December 2, 2012

For most people that I know the mortgage and rent payment will eat up the largest portion of a monthly budget. This is the case for the vast majority of Americans as well. Housing is the biggest line item expense on the monthly budget. For the most part people tend to think that the Federal Reserve is fully focused on home owners but the reality is this is only an afterthought. The core focus of the Fed is to inflate the debt of the banks (massive amount) and the government away ($16 trillion and growing). Even a tiny bit of inflation is painful if household incomes are not going up. Household incomes adjusting for inflation are back to levels last seen in the mid-1990s. With the push for lower rates, rents have been going up consuming a larger part of a household’s budget. Even if overall inflation looks stable the big jumps in rents, health care costs, tuition, and food are hitting households very hard.

Overall inflation

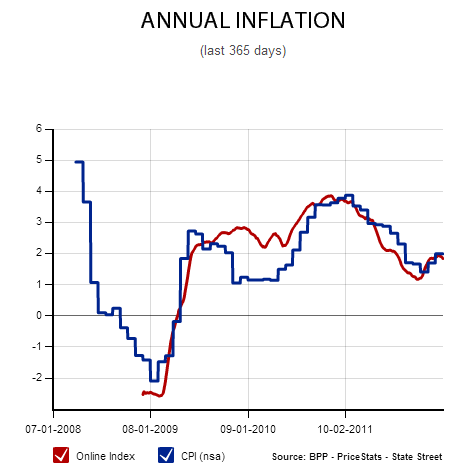

I’m not sure where people get the notion that we are not experiencing any inflation. According to the MIT inflation data and CPI, we’ve been seeing general price rises since the brief dip in 2009:

Households are feeling this because incomes are not going up so even a 2 or 3 percent annual increase is felt deep in the wallet. You are moving back. For the 1990s and 2000s with stagnant incomes, households were able to keep their spending levels up byincreasing their debt. This provided a cover for the slow erosion of wage growth.

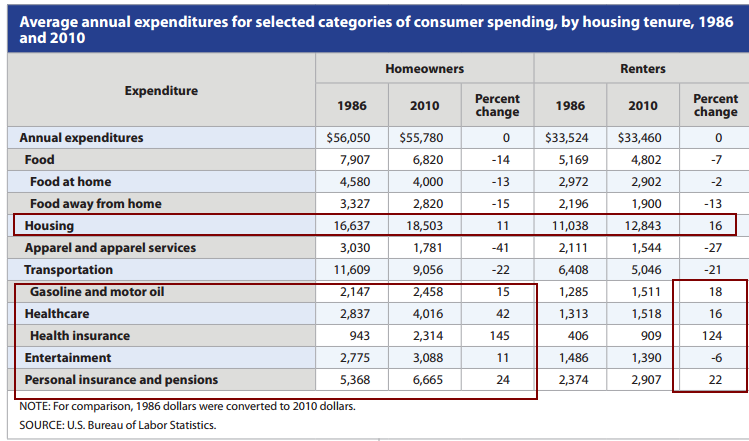

If we look at spending over the last few decades, you will notice that a couple of areas now consume a large portion of the budget:

This chart is very important to examine. As a percent of household income, Americans now spend more on the following items since 1986:

-Gasoline and motor oil-Healthcare and Health insurance-Housing-Personal insurance and pensions-Tuition

This is an interesting perspective. Tuition should be included here because the increase in paying for college is on par (even higher) than the increase in healthcare. For a renter household, imagine they went to a college with an annual cost of $20,000. This amounts to 60 percent of their overall budget and 36 percent for a homeowner household. No wonder why student debt is well over $1 trillion. The point being, the cost of living has gotten much more expensive and Americans are now feeling the pinch as access to debt has decreased. The only access to easy debt that has been left open is through mortgages and student debt.

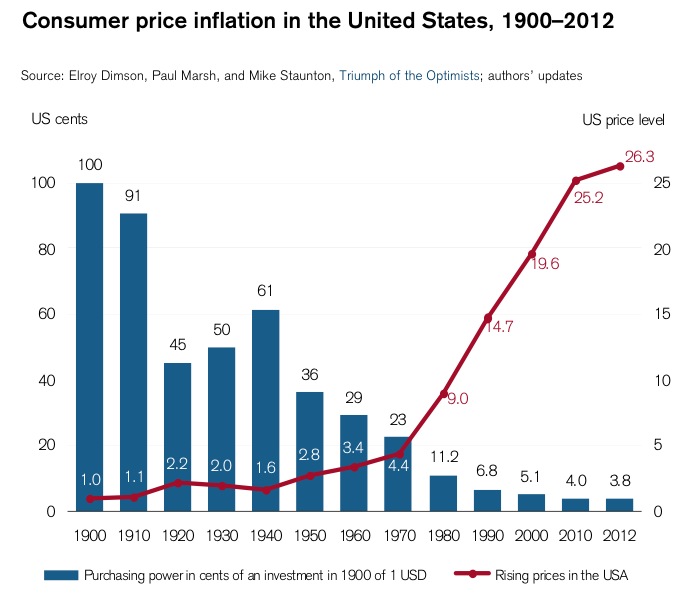

This overall trend is the squeeze Americans are living through. Inflation is part of our economic system:

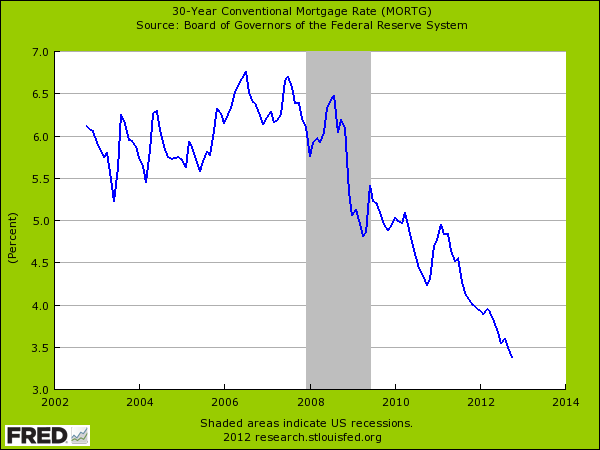

Nothing has truly gotten cheaper for US households. Many think that having access to debt is similar to wealth but that is not the case. We have seen that through the recent period of deleveraging. But examine the chart above. A US Dollar back in 1900 now has the purchasing power of 3.8 cents. This also makes the Fed’s actions more covert in the respect that they realize Americans are completely focused on the monthly payment. So interest rates have fallen dramatically in the last decade keeping asset inflation intact (in order to bailout banks and the government with a weaker dollar). This is the change in interest rates:

Interest rates went from roughly 6.5 percent in 2008 to below 3.5 percent today. How big of an impact does this have? Examine a $200,000 mortgage:

Principal and interest at 6.5%: $1264Principal and interest at 3.5%: $898

It seems like a clear win and on the principal and interest side it is. But then again, home values simply inflate to new levels. Also, taxes on properties are based on the underlying price of the home and so is insurance. So these remain inflated adding additional cost to the overall monthly payment. In other words, the focus on simply keeping home values high is really a method to allow banks to offload inflated properties while pushing on ancillary costs to homeowners (i.e., mortgage insurance, taxes, etc).

The American consumer is not better off than they were a few decades ago. Plus, we have a massive number of Americans on food stamps, some 47 million and this number is a peak both in percentage terms and as a raw number. The only inflation that isn’t occurring is on household wages. Those claiming inflation is not happening are not looking at the data.

No comments:

Post a Comment