June 17, 2013

Inflation in the United States is largely seen as a built in part of our economy. People take it for granted as if this was simply the order of things. Yet our central banking system has inflated our debt based financial system and subsequently, the value of money has eroded. For example, most items that are financed through debt have increased dramatically during a time when household income has reverted to inflation adjusted levels of the 1990s. The cost of inflation is hidden of course from the eyes of the public as to not shock people into action. Playing with interest rates, a car that once cost $20,000 is now going for $30,000 but the monthly payment has remained the same thanks to theFed’s unrelenting push to lower interest rates. There is a cost to all of this of course. If it were so simple to fix an economy, the Fed would simply send unlimited debit cards to each and every American. Inflation is a threat to the economy from the perspective that it destroys the purchasing power of working and middle class Americans, those with limited access to debt. In our economy, debt provides access to real assets and those with the most access to debt (banks) can lock into the larger share of assets (i.e., banks now buying up thousands of rental properties). Is inflation a main culprit in the two income trap?

Where inflation hurts

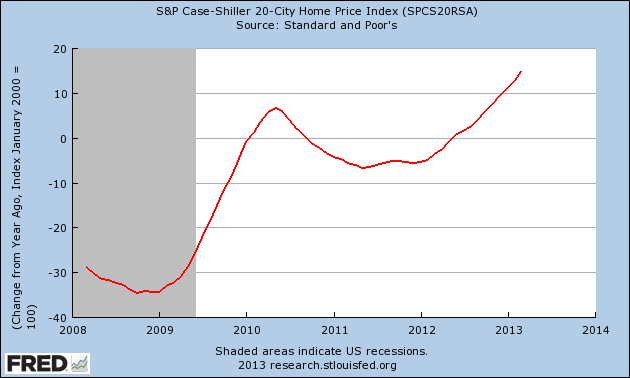

Americans store most of their wealth in real estate. So you would think that the rise in real estate values is a good thing:

Nationwide, home values are now increasing at a double-digit annual pace. The only problem is that this is coming in the form of big money crowding out regular home buyers. The data is convincing. Nearly one out of four purchases for the last few years has come from investors. The battle for limited homes in places like Arizona and Nevada has created a secondary bubble. Regular people may not even know that inflation is occurring but the only reason this is happening is that low rates are putting pressure on real assets in the economy. In the end, you pay more but your monthly payment is likely to remain the same. The public for the most part does not pay attention to what the Federal Reserve does.

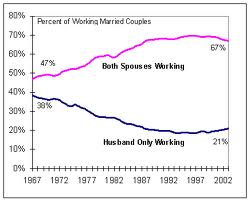

The impact of this on real estate is the pressure on rents and home values. This would be fine if household incomes were going up. But many families in the US are now in a two income trap simply to keep up. In the past, it was possible to purchase a home, go to college, and pay for basic necessities with one blue collar job without going into massive debt. That seems so “old school” but that was the nucleus of the US middle class. That is no longer the case:

Adjusting for inflation, Americans now have less discretionary income compared to a 1970s family and have much higher fixed costs. Is this a positive revelation? Probably not and families are struggling to send their kids to college and also are having a harder time saving for retirement. It is interesting because more families now have two incomes under one roof instead of one:

It is great when both spouses are working because they are doing it out of their desire for career growth and professional development. It is another thing when both working adults in a household need to work simply to put food on the table and make ends meet to pay the mortgage. Also, childcare and other costs eat into any additional income that is brought into the household.

The basic needs

The basic needs of daily life are getting more expensive on an annual basis. We hear about computing costs getting lower but most of your money will go to food, energy, housing, and other expenses like college and healthcare. The bulk goes to housing (over one-third for most households) so the rise in home values of double-digits with no subsequent growth in income is an inflationary trap. The price of a home just got much more expensive but the monthly payment in a sneaky way stayed the same.

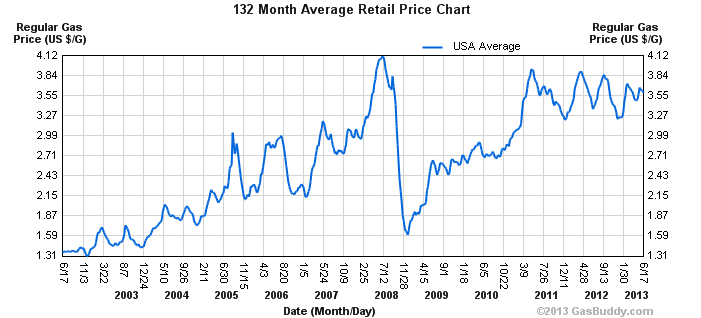

Take a look at how much it costs to fuel your car:

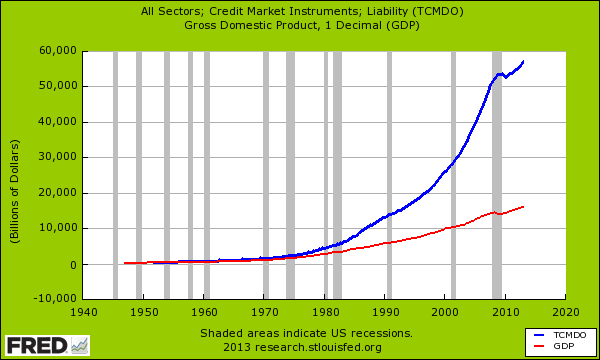

In the last 10 years, the cost of a regular gallon of gas has gone up 270 percent. Has household income gone up 270 percent? College costs have soared even more dramatically pushing the total student debt outstanding to well over $1 trillion. A family trying to get ahead needs to go into massive debt just to keep up. How else will the median household income of $50,000 pay for a college education for their kids? Since blue collar jobs are no longer an entry point into the middle class, most of the new emerging middle class jobs do require a set of tangible skills. This is why the total credit market has ballooned in the last few decades detaching from GDP:

Up until the 1970s the total debt market kept track with total GDP. This is no longer the case. Total debt is multiple times larger than GDP (total debt outstanding is approaching $60 trillion). For many families, the two income household is simply a way of keeping up as inflation erodes purchasing power. Many may not see it directly since the dollars coming in seem the same (they are for the most part) but what they are able to buy in the marketplace has decreased:

-That $100,000 home is now $150,000-That $20,000 car is now $30,000-That $2,500 state school education is now $10,000

This is how inflation has pushed more and more people into a two income trap. Inflation is a subtle economic force and many people don’t realize that for years, this slow erosion has made them poorer. Two incomes are a necessity for many, not a luxury.

No comments:

Post a Comment