The Federal Reserve has one clear mandate. That mandate involves protecting the biggest investment and commercial banks on Wall Street at the expense of the American people. This deflation of quality of life is being felt in the most clandestine and subtle ways like a shift in the wind. The Federal Reserve through archaic money operations has bailed out the too big to fail and has passed on the bill to millions of Americans.

We are now seeing this through the rising cost of goods outside of housing. As noted before manufacturers unable to charge Americans with an average annual income of $25,000 anymore on goods for fear of losing customers, many producers are simply shrinking the package of items hoping customers do not notice. Aside from this hidden cost since the US dollar is being devalued by virtual money printing, the CPI which is heavily weighted by housing is also showing increases in inflation. As expected it looks like the Fed is only concerned with protecting one sector of our economy.

The Federal Reserve causing another bubble?

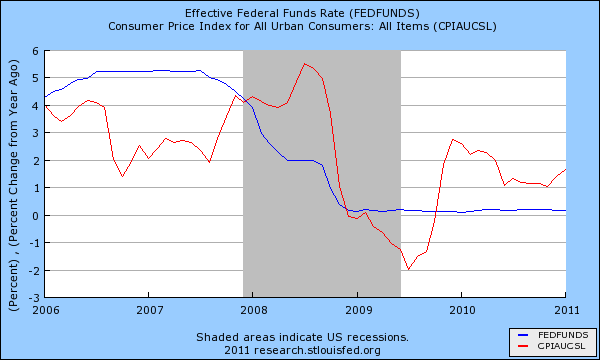

The above chart shows the Federal Funds Rate and the current CPI year-over-year change. The above chart highlights the minor bout of deflation we faced in 2009 after the 2007 and 2008 market collapse. Yet the CPI is now steadily up but the Federal Funds Rate has been stuck at near zero since late 2008. If you recall, the housing bubble was largely fueled by the Fed holding the funds rate too low for too long. Why? Former chief of the Fed Alan Greenspan was trying to re-inflate the economy after the technology bubble burst. The result was the biggest housing bubble the world has ever witnessed. There has never been a period in history where the entire globe from Sydney to Los Angeles to London all faced simultaneously rising housing bubbles.

Read the entire article

No comments:

Post a Comment