April 22, 2012

A large part of our recovery is running on public relations trickery and smoke and mirrors debt machinery. Let me explain what I mean by this since on the surface we have been out of a recession since the summer of 2009. Government debt is soaring and public debt in certain sectors is flying off the charts. Take for example food stamp usage and student loan debt. These payments typically rise during tough times as would be expected. So you would conclude that being in year three of this so-called recovery that costs for both of these sectors would be retreating. You would be absolutely wrong in this Alice and Wonderland debt world. The student debt market has become a predatory landmine for prospective students and continues to grow like a wild fungus. Food stamp usage is expected to be high deep into 2014. Can you call it a recovery by using accounting magic that actually hides the continuing deterioration of the middle class?

Food stamp usage peaking during a recovery?

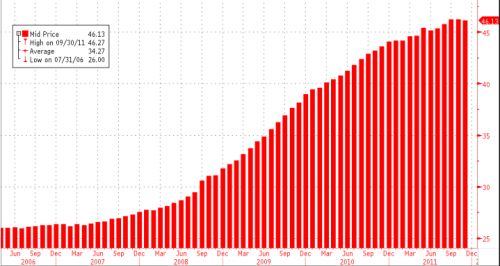

First, food stamp usage is at a peak:

Source: Zero Hedge

How is it a recovery when 15 percent of the population is receiving food assistance just to stay afloat? But examine the chart carefully. When the recession officially ended in 2009 there were 35 million Americans on food stamps. Today, three years later and deep into a recovery we have 46.5 million Americans receiving food stamps! In other words, food stamp usage has increased by more than 32 percent during the recovery. Since when does a recovery involve increasing the amount of Americans on food stamps?

There is a cost to having 46.5 million Americans on food assistance:

Source: Cato Institute

We amended the chart with the expected cost of the program for 2012 which will cost roughly $82 billion. In 2009, the year of the recovery, the cost of the program was running at roughly $40 billion. So the cost is now over double that since payouts have increased in conjunction with the wonderful hidden inflation we are seeing with food prices.

What does this say about our recovery? What it highlights is 46.5 million Americans are basically one EBT food debit card away from not eating? We have seen an emergence of people crowding out Wal-Marts at the end of the month just waiting until the debit card is refilled so they can purchase food for their family. Does this sound like a recovery? This $82 billion is injected back into the economy and it is coming from the government but again, this is not a sustainable recovery as the media would like us to believe.

So you have to ask how is it that food stamp usage is still at a peak if we are truly in a recovery? This leads us into the other funny math being used with higher education and thebubble in student debt.

No comments:

Post a Comment