October 18, 2012

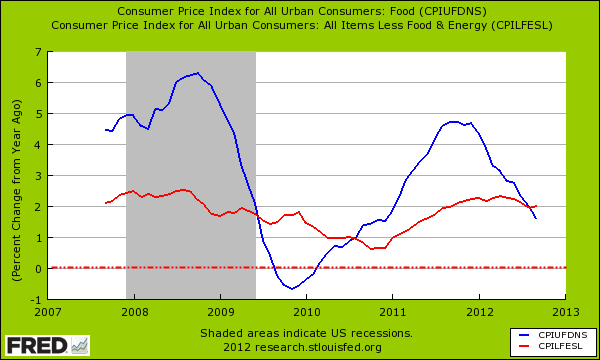

The Consumer Price Index (CPI) attempts to measure the change in price for a basket of American goods and services. I say attempts because measures like the “owner’s equivalent of rent” are simply an estimation as to what a home owner’s place would rent for. In the early 2000s with home prices surging, it missed a glaring trend that a place that would rent for say $1,000 was now costing the home owner $2,000. This was missed and the data understated this important fact. Since housing is the biggest line item for Americans and the CPI is heavily relied upon, many just assumed overall inflation was “healthy” during this time. Today we are facing a situation very similar to stagflation where unemployment remains elevated while the standard of living decreases. Those that claim inflation is nonexistent or healthy point to the CPI but ignore the headwinds that are starting to emerge. The last two months have seen the biggest increase in the CPI since the middle of 2009.

The CPI is now being impacted by rising rents

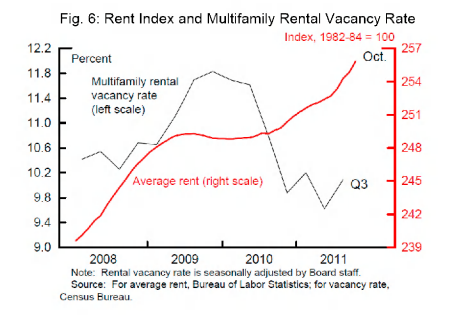

There is an odd situation occurring in the US right now. The Federal Reserve essentially owns the mortgage market and has caused interest rates to drop to record lows. This was all in part to conduct a shadow bailout of the too big to fail banking industry but the repercussions are being seen in other areas where the quality of life for most Americans is being squeezed. Just take a look at rents:

Rental rates have gone up strongly since 2008 at a fragile time when household incomes have fallen. So you ask, how is this feasible? First the housing market is now controlled by the Fed and banks while inventory is incredibly low. Many homes are being purchased by Wall Street investors and are put back on the market as rentals for higher prices. The lack of supply and demands of a growing population has simply pushed prices up. Ironically the same financial system that turned a stable American item like housing into a casino are now back at it profiting hand over fist thanks to the Fed and generous rewriting of accounting rules.

It is important to always remember the most important fact and that is household income is stagnant. We are also seeing continued inflation in food and energy:

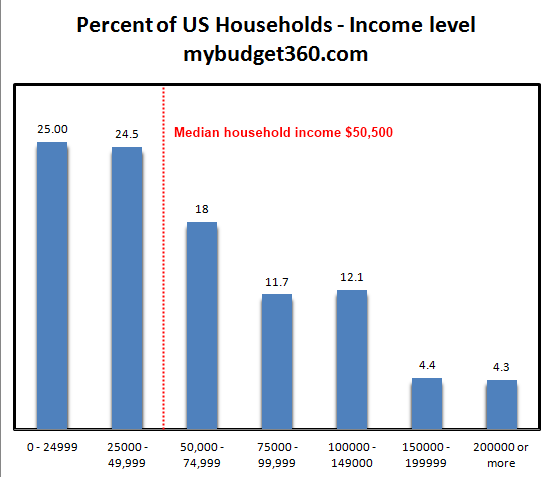

Yet income remains the same. This is the slow eroding process of losing the standard of living in America. Millions are living this every single day. 1 out of 7 Americans are on food stamps. This is why it is valuable to understand how income is broken down in this country:

The distribution is typically shocking to most people but this is the raw data. Some are simply spellbound by the media thinking that every other household is making six-figures. According to the facts, one out of five households is in this category (not bad but certainly not what is portrayed on the media).

The CPI continues to make an attempt to measure the changes in price. It is interesting that lower rates have actually placed the largest burden on those least able to support it. You have rising rents for many Americans and the cost of rising food and fuel is hitting those on fixed incomes like Social Security but also the millions on food stamps. Then you have the rising cost of higher education and many feel trapped.

I think most people understand at a visceral level what is occurring but simply looking at the CPI gives you a picture of economic tranquility even through the biggest financial crisis since the Great Depression. The Fed and banks are now deep in the housing market again and rents are going up.

No comments:

Post a Comment