February 16, 2014

There are significant consequences with the Fed continuing on course with Quantitative Easing. On paper, it may seem that all is fine on the home front. However, many regular Americans are finding it harder to purchase a home in spite of a low interest rate environment. The Fed has created perverse incentives where big banks are leveraging low rates to invest in single family homes. This used to be a staple of asset growth for Americans but that is now waning. American households are cash strapped and having a lower rate does very little if incomes are not growing. Yet banks suddenly have a giant interest in being involved in the housing market. Why stop at being satisfied with an inflated stock market? The ability to access debt has been key to the re-inflation of this bubble. If you look at the mortgage-backed securities (MBS) market you will clearly see that the Fed is now the major player in this segment of the market.

Fed is the housing market

Simply put, the Fed is the housing market. They are driving the biggest asset class in America by their manipulation of interest rates but also the amount of MBS they own. The results have been to increase the massive inequality in the nation. Sure, most Americans don’t own stocks but housing was one area where most Americans did own. And many Americans did not have to worry about competing with investors or big banks in their neighborhoods when trying to purchase a home.

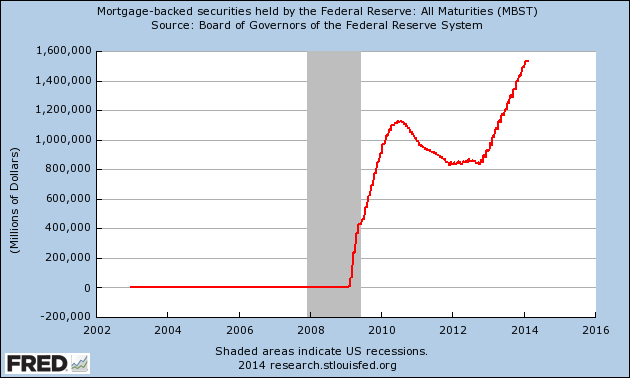

The market, if we can even call it that, is now dominated by the Fed and big banks are using this crony system to buy up large pieces of American real estate. Take a look at the growth of MBS on the Fed’s balance sheet:

The Fed went from owning zero in MBS all the way to the current $1.5 trillion. The Fed is a massive portion of the market and is buying up nearly 100 percent of all issued MBS. This has also caused massive volatility in the bond market. Yet the end result is that homeownership overall is actually down for Americans because a large portion of the buying is going to Wall Street and big banks.

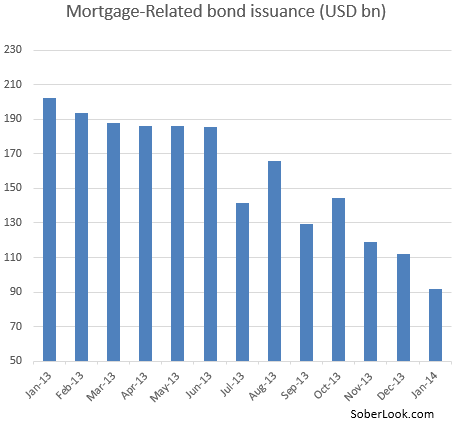

You can even see this on the private side with MBS issuances:

What need is there to grow this portion of the market if the Fed is dominating it so dramatically? There is little incentive to make this more competitive when banks instead of helping American homeowners are actually buying up massive amounts of homes with the corporate financial welfare of the Fed. Driving up prices with no subsequent growth in incomes is not a healthy policy.

Since the Fed has intervened we have seen roughly 30 percent of all home purchase going to investors:

“(NAR) All-cash sales comprised 32 percent of transactions in December, unchanged from November; they were 29 percent in December 2012. Individual investors, who account for many cash sales, purchased 21 percent of homes in December, up from 19 percent in November, but are unchanged from December 2012.”

This has created a new form of a Gilded Age society because inequality continues to rise and home prices rising with no real substantive growth in income is not useful. What does it matter if a regular home buyer has access to a mortgage at a 4 percent interest rate when connected banks can leverage debt at close to zero percent?

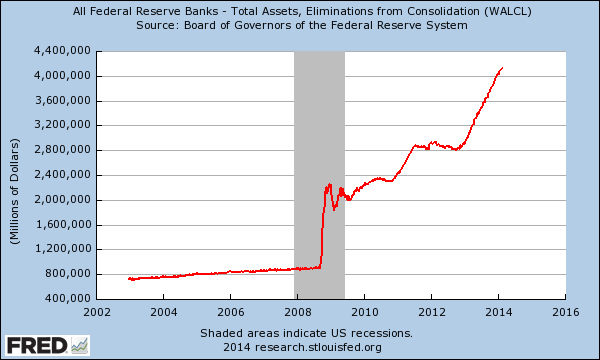

The Fed’s balance sheet continues to grow out of control because this entire market is built on access to cheap debt, debt that is largely going to a select few:

A drop in homeownership, massive investor buying, a re-inflation of the housing bubble. Glad the Fed is looking out for regular Americans.

No comments:

Post a Comment