February 5, 2014

When you live life as a hammer, everything must appear like a nail. So when our economy is run and operated by thefinancial industry, everything must appear like a casino just asking for it in terms of speculation. Such is the state of affairs in a crony capitalistic system. The term gets thrown around but in reality, we do have a system that is punishing the working and middle class in favor of a small connected financially elite. The financial sector in our economy is so powerful, that the biggest financial meltdown in our generation resulted in nothing more than a hand slap and not one heartbeat was skipped on those big banking bonuses. In the meantime the middle class continues to shrink and young Americans are swimming in oceans of student debt. Many are graduating into a tough economy where the market is flooded with low wage jobs. Is this crony financial system benefitting young Americans?

How cronyism hinders economic growth for the young

Take what you can capitalism. We have become a culture that is conditioned on debt. Only a few decades ago, it was feasible for a student to work part-time and pay for a public education. This was manageable and doable. Yet those days are fully gone because inflation has devoured the purchasing power of the dollar. In the cost of higher education, the costs have far outpaced any real growth in incomes. This is why trying to juggle a part-time job and college is not going to cover your costs, but a generation ago this was extremely common. How did this get out of hand? First, the government backs most of the student debt out there. However, the financial industry has co-opted a large part of this market as well. The system also does not allow for student debt to be discharged in bankruptcy and you have nearly the perfect design for a modern day debtor’s prison.

A closed loop system and the young are not part of this club. They are the meat that gets put into the financial grinder.

Think college costs are moving up in a normal way? Take a look at this chart:

This is fascinating. While people scream about the rise in medical care (which is out of control in itself) we find that college tuition is in a league of its own. Since 1978 the cost of a new car has gone up around 95 percent. Medical care? A whopping 613 percent. You would think this is hard to beat but college tuition and fees are up a jaw dropping 1,140 percent. Then you wonder why we have $1.2 trillion in student debt outstanding and delinquencies at record highs.

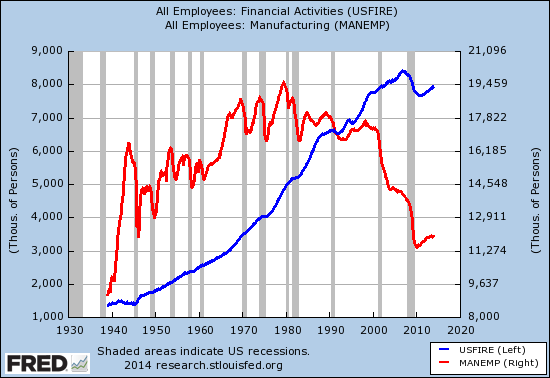

This is a problem of pigs at the trough. The banking industry loves the profits here. We’ve also had the surge of for-profit institutions that operate virtually as paper mills. A college degree is more of a necessity for moving into the shrinking middle class because we have decimated our manufacturing sector:

At the same time we have created a boom for those that work in the financial sector. So the system is self-perpetuating an addiction to those that work in finance. This trend has larger macro consequences in the economy. There is little doubt that our massive housing bubble was brought on by an industry that saw the full potential of turning a boring item like housing into a speculative casino. It is also no surprise that banks are at it again buying up a large portion of single family homes and crowding out young families merely looking for a home to start off with. The young are battling it out in a system full of financial landmines and it would appear that the only way to play is to go into debt via the banking system. In other words, the game is rigged when housing, college, and auto debt to name a few all depend on an intricate network of financing.

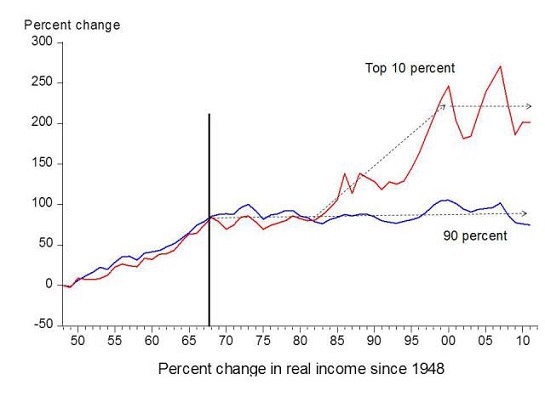

Not all debt is bad of course. This is necessary for an economy. But to make it essential? That is when things become squirrely. Yet you can see how out of hand it gets with items like tuition. And why wouldn’t prices get out of hand? This is a guarantee to the financial sector backed by the US government. Inflation isn’t an issue when incomes are rising but they are not, at least for most of the population:

For the bottom 90 percent of Americans, real income growth has gone stagnant since the 1980s. This is not the case for the top 10 percent. Rising inequality is at record levels. Much of this is being pulled in by the big financial apparatus that is now usurping the power of government. In our current system, money literally buys you votes and power in D.C. and this money is filtered back through the Wall Street machinery. The chart above shows magnificent success for a few but not the majority of the country. The young are going to college at the most expensive time in history and exiting into a workforce where low wages and low benefits dominate. Crony capitalism similar to an aristocracy favors those with access to capital and established power, not necessarily merit or talent. This is how you get CEOs of financial institutions imploding the economy but leaving with multi-million dollar paydays. It wasn’t the young that led the economy into a ditch but are paying for pulling the car out.

No comments:

Post a Comment