May 18, 2012

Now that tax seasons is mostly finished for your average American and people can exhale and take a breather, some interesting data is released by the IRS. Audit data is fascinating because it highlights that in terms of those getting an audit, the more you make the more likely you are to be audited. It is useful to get a sense of how this plays out. The IRS is unlikely to audit the average American making $25,000 a year because in reality, the cost and return of going after this group is so minimal. As the famous bank robber Willie Sutton once replied to a reporter as to why he robbed banks, “because that’s where the money is.” The government is running lean and as many of you know, carrying over a $15 trillion in public debt is starting to become a burden. Debt ceiling talks are already out in the open as if we are already preemptively ready to spend more money we don’t have. Ultimately all Americans will need to shoulder some piece of this debt via cuts or tax increases and that is the painful reality.

IRS audit data

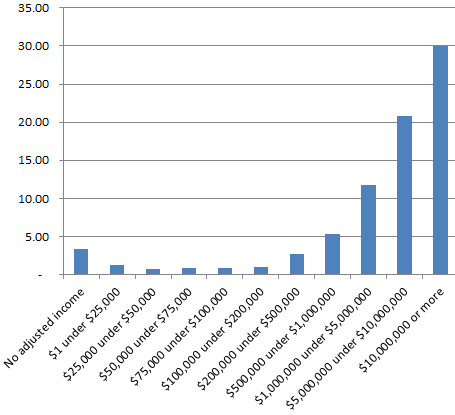

The IRS data is fascinating in terms of where they focus the large portion of their audits:

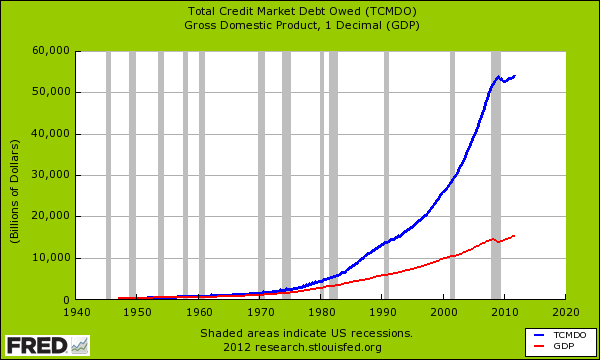

You’ll notice that once a $200,000 income is hit, the risk of being audited increases. I also found it interesting that those reporting no adjusted income had a higher chance of being audited than those who made between $25,000 and $500,000. This is probably another group that will show up on the radar. However, those with incomes of $10 million or more have a 30 percent chance of being audited. Yet as we know many Americans are simply struggling to get by with a per capita income of $25,000. Our total credit market debt is simply off the charts and over three times annual GDP:

Some serious challenges are coming online in the near future:

-1. Unemployment benefits are phasing out and expiring for many-2. 2001 and 2003 tax cuts set to expire-3. The debt limit will be reached again by the end of the year-4. Payroll tax cut will expire and increase from 4.2% to 6.2%-5. AMT will drop from $74,000 or higher to $45,000 or higher. This will make it harder for middle class families to use deduction in effect creating a tax increase

Many purists would argue that we either go full on tax increases or full on cuts. The reality is, the economy is incredibly weak. Most of the economy is still fueled by subsidies via home owner mortgage interest deductions, bailout funds to banks, government backed student loans, food stamps, and unemployment insurance. In other words, transfer payments are holding many people from full on economic disaster. For example, 1 out of 3 retirees relies on Social Security for most of their post-work income.

No comments:

Post a Comment