January 8, 2014

Only those deep in denial think that inflation is not occurring in the economy. You only need to look back 10 years to see how nutty things have become. Is the price of a car more or less than it was 10 years ago? How about the price of tuition? Real estate? Healthcare? Inflation is alive and well in the economy. You even have many cases at grocery stores where you pay the same for less. Sure, the price didn’t go up but you are paying more for less of the product in what is usually termed dis-inflation. Access to debt has created some of the biggest bubbles in spite of real household income falling back to levels last seen in the 1980s. This is why juiced up sectors like real estate and higher education are seeing runaway price hikes. Say hello to my little friend, inflation.

Shrinkage in the package

I’ve noticed a good number of examples with companies shrinking packages to mitigate rising costs or to squeeze out more profits. This has occurred with chips, crackers, and even tuna cans. The latest product to go this way is with the popular Chobani brand of yogurt:

“(CNBC) Shrink a product and customers will notice, Chobani recently found out when it downsized some of its yogurts early last month.Following the move, many fans logged onto Facebook and Twitter to complain of yogurts that shrank to 5.3 ounces from 6 ounces – a roughly 12-percent decrease.“We kind of wanted to be more consistent with ourselves and the category more,” said Peter McGuinness, Chobani’s chief marketing and brand officer, noting that most competitors’ single-serve yogurts are 5.3 ounces, as are several of Chobani’s recently launched products. Before the switch, customers often wondered why Chobani’s larger yogurts contained more calories and sugar than rival cups.”

It is interesting to see this unfold. Now on the CPI scale, this change doesn’t register as inflation since the price for the same product is the same. But you are getting less. Of course the CPI misses a lot of important things including using the owner’s equivalent of rent (OER) measure instead of your actual PITI from your mortgage payment. This makes no sense even though it missed the first housing bubble entirely and is missing inflation yet again in the raging housing market.

One of the most massively debt addicted sectors is with higher education.

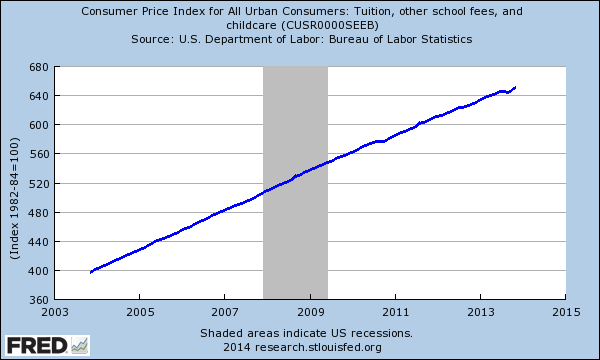

CPI tuition component up 60 percent in last 10 years

The CPI looks at tuition and misses other items like books, fees, and other costs associated with going to college that have also seen stunning rises in cost. Even with that said, the CPI has registered an impressive 60 percent increase in tuition over the last 10 years:

Of course there is no 60 percent rise in incomes for young college graduates. What do you expect from a sector that doesn’t examine the ability to repay debts carefully? This is why you can have for-profit paper mills taking in billions of dollars mostly because of government subsidies.

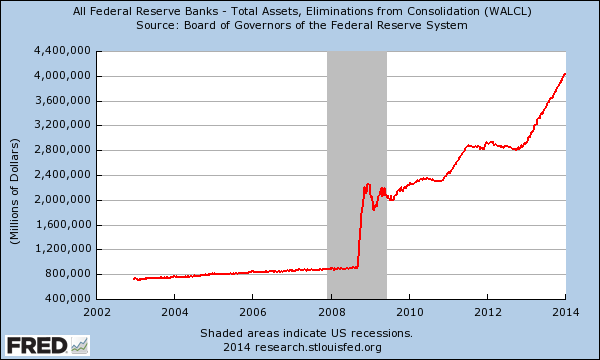

Fed balance sheet

While one bubble is blowing in the east, another bubble is blowing in the west. The Fed has allowed banks to recover via a shadow bailout and has created an artificial system where banks have prime pickings of distressed real estate crowding out regular income constrained households. The outcome? A massive amount of buying in single-family homes is now from investors. Home prices are up 13 percent over the year yet incomes are not. Here is the Fed’s balance sheet:

The result? More income from cash strapped households is now going to rents or mortgages. In other words, too much debt chasing too few goods.

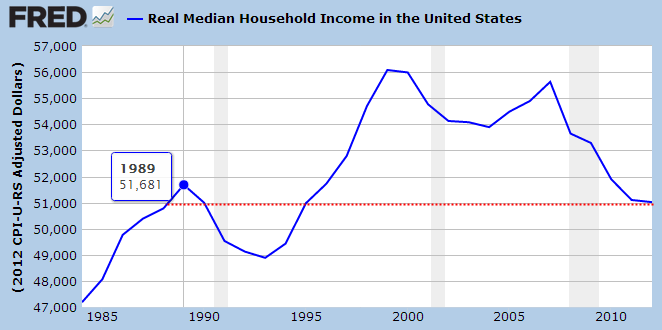

Real income and total credit market debt

All of this would be of little concern if incomes were actually rising. They are not:

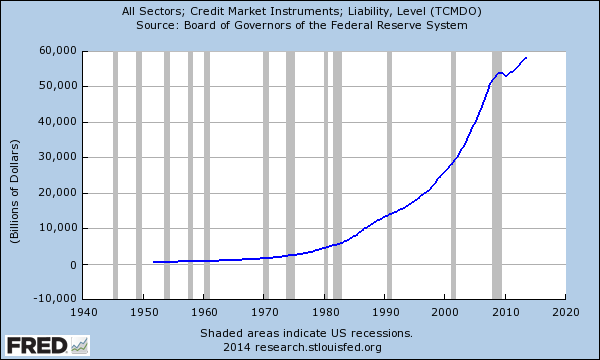

Real household incomes are back to levels last seen nearly a generation ago. Of course, most of the recent gains have gone to the top 10 percent of our population that control 75 percent of all wealth in the system. How does the public keep up then with these rising costs? By going into deep debt yet again:

The total amount of debt outstanding didn’t even skip a beat in this crisis. Last year, over 90 percent of non-housing debt growth occurred because of auto loans and student debt. Who in the world believes that inflation is not occurring? It really is time to say to our new friend, inflation.

No comments:

Post a Comment