May 11, 2012

The viable pathway for success for many young Americans seems to have gotten very narrow in the last decade. The opportunities for many young workers have become mired with an economy that is largely in a deep recession with limited quality positions. Many are saddled with debt and taking on employment positions that may not even utilize the very expensive college education some have taken on. Education is important but doing it intelligently has become tougher since we are living in a student loan bubble. Many young Americans have been forced to move back home to live with mom and dad because of the shoddy economy even if they have a job. Each point of data suggests that we will have a less affluent generation coming forward yet this is the generation that is largely going to shoulder the burden of unsupportable government debt? The bill is largely coming due but many younger Americans are already starting with a negative net worth.

Step 1 – Access to higher education saddled with massive student loan debt.

The outsourcing of many blue collar jobs is not a new thing. What is new however is that for the viable white collar jobs a college degree is nearly mandatory. Yet many are being lured into student loan debt by subpar institutions and are finding themselves in unmanageable debt:

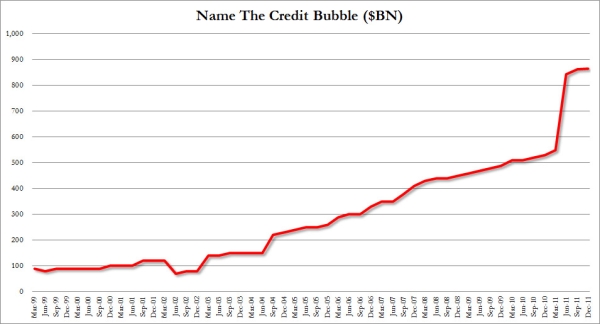

Source: Zero Hedge

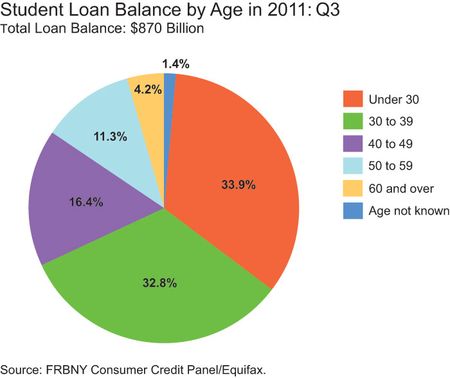

This isn’t exactly a chart you want to be seeing especially when incomes have gone stagnant for younger Americans. The issue as well is that most of this debt is being saddled on the backs of recent graduates:

This is not a good alignment. High student debt and fewer job prospects. In other words, the higher costs are not being reflected on a return on investment (ROI). You have young Americans entering a very weak economy with massive levels of debt. This leads us to the employment side of the equation.

No comments:

Post a Comment