April 2, 2012

There are unintended consequences when policy aims at depreciating a currency in favor of bolstering an ailing banking system. The Federal Reserve has been on a multi-decade mission to lower the value of the US dollar. The primary purpose of this mission is to inflate banks into solvency as they try to work their way out of the massive financial crisis. The amount of troubled real estate loans is still impressive when we look at the temporary sanctuary being provided by the Federal Reserve on their overloaded balance sheet. This luxury is not afforded to your common household and consequently many Americans are now facing higher and higher costs in items like energy even though demand is slightly lower. This occurs for a variety of reasons but a main driver is the declining purchasing power of the US dollar. This permeates over into the employment market that is largely being driven by lower wage positions. Inflation is creeping back into the economy.

Consumer inflation now edging back up

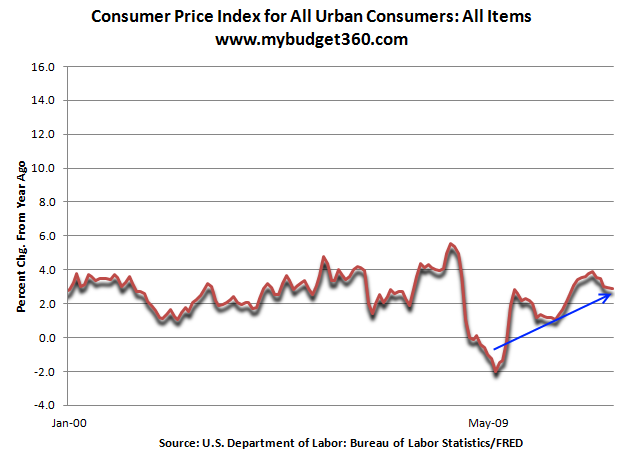

Since our economy is fantastically debt based and debt is the medium of exchange, more debt is likely to produce higher prices given the same amount of goods. Typically this equation is leveled at the money supply but our system is one in which debt rules supreme. While households are in the painful process of deleveraging, debt has increased overall because of banking bailouts but also government spending. For this, we are seeing consumer inflation pickup:

The inflation rate has been moving up since the crisis hit a trough in 2009. Americans are facing higher prices in a variety of sectors including healthcare, energy, food, and higher education. Ironically inflation is hitting in many of the cornerstones of what was once thought to be part of a middle class lifestyle. The recent push in prices has largely come from the higher prices in energy:

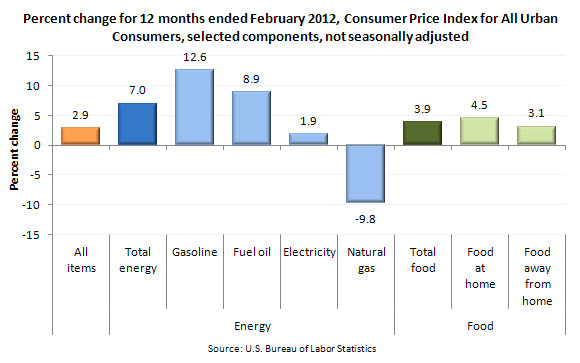

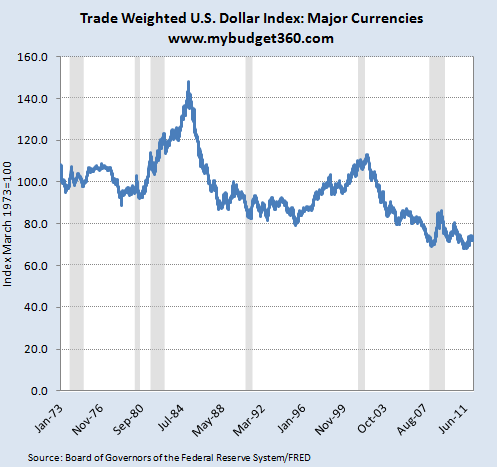

Total energy costs are up 7 percent over the last 12 months while wages have gone stagnant. Gasoline has seen the largest push up in the last year moving up by 12.6 percent. Looking at food, the total cost of food has gone up by 3.9 percent over the last 12 months. Of course much of this is synergistic with the rise in energy given that food is transported and also produced with high levels of energy usage. The interesting point here is that energy usage overall has not necessarily surged in the US to justify this movement. This is largely being driven by an overall depreciation in the US dollar:

The US dollar has lost over 50 percent of its purchasing power since the 1980s. It is no coincidence that global goods like food and energy are now more expensive. This is problematic since Americans are seeing little growth in their wages. The stagnant wage dilemma has been in effect for well over a decade now.

