May 14, 2012

The math on the employment situation in the US simply does not compute. Over the last few years, many have escaped the employment market by diving into massive student loan debt. This looks good for the employment figures since these people are not counted as part of the workforce. The headline unemployment rate of 8.1 percent does not jive with 1 out of 7 Americans on food stamps. The last time we had a headline unemployment rate close to 8.1 percent was back in February of 2009 and at that time, we had 32,000,000 Americans on food stamps or over 14,000,000 less! Digging around the data you begin to realize how much phony calculations are being used especially when talking about employment. There is an interesting figure that emerges from a recent surge in disability benefits.

The calculus of the employment market

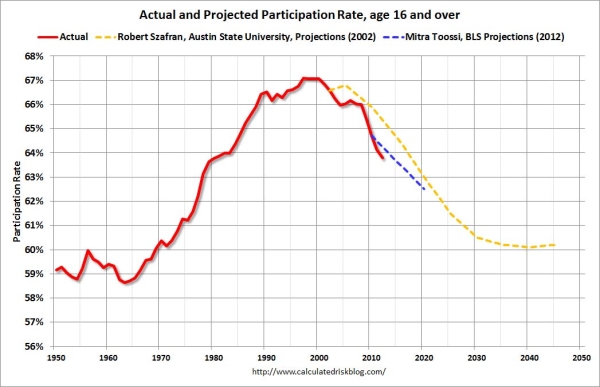

The official recession has been over since the summer of 2009 even though we have added some 14,000,000 more Americans to the food stamp program. What we do see is a surge in Americans filing disability claims shooting up by 2.2 million since mid-2010:

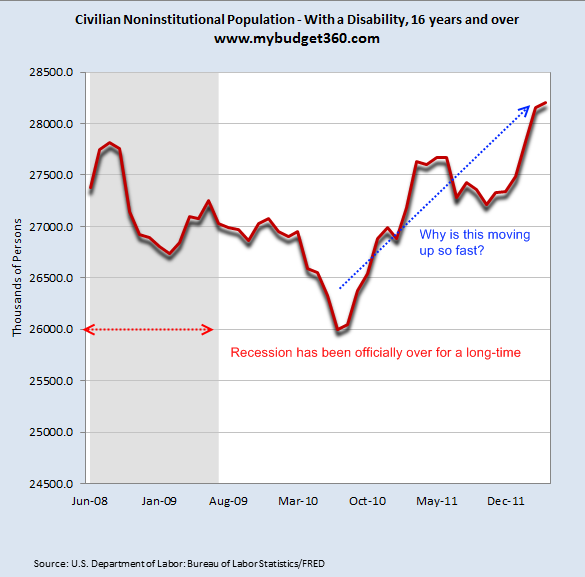

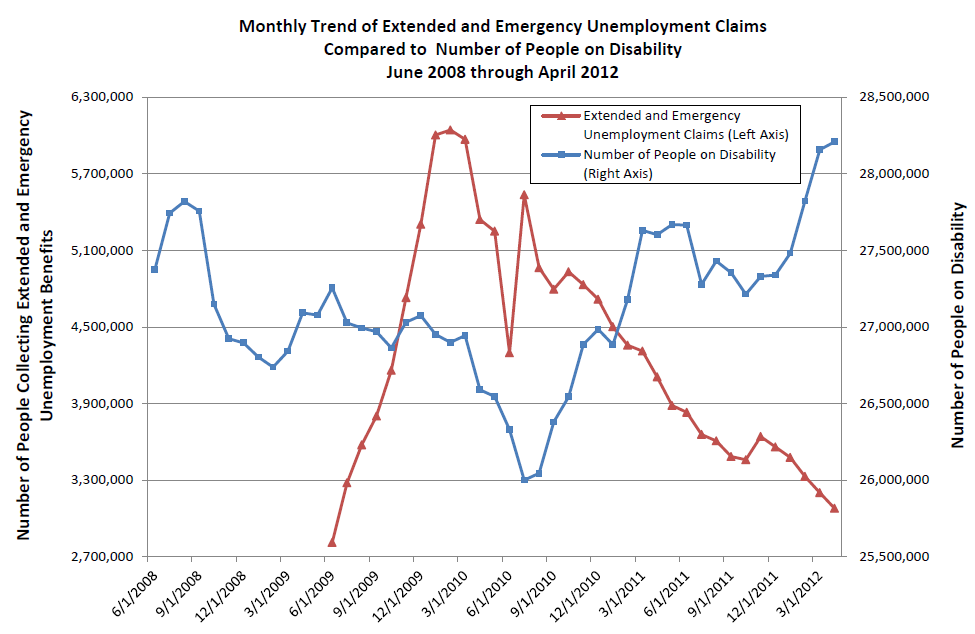

Why the recent reversal? One observation that was made is that the recent run-up was aligned with the expiration of unemployment insurance:

“(TrimTabs) From July 2010 to April 2012, the decline in the number of people collecting extended and emergency unemployment benefits was 2.46 million. Over the same time period the number of people collecting disability benefits increased by 2.20 million. We suspect the similarity in the inverse relationship is more than coincidence.”

This is an odd synergy. We know that recently more and more Americans are exhausting their regular unemployment insurance. Interestingly enough states are tied to the headline rates which are now being fudged in a variety of ways. So you get charts like the below:

Source: TrimTabs

It just seems odd that 2.46 million going away from extended unemployment insurance nearly aligns with the 2.2 million increase in disability benefits. Couple this with massive underemployment and many going to school with massive debt and you realize that the 8.1 percent headline unemployment rate misses a really big part of the economy.

Throw in the participation rate

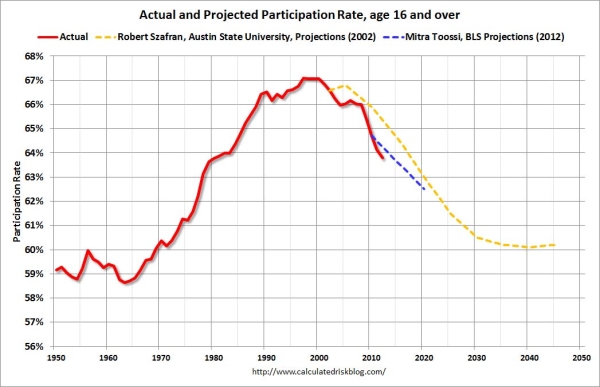

What is adding more fuel to the flame is the declining participation rate. This also helps make the unemployment rate look better but the reality is, many of those now retiring are to some degree costing the system. Actually, we know that 1 out of 3 retirees rely very heavily on Social Security for their retirement income. More and more Americans are retiring requiring more transfer payments while those actually in the workforce continues to decline:

The fact that the per capita average income is $25,000 and the median household income has gone stagnant for well over a decade should tell you the true status of the middle class in our country. It is stunning to see observations like the above. It plays into the low wage economy that is developing. A protracted unemployment situation creates excess labor in the market and wages get slammed. Yet with no political energy or will to protect the middle class, you have a system where the financial system rips off the public and you see how well your bailout dollars are put to use with the case of JP Morgan Chase and their risky bets.

Just think about the fact that the last time we had an 8.1 percent unemployment rate we had 14,000,000 less Americans on food stamps. If this trend continues we’ll have 50,000,000 Americans on food stamps and a 7 percent unemployment rate. This is the new calculus of our employment figures.

No comments:

Post a Comment