September 21, 2012

Recently the topic of taxes has been put on center stage again. Aside from the political bickering the data shows us an even more disturbing trend. The middle class is demonstrably shrinking at a time that the government is spending money it doesn’t have while the Fed is digitally printing money to save its allied banks. The reason nearly half of Americans pay no federal taxes, this is different from other taxes (i.e., payroll, sales, etc) is that nearly half of Americans make too little money. This might come as a surprise to many given that we are the wealthiest nation on the face of the planet. However, we need only remember that we have the highest percentage of Americans on food stamps in a generation with nearly 46.5 million receiving this aid. Yet part of the data also reflects our aging population. After all, since 1 out of 3 Americans have zero in savings many retire relying completely on Social Security for their income.

The tax data

Let us break down the figures for income taxes:

Source: Tax Policy Center Credit: Lam Thuy Vo / NPR

First, what you’ll notice is that 23 percent do not pay income taxes because they simply make too little. Again, this does not mean that they do not pay payroll taxes (i.e., Social Security and Medicare) which all Americans earning any money must. How low is this? For a family of four it would need to be under $26,400. Given that the average per capita earnings for Americans is $25,000 it should come as no surprise that many fall under this category.

Then you have older Americans on Social Security. Since many rely on this as their major source of income and the typical payment is roughly $1,000 a month, not much you can tax here. Then you have benefits for the working poor that allow additional deductions such as the earned income tax credit. In this case, a family of two parents and two children earning $45,775 would have paid no income taxes. Again, they are still paying payroll taxes. Given the median household income is $50,000 you would expect this figure to put many in the non-income tax paying category.

Yet the overall issue of course is that we are spending more than we make and somehow trying to ignore the fact that we are crushing the middle class. The middle class has shrunk over the last 40 years by 10 percent:

Source: CNN Money

What was even more troubling is that nearly half of Americans pass away with zero to their name:

“(NBER) We find that a substantial fraction of persons die with virtually no financial assets – 46.1 percent with less than $10,000 – and many of these households also have no housing wealth and rely almost entirely on Social Security benefits for support.”

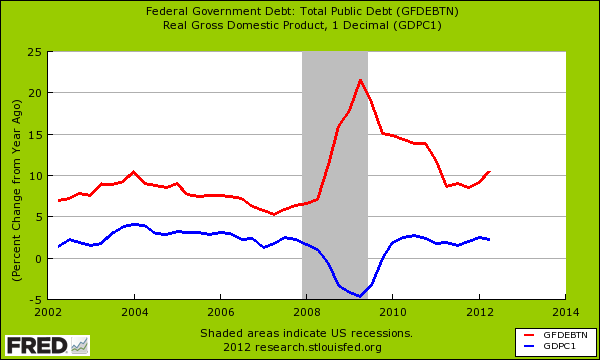

The heavy reliance on Social Security, food stamps, Medicare, and other programs shows how precariously close our economic system is to a depression. We have 46.5 million Americans that would likely have a hard time buying food if it were not for these programs. Does this even remotely sound like an economic recovery to you? The spending keeps going up yet the economic growth isn’t necessarily coming:

You’ll notice that out debt growth is far outpacing out GDP growth. It is unfortunate that mired in all the rhetoric there is little substantive debate regarding helping the middle class. We have a system that is largely controlled by a millionaire Congress that is far removed from Main Street. The fact that many Americans are confused about the tax equation isn’t surprising given the low level of financial literacy in our country. Much of what is out there is set to confuse and keep turmoil in the system. If you haven’t notice, our economic inequality is at levels last seen since the Great Depression.

No comments:

Post a Comment