July 5, 2014

Young Americans continue to carry a heavy burden brought on by the Great Recession. A recent analysis conducted on US Census data found that 40 percent of unemployed workers are Millennials. Many young workers are simply trying to start their careers and each year that passes is a year where retirement planning is delayed, savings are put on the shelf, and the machinery of spending is put on ice. Young Americans are a key spending demographic. Many will look to purchase their first home. Many are out in the market to purchase cars. Vacations and spending are common characteristics of this group assuming they have the money to spend. Unfortunately with such a large portion of our unemployed coming from the young, we are seeing new demographic trends hitting the market. The housing market is seeing a smaller number of first time home buyers in spite of very low mortgage interest rates. Many are saddled with back breaking levels of student debt and default rates are highest among this debt class. In the US, being young increases your odds of being unemployed.

Young and unemployed

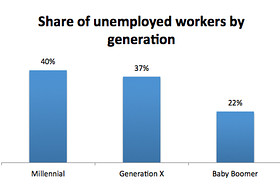

The Great Recession has had a far reaching impact on all age cohorts. But it is undeniable that the impact it has had on young Americans has been disproportionately large. So it should not come as a surprise that Millennials make up the bulk of those currently unemployed in the US:

“(MarketWatch) Some 40% of unemployed workers are millennials, according to an analysis of U.S. Census data by the Georgetown University Center on Education and the Workforce released to MarketWatch, greater than Generation X (37%) and baby boomers (23%). That equates to 4.6 million unemployed millennials — 2 million long-term — 4.2 million unemployed Xers and 2.5 million jobless baby boomers.”

Generation X isn’t fairing so much better either making up 37 percent of the unemployed:

Young Americans are very likely going to see a decline in their standard of living relative to that of their parents. Keep in mind that many older Americans are fully unprepared for retirement so we are looking at those financially unprepared to those with absolutely no savings. The end result is that economic struggles continue to impact the country.

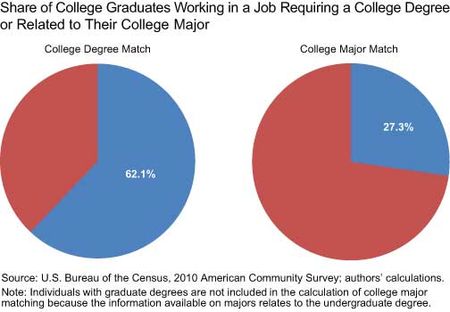

At the core, we are facing an unemployment crisis of the young. Many are giving up and simply taking on low wage jobs if they can find one to pay the bills. We continue to tout that we have a record level of college educated Americans but then we see stats showing that only 27 percent of college grads work in fields that relate to their degree:

When you are paying the current sticker price for college, you should expect better results.

Young and unemployed impacting housing market

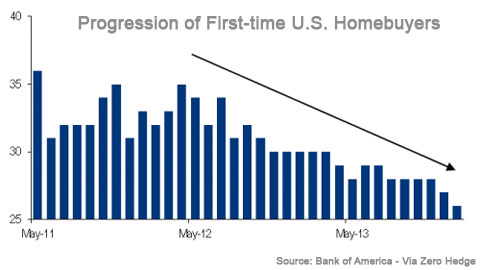

This is a bigger issue because many young workers are also first in line to purchase homes. Purchased homes usually need to be filled with furniture and other consumer items (i.e., fridges, ovens, sofas, etc). You also need to build those homes which means jobs for construction, plumbing, and all the other ancillary services that go into putting together a property. Because young Americans are having such a tough time, first time home buyers are not leading the charge in a housing recovery:

Where is the housing recovery here? Investors are buying in droves but regular families are not buying at a historical rate. Until young workers have steadier work and healthier paychecks, expect to see this trend continue.

Having this many young Americans unemployed is not good. We need to remember that 70 percent of our economy is built on consumption and because of life stages, young Americans will spend more if they can do so. Those entering retirement age simply spend less (i.e., they might already own their home, no need for large purchases, shifting spending to healthcare, etc). The longer this goes on, the harder it will be to reset the timing on this big cohort of Americans.

We have yet to see a steady healthy growth of good paying jobs for Americans. And when the young make up the bulk of your unemployed, you know you will have problems down the road.

No comments:

Post a Comment