August 30, 2011

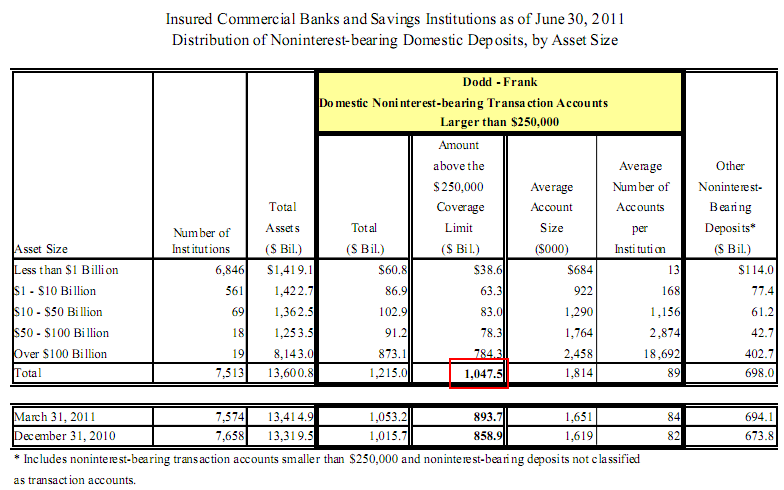

It is amazing how much ill placed faith is thrown into the current banking system when there is plenty of evidence of insatiable malfeasance. The FDIC recently released its quarterly banking report and somehow dismal information was twisted as being positive. Take for example the reality that $6.5 trillion in insured deposits are backed by $3.9 billion. Does this give anyone any comfort? What is even more staggering is you have $1 trillion in deposits above the $250,000 FDIC protection limit riding it out with absolutely no protection. The banking sector is going to face dramatic problems ahead because the past issues of bad loans have yet to be realized. Sure, accounting trickery and fancy financial magic can buy you a few years but ultimately you have to come to terms with the deep issues in the balance sheet. The FDIC is overseeing an industry with $13 trillion in “assets” and only carries a $3.9 billion insurance fund. It appears the wizard behind the curtain is blowing more smoke than ever.

$1 trillion in deposits with no protection

One of the upsetting revelations in the quarterly report is the fact that over $1 trillion in deposits are not insured by the $250,000 limit. Most of these deposits are placed in the too big to fail institutions. As you can see from the table above, the U.S. has over 7,500 banking institutions but only 19 with over $100 billion in assets. Incredibly, these are the most problematic banks as well. The vast majority of these deposits are simply out to sea with no sail. This only brings up the issue of potentially more bailouts as if the trillions of dollars given to the banking sector were not enough already. Look at how well the bailouts have helped the wilting economy.

Read the entire article

No comments:

Post a Comment