June 16, 2011

For over 30 years the debilitating shrinkage of the middle class has been papered over with access and use of debt. Debt in every form; mortgage debt, credit card debt, auto loans, and student loans. Yet debt is not wealth. Americans are facing a financially nightmare where 1 out of 3 has no savings. This should come as a little surprise since the per capita income in the country is $25,000.

Many workers are simply getting enough out of their stagnant paychecks to pay the monthly bills. Of course much of the real wealth has been systematically looted through bailouts and crony capitalism. There was a time when the government and even Wall Street benefitted by a growing U.S. middle class. Now all you hear from banking executives is how much cheaper it is to outsource American jobs at the same time their pay keeps soaring. Why don’t we outsource their job? The problem of course is a deep capture of our political system and a perfect fusing of Wall Street and the government.

The middle class is slowly floating away as inflation created by the Fed bailouts of the too big to fail banks causes more and more financial pain.

The economy that debt built

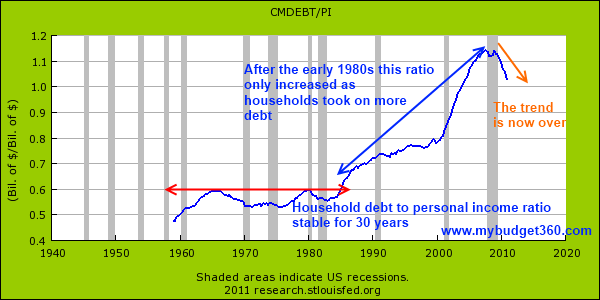

I wanted to examine the growth of personal income in relation to household debt. If we setup a ratio between the two we see that from the 1950s to the early 1980s the ratio was rather stable. Even while debt went up, so did incomes at a relative level. This all changed in the early 1980s:

Just like a person can go out and buy a McMansion with a giant mortgage, lease a European luxury car, and go into $100,000 of student loan debt the good times are felt only shortly. The bill eventually does come and it is coming in full to the American public. Yet the middle class only expanded because of access to debt. So as this access is shunted the American middle class has now faced over a decade of lost returns in wages. No growth. The reason so many people are losing their homes is because they simply do not have the income to sustain their purchases of the years when debt was handed out like candy.

The big banks still have access to this debt machine courtesy of the Federal Reserve. Yet the middle class is now being thrown to the wolves to support the too big to fail. Why doesn’t the media after four years examine deeply what we have gotten for the trillions of dollars thrown at the banking sector?

Read the entire article

No comments:

Post a Comment