February 7, 2012

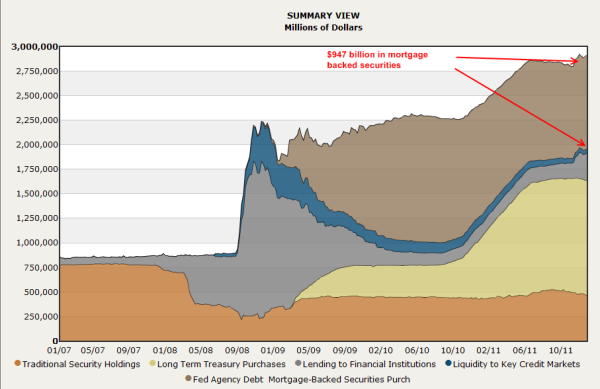

The Federal Reserve continues a secretive bailout of the banking system by purchasing more and more questionable mortgage backed securities. You would think that $1 trillion would catch the attention of the media but they seemed focus on other trivial items. The Fed balance sheet is still at record levels above $2.8 trillion to be exact, but the more troubling aspect of all of this is the amount of mortgage backed securities they have purchased. They continue to hoard toxic commercial real estate loans and a massive amount of residential mortgage backed securities. How much? The Fed now holds over $947 billion in mortgage backed securities. Keep in mind that prior to this financial crisis the Fed rarely held anything else except quality paper on its balance sheet. Yet this is the cost of the shadow financial bailout.

The shadow bailout of the financial system

The Fed continues to artificially interfere with the market by purchasing securities that have little demand in the real marketplace. Because of this, the Fed balance sheet looks like a dumping ground for toxic paper:

Examine the above chart very carefully. Prior to 2008 the Fed principally held traditionalsecurity holdings “aka things not toxic” but now a large portion of their portfolio is toxic paper. When we say toxic we mean that the Fed is overpaying and storing these paper assets like a nuclear waste facility. At some point, people need to recognize what is being pushed into the Fed balance sheet. The banking system has failed to deal with these problems or to confront them head on. Most of the loans in the balance sheet are backed by the ailing real estate market.

No comments:

Post a Comment