February 25, 2011

One of the quickest ways to bring down the U.S. economy would be to dramatically increase the price of oil. Oil is the lifeblood of our economic system. Without it, our entire economy would come to a grinding halt. Almost every type of economic activity in this country depends on oil, and even a small rise in the price of oil can have a dramatic impact on economic growth. That is why so many economists are incredibly alarmed about what is happening in the Middle East right now.

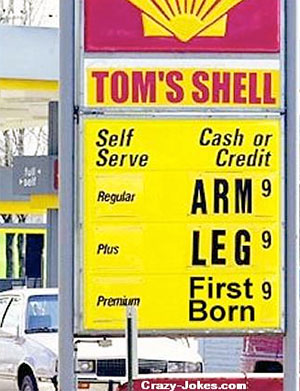

The revolution in Libya caused the price of WTI crude to soar more than 7 dollars on Tuesday alone. It closed at $93.57 on Tuesday and Brent crude actually hit $108.57 a barrel before settling back to $105.78 at the end of the day. Some analysts are warning that we could even see 5 dollar gas in the United States by the end of the year if rioting spreads to other oil producing nations such as Saudi Arabia. With the Middle East in such a state of chaos right now it is hard to know exactly what is going to happen, but almost everyone agrees that if oil prices continue to rise at a rapid pace over the next several months it is going to have a devastating impact on economic growth all over the globe.

Right now the eyes of the world are on Libya. Libya is the 17th largest oil producer on the globe and it has the biggest proven oil reserves on the continent of Africa.

Right now the eyes of the world are on Libya. Libya is the 17th largest oil producer on the globe and it has the biggest proven oil reserves on the continent of Africa.Before this crisis, Libya was producing approximately 1.6 million barrels of oil per day. Now the rest of the world is wondering what may happen if revolution spreads to other major oil producing nations such as Kuwait (2.5 million barrels of oil per day) or Saudi Arabia.

Saudi Arabia produces 8.4 million barrels of oil a day. It produces more oil than anyone else in OPEC.

If revolution strikes in Saudi Arabia and a major production disruption happens it could be catastrophic for the global economy.

Read the entire article

No comments:

Post a Comment