July 8, 2012

The US economy is facing tremendous financial hurdles in the years to come. The current market is being held together by a flood of debt that is masking underlying issues. Total credit market debt is many times larger than our annual GDP. Student loan debt continues to expand unabated even though the return-on-investment for many college degrees is not worth it. We also have an interesting dynamic where we still do produce manufactured goods but require fewer and fewer workers to conduct these jobs. These challenges will not go away when the last ballot is cast this November. We also have big challenges of taking care of an older generation with a much less affluent and deeply in debt younger generation.

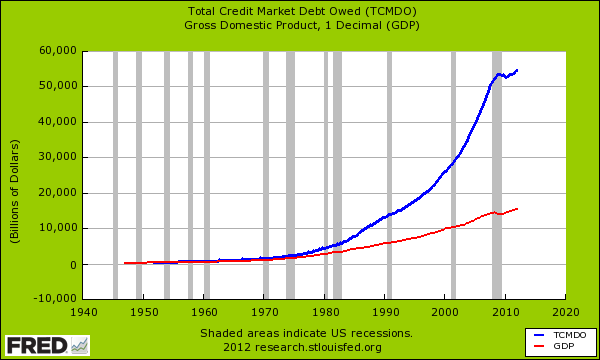

Total credit market debt

The total credit market in the US is over $55 trillion while GDP is roughly $15 trillion. This ratio was not always the case. It is interesting that once the US went off the gold standard in the 1970s did we enter a phase where deficit spending seemed to become the norm. This ballooned in the 1980s and we have yet to look back. Of course this can only continue so long as GDP growth continues to expand at a healthy pace. US GDP growth has slowed dramatically and actually contracted severely during the recession.

Global markets around the world are facing peak debt situations. The solution thus far has been to extend more debt to cover up current existing debt payments. The reality is that central banks would like to inflate the debt away since this would be the gentlest path forward yet this will bring pain to the working and middle class. Ask the unemployed around the world how gentle this path is.

No comments:

Post a Comment