June 7, 2013

The American economy has developed a deep disconnect between its financial markets and the working and middle class. The stock market has soared by 138 percent from the low reached in 2009. Yet very little of this has trickled down to the majority of Americans. In fact, most Americans actually saw little to negative growth in their net worth over this period. Even more problematic is the emergence of a permanent working poor in spite of a booming stock market. Over 47 million Americans are still receiving food stamps on a monthly basis. Not only has this number remained high, there is now an economy that is building up around servicing the needs of this large constituency. Why wouldn’t there be a new booming market here? Nearly one out of every six Americans is on food assistance in the most prosperous country in the world. Doesn’t exactly go hand and hand with the perception of a record breaking stock market. Is the US and the current economy developing a permanent under-class of citizens?

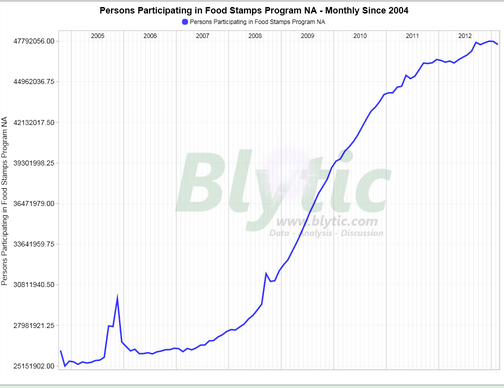

The boom in food stamp participation

What is fascinating is that the boom in food stamp usage coincided with the massive rally that started in 2009. The recession officially ended in the summer of 2009 but take a look at this chart:

Source: SNAP

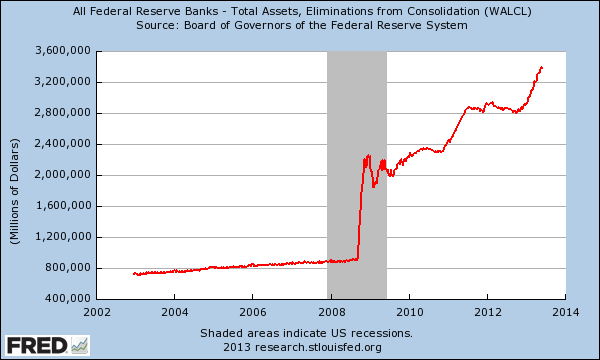

Since the recession ended, we have added over 17 million Americans to the food stamp program. This was a 56 percent rise during a time that the stock market rose by 138 percent. Yet a large part of the rise has occurred courtesy of the Federal Reserve allowing banks to borrow for very little and allowing for the same kind of speculation to occur once again that led to the initial financial crisis. The Fed’s balance sheet currently stands at $3.38 trillion:

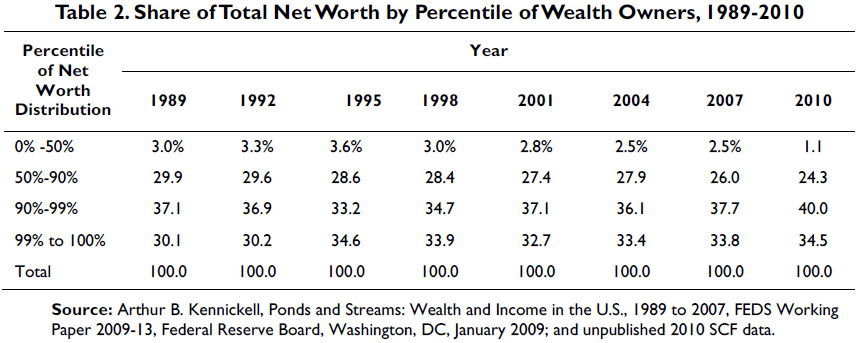

The expansion is fascinating because it allowed banks to offload non-performing and sluggish loans and freed up leveraging capabilities so the large financial institutions could go back to speculating in global markets. American households are still in a process of debt deleveraging. Yet it is abundantly clear that very little of this freed up money flowed into theworking and middle class. In reality more and more of the wealth in the country is flowing into the hands of a few:

In 1989, 32 percent of all the wealth in the US was held by those in the 0 to 90 percentile of income. Today it is merely 25 percent. And the top one percent is holding a much larger share showing that the inequality when it comes to wealth is only getting larger.

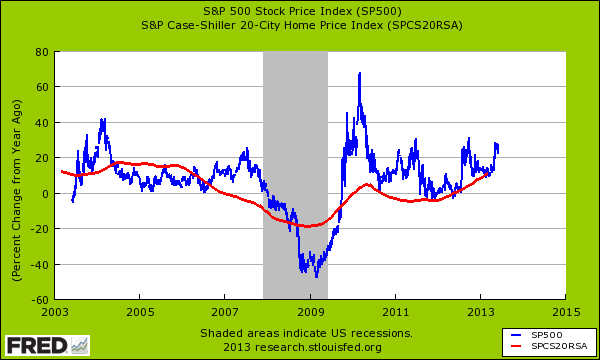

Another point to make is that most Americans do not own any sizable amount of stocks or investments. Most Americans derive whatever net worth they have from housing. Yet in a low yield environment the Fed has created an incentive for Wall Street to invest in residential real estate again but this time crowding out regular buyers. Even with that said, the gains in housing pale to what has occurred in the stock market recently:

At the height of annual gains the S&P 500 was going up at an annual rate of more than 60 percent. This is how the S&P 500 was able to soar by 138 percent just from the recent lows in 2009. Yet many of these gains have come at the expense of slashing wages, cutting costs, and passing on fewer and fewer of the gains to workers. Keep in mind many of these large companies and financial institutions required every sort of bailout from the American people yet now, are largely in a position to squeeze them even further. Corporate welfare.

It is hard to see what will reverse this trend of a shrinking middle class. Many estimates assume that food stamp usage will remain high for many years to come. Bread, butter, and food stamps. At least this recipe seems to work for a boom in the stock market.

No comments:

Post a Comment