June 28, 2012

The crisis in Europe is boiling over yet again. The central connecting factor of all of this is too much debt relative to production. Debt in itself is not a bad thing. If you borrow modestly for a home and have sufficient income to cover your mortgage payment then this might actually be beneficial. When things go haywire is when you leverage up. You had people buying homes that were 10 to 12 times their annual income. This however is a modest example compared to investment banks that were levered 30-to-1 and in some cases even higher. The issue with the European Union is the lack of cohesion but also the amount of debt relative to their production. True colors do not shine in boom times but do come out in crisis. The issue at hand for the moment is that stronger more productive economies with moderate levels of debt will need to step in if they are to bailout the periphery where debt levels are extreme relative to the local country GDP. Politically you can see how this is not going well. In the US, even though the bailouts were geared heavily in favor of the banks, few doubt the power of the Fed in stepping in and bailing out a big bank in California all the way to New York. This is not exactly the scenario playing out in Europe.

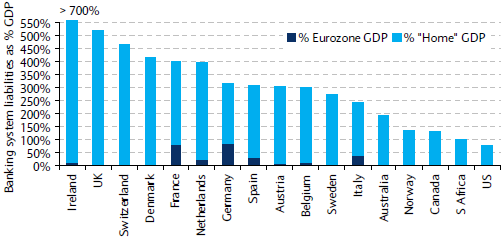

Banking system liabilities

The biggest bank in the US, JP Morgan Chase has liabilities of roughly 13 percent of US GDP. Compare this to the massive banking liabilities of some European banks:

20 European banks have liabilities upwards of 50 percent of their home country GDP! This is just incredible and actually demonstrates the deep issues in the European Union. This weekend there will be talks about methods of backing up all deposits in similar fashion to our FDIC. The problem of course is that you will have systems where banks are more stable like in Germany and France needing to go on the hook for the deposits of other countries with banking systems that are unstable. This is hardly going to go over well and the political changes hitting the EU are centering on who will end up picking up the bill.

No comments:

Post a Comment