March 1, 2013

Most Americans are incredibly unprepared when it comes to retirement. The goal posts keep shifting. Now for full retirement under Social Security people will need to retire at 67 versus 65. What is rarely discussed is that rising Medicare premiums are being taken out of monthly payments so the amount being received is already shrinking while the cost of living is going up. One startling piece of information that came out this year was that half of Americans are one tiny emergency away from being flat out broke. No wonder why we have a record 47.6 million Americans now on food stamps. When pensions were phased out starting in the 1980s many thought that the 401k or IRA would be the new way to save. Hey, Americans will stuff their money into the stock market casino and after 30 years, they would have a million dollar nest egg thanks to compounding. How did that work out? Let us take a look at where things stand today.

The net worth of Americans

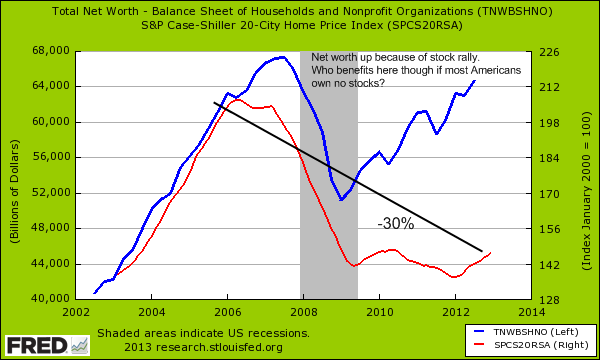

First, it is important to note that most Americans derive their net worth from real estate. More to the point, the equity they have in their homes. The stock market is largely a side show for most especially in today’s market where profits are being driven by overseas profits and cost cutting at home. While the stock market is nearing its peak, real estate is still a long way from recovering all the losses that occurred:

This is problematic for two reasons. The first one is that real estate values are down by nearly 30 percent from their peak but Americans are still paying mortgages that reflect inflated values. Second, the stock market recovery has been driven by hot easy money from the Fed versus organic growth to households wages. As we’ve discussed before, the vast majority of financial wealth (i.e., stocks, bonds, etc) are held by the top 10 percent in the US and do not accurately reflect the health of the majority in the country.

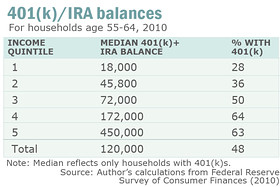

Half of the country has no retirement plan. That is, many will simply depend on Social Security to get by. This is a startling fact given that we are seeing many baby boomers reach retirement age. Since the press rarely covers the other half, let us take a look at those that actually do have a retirement plan. How is the 401k and IRA model working out?

The above data is interesting. This is only looking at people 55 to 64, supposedly those that were given the 401k and IRA path to success back three decades ago. As they near retirement, how do things look? Over half of this group has no retirement plan! Keep in mind this is the baby boomer generation that lived with one of the biggest bull stock markets and also, a very strong real estate market. Even with that said, the median net worth nearing retirement age is $120,000 for those with a 401K or IRAs. At a safe withdrawal rate of 4 percent we are looking at $400 a month for those that actually planned or had the ability to save, let alone the other 52 percent that have no IRA or 401k. Even the “planners” are planning on Social Security as the main source of their retirement funds.

Looking closer at the data, you will realize that many of those even with 401ks and IRAs are woefully unprepared. What the three decade experience has taught us is that the 401k and IRA model really hasn’t worked well for most people.

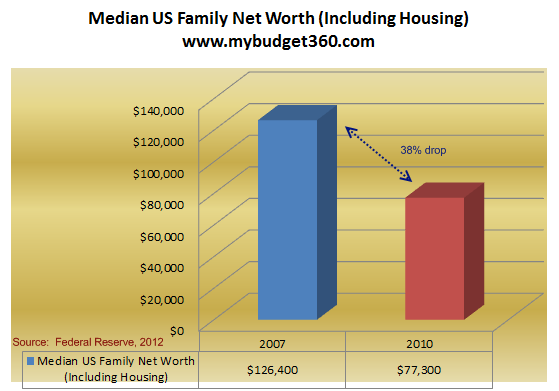

Household net worth has been crushed for most families:

While the stock market is rallying and now the housing market is up, early signs show us that the housing market is being crowded out by investor money. So local families are now competing with large investors that are buying up properties chasing higher yields. Then those that rent, are having to dish out more of their disposable income simply for shelter. No inflation? Only if you are sticking your head in the sand and ignoring reality.

The fact of the matter is retirement has become a distant dream for most. A mirage in the fast money nation where Congress has mostly millionaires looking out for one another. Nothing wrong with making money but do not think that you have a chance gambling in this casino where short-term gains are rewarded via cutting profits or betting on the short side. Now that millions have lost their home via foreclosure, you have Wall Street, primarily the system that created the housing bubble, diving back in to pick up properties on the cheap. They’ll rent these out to you or sell it back to you but for a big profit. Those retirement plans are going to be put on a permanent hold for many. In other words, you are going to work forever.

No comments:

Post a Comment