January 21, 2012

The economy for young Americans might as well be in a parallel universe to the stock market run since early 2009. Talks of recovery must fall on confused ears as many young college graduates compete for fewer jobs with higher amounts of student debt. In the last decade college graduates have encountered the highest tuition increases ever while getting a lower return on their investment once they enter into the workforce. The economy is still a mess if we dig into the data and look outside of the stock market gains. Many of the S&P 500 companies added jobs globally but outsourced many domestic jobs to foreign markets to save money. So profits increase but how does this help the domestic job market? It doesn’t and that is why this recovery is one of low wage capitalism andbanking handouts. For the millions of young Americans that are entering the workforce with tens of thousands of dollars in student debt, what can they expect from the current economic structure?

The old and the new

The cost of living has soared across many sectors with food, healthcare, college tuition, and energy all outpacing the growth in the typical paycheck. For these reasons including fewer jobs, young Americans are facing harder times when it comes to saving money:

Source: CNN Money

“Ultimately we are pumping out hundreds of thousands of graduates each year that are starting with a negative net worth.”

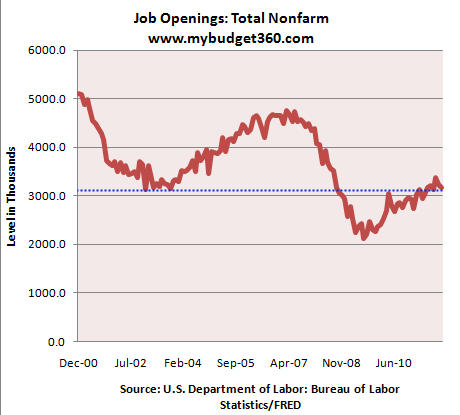

Contrary to what is being spouted on the media, the employment market is still very weak:

Source: Census

You have nearly two million job openings less than we did before the recession gained full steam. Yet our population is expanding and recent graduates are entering the workforce in higher numbers. The recent job growth is positive but the underlying data shows that many of the jobs are coming from low wage fields. Many companies, like those in the S&P 500, are exporting jobs to other countries where they can push for lower labor costs. The question remains, how does this benefit domestic workers? To the point, this is more momentum when it comes to squeezing out the middle class.

No comments:

Post a Comment