Impact of low wage employment

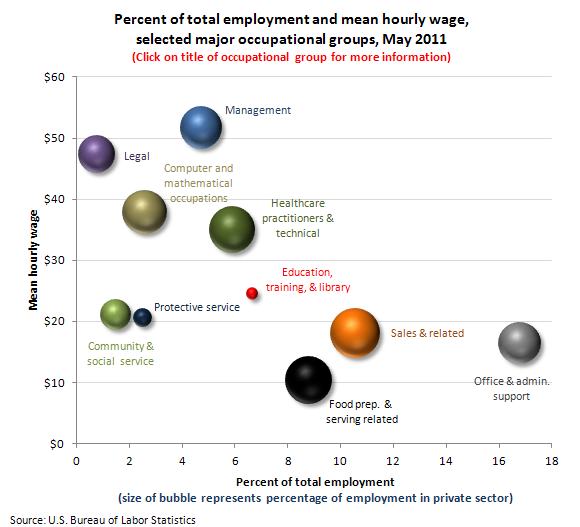

The top three employment fields in our country are:

1. Office and administrative support work2. Sales & Related3. Food preparation and serving related

In the past, a large portion of our labor force was in good paying manufacturing positions. Now, the low wage labor force dominates. This is a major driving force for the slow disappearance of the US middle class. Some of the higher paying positions require high levels of specialization and schooling, certainly in healthcare and technology positions. These industries however employ a smaller part of the entire labor force as the chart above indicates.

Overall there are many challenges looming on the horizon. There is definitely a divide in the country where the middle class is shrinking. Many of the good paying jobs are in what are known as the STEM fields (science, technology, engineering, math) and on the flip side you have many colleges for example catering to fields that are lower paying yet charging absurd fees pushing many students into enormous debt. The for-profits in many cases produce degrees that yield very little return once students graduate.

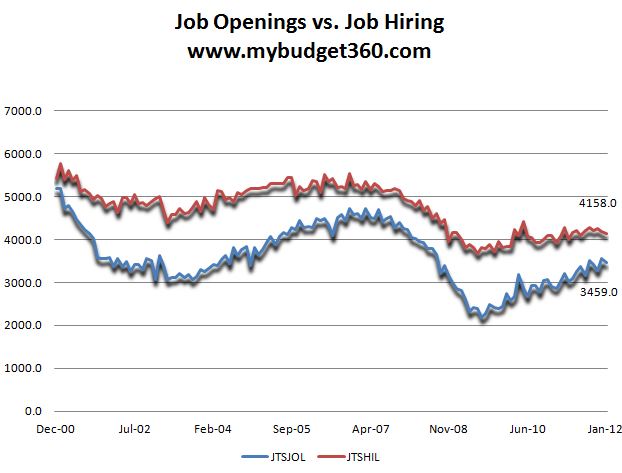

This is why another interesting chart to examine is the number of positions opening up and those being hired:

While job opening have certainly moved higher up, I find it interesting that actual hires have been rather steady since the recession ended. Could it be that many of the jobs in demand are simply not finding the needed skills in the current market? This trend is likely to accelerate and many on the edge of the middle class are being pushed off into the working poor. 46,000,000 Americans are on food stamps even though we are years into a recovery. Since many of these people have less disposable income and a larger portion of their money goes to food and energy, the massive inflation in these two segments of our economy are going to hit them much deeper. If you look at banking profits thanks to generous bailouts by the Federal Reserve and subsequent depreciation of the dollar impacting the working poor, you should get a better sense which segment of our population is taking the brunt of this economic restructuring.

No comments:

Post a Comment