April 26, 2011

At the dark heart of our financial dilemma is debt. Too much debt was used to bolster households during the real estate bubble and now too much debt is being used by the government to bail out the financial sector. Is there a tipping point in the amount of debt the American economy can shoulder? I believe there is and looking at the data carefully we begin to see unusual patterns not seen in a generation.

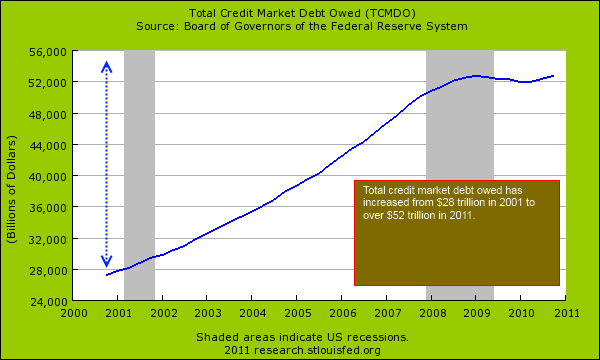

The mosaic of tools used for this financial crisis would have worked if the problems we faced were merely issues of confidence. Of course the problems were very real and dealt with more than just perception and instead of confronting the reality of an over leveraged debt addicted machine we have only stepped on the accelerator. Yet this time instead of credit flowing to households for added game rooms or a trip to Hawaii credit is being extended to Wall Street courtesy of the Federal Reserve. Total credit market debt owed jumped from $28 trillion in 2001 to over $52 trillion today. During this time GDP went from $10 trillion to $14 trillion. You do the math where the growth is occurring.

Peak debt

I find the above chart startling because it shows how heavily our society relies on debt. Atlas can only support so much even in a myth. There is no doubt that credit serves a very useful purpose in society. Yet when debt begins to over shadow actual GDP or serves as a substitute for income, then we have a serious problem on our hands.

During the real estate bubble many families started to rely on their home equity as if it were normal for homes to throw off $50,000 or $100,000 a year in appreciation like some money tree. Households enjoyed this because wages went stagnant and surely pulling money from a home is easier than saving money for a rainy day and living within a budget. However all of it was a charade and American households are now paying the bill.

Read the entire article

No comments:

Post a Comment