April 10, 2012

The biggest market in the world is the European Union and debt problems are still rippling through the global markets. It is apparent with the financial crisis that the global markets are tied together by large banks and interconnected trade. A problem in the largest market should be unsettling and the unemployment rate in the European Union is now at a 15 year high. The global debt problem was never really solved but papered over with extensions and banking trickery. The US has dealt with much of the debt issues by suspending major accounting rules and stuffing bad loans into the Federal Reserve like a Christmas stocking. The European Union is facing some challenges ahead and all eyes will be watching given the impact of contagion impacts. Greece was only a tiny sliver of the debt issues compared to the major debt restructuring that will be necessary for a large economy like Spain.

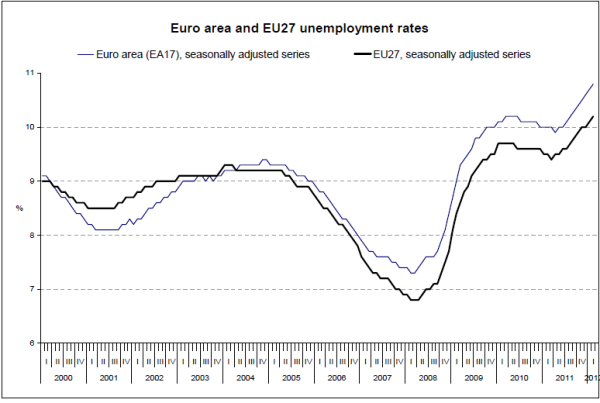

Unemployment in the European Union rising to higher levels

The European Union is facing a very problematic recession. The unemployment rate continues to climb:

The unemployment rate now stands at 10.8 percent. Countries like Spain have an astounding 23.6 percent headline unemployment rate. The young in Spain are facing an unemployment rate above 50 percent which is stunning for a developed market economy. These kinds of structural issues cannot be peppered over with more debt. The issues facing the global markets are based on peak debt situations. Central banks like the Fed and the ECB are dealing with the crisis as if it were based on short-term liquidity issues. Like someone asking you for rent in the middle of the month when your paycheck will not come in until the end of the month. In this case, you know the income is forthcoming and will cover the requested payment. That is not what is impacting the global economy today.

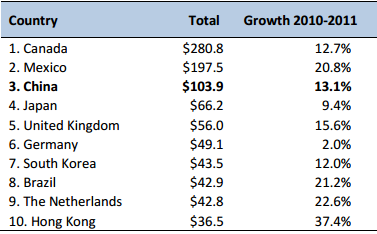

Peak debt has been reached in many cases and when it hits markets are forced to deleverage and price discovery unfortunately is a necessary and painful process. To think that the European issues will stay isolated is unrealistic. If we take a look at our biggest trading partners we will find some familiar names:

Three of our top ten trading partners are in Europe. Not only is this the case, China’s two largest markets for selling goods are the US and Europe. If you look above, China is also a major trade partner with the US. If the crisis deepens further in Europe the rippling impact will be felt throughout the world just like when the crisis caught momentum in 2007.

No comments:

Post a Comment