April 21, 2011

One of the most troubling aspects of this “recovery” is how it is being achieved. We keep hearing about the wonderful Wall Street recovery yet a large portion of this is being created by extracting productivity from workers and stifling wages. Obviously if you scare the working and middle class and give them no job protection then many will retreat to their dark corner. Yet the reality is, these same companies are borrowing at subsidized rates from the Federal Reserve and using the taxpayer as a safety net. This economy is operating under a reverse Robin Hood effect where you steal from the poor and working class and redistribute the wealth to the top. The political class does not represent the people because as things stand, money buys power and many more Americans are losing their voice since they do not have funds to purchase lobbyists. The below chart is one of the more disturbing confirmations of our disappearing middle class.

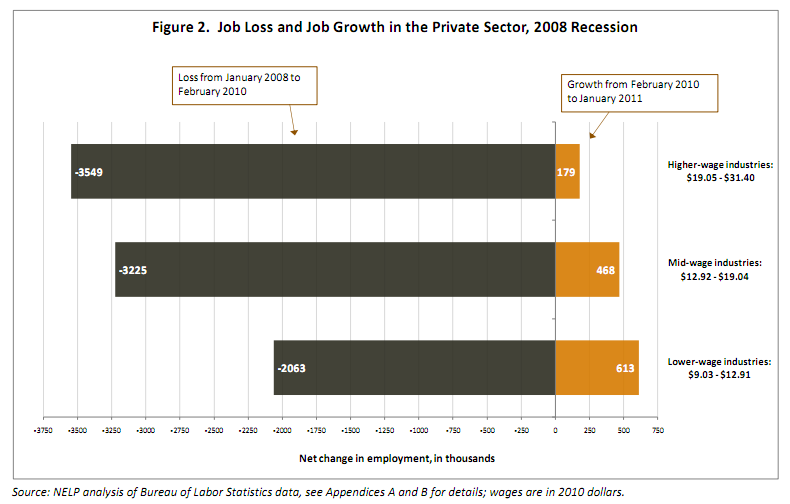

The low wage recovery

Source: NELP

This chart sums up our current recovery in one picture. We lost over 3,500,000+ higher-wage jobs during the recession and so far, we have added 179,000. The mid-wage sector has lost over 3,200,000+ jobs but has added 458,000. More troubling however, is that 2,000,000+ jobs were lost in the lower-wage fields and this is where the bulk of the current economic growth is occurring with 613,000 jobs being added in this sector:

“(Huff Po) While the recovery of the labor market and the broader U.S. economy depend critically on job growth, equally important is the quality of those jobs. During the economic downturn, 40 percent of the jobs lost came from high-wage industries — yet high-wage industries accounted for only 14 percent of the new positions created in the first year of post-downturn job growth, according to a report released in February by the National Employment Law Project.”Read the entire article

No comments:

Post a Comment