would lend out money for 30 years at these current rates. With this kind of action however you crowd out other investors and hot money flows to largely unproductive sectors. Just look at China and their millions of empty apartments.

Outrageous tuition, increasingly expensive food, energy costs, and stagnant wages are all part of the standard of living compression brought on by these actions. That is great that you are saving $200 bucks a month on your mortgage (behind the scenes the bank can offload these inflated assets and the American public slowly forgets about the biggest financial crisis perpetrated on the nation since the Great Depression). It is going to cost you $50,000 per year to send your kid to a good private college so hopefully that $200 saved per month is going to help. In the end the falling dollar is merely a way to inflate our way out of our massive debt and bailout the banking sector. Most Americans as based by their net worth are not doing financially better.