July 17, 2011

Trying to induce inflation to reduce accumulated debt is not a modern invention. Dr. Carmen Reinhart and Dr. Kenneth Rogoff trace this kind of financial crisis and others back to the Dionysius of Syracuse during the 4th century.

The debasement of currency also occurred in the Roman empire and Byzantine empire and as usual printing money or devaluing your own currency does not usually lead to beneficial outcomes if we are to use history as any guide. We need to be upfront about what is going on here and that is the globe is reaching a peak debt situation. Think of the recent problems we have seen in Iceland, Ireland, and Greece. Yet these are simply tips of the visible iceberg of financial mania in our current system.

Europe has many issues to contend with especially when looking at Spain, Italy, and Portugal. Here in the U.S. the Federal Reserve and U.S. Treasury are doing everything they can to ignore the reality of our current situation. Politicians are unable to make the hard choices and bankers simply want to extract productivity from the working classes. Our current predicament is not unusual in the books of history but the size and global interconnectedness is.

A history of manias and speculation

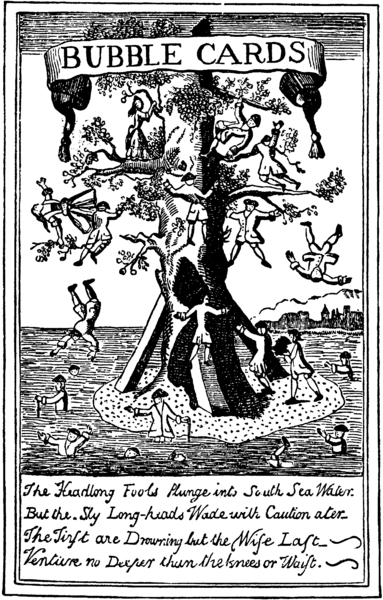

Source: Extraordinary Popular Delusions and the Madness of Crowds; Charles Mackay 1841/1852

Speculation is inherent in most financial panics. The above picture is from the South Sea Bubble of 1720 where investors speculated in South America. This was largely concentrated in the United Kingdom but had a parallel event with the Mississippi Bubble that concentrated speculation in France. Bubbles seem to spread so it is no surprise that Europe was whipped up in frenzy and when the bubble popped, the economies crashed and many were left in financial ruin. In both cases investments were exaggerated in value and many people got sucked into the desire for a quick buck. Banks like the Banque Générale Privée were more than happy to allow the speculation to continue. We can find many parallels in our banking system and how it was central to the U.S. real estate bubble.

Read the entire article

No comments:

Post a Comment