December 11, 2014

The Americans Dream was largely built on a few simple ideals. One was the ability to purchase your own home without needing artificially low rates and dangerously low down payments. Another key aspect of the dream was allowing young Americans to receive acollege education to pursue their future. While more Americans are going to college, many are taking on dangerously high levels of debt to embark on this journey. Another key component of the American Dream was having the ability to have a job that paid well enough to have a good standard of living. That standard of living is eroding as inflation is eating away purchasing power. It is hard to come to terms but the upcoming generation may not have it as good as that of the baby boomers. There is no fast and hard rule saying that each generation should be better. That is why the middle class rising in the US was a historical anomaly. Something worth aspiring and investing in. Yet if we look at history, you largely have one of a small wealthy elite and the rest. The fact that we are looking more like the Gilded Age is not a positive sign. For many, dreams are being deferred.

Building for cash strapped young

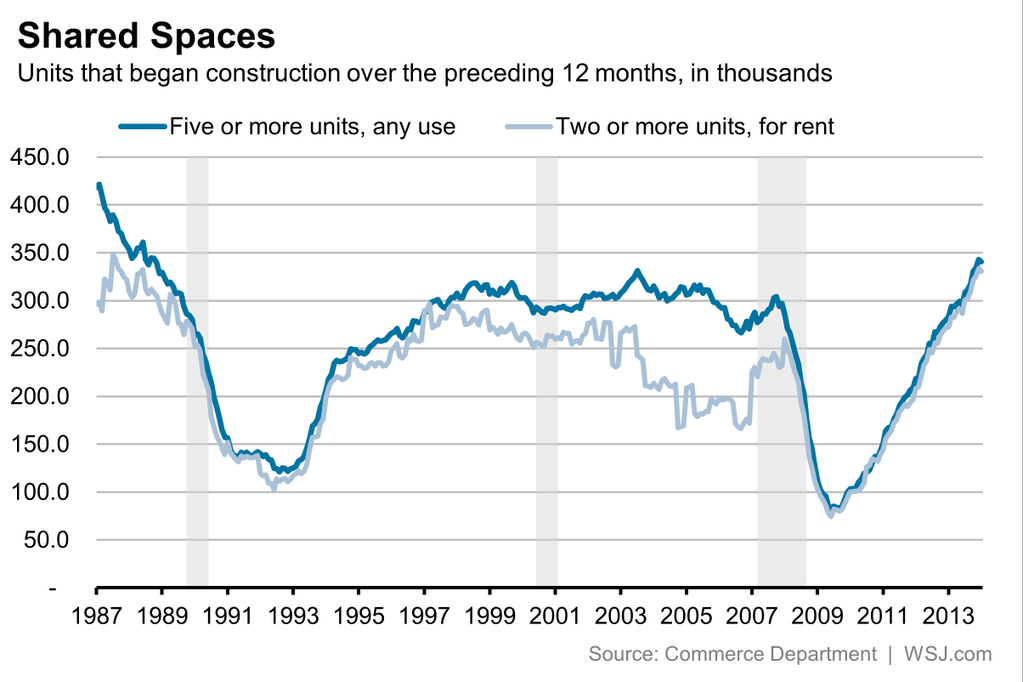

Since the Great Recession hit, many builders are realizing that the future for many Americans will be of renters. The flood of money and bailouts allowed big banks to shift properties from regular homeowners that over leveraged into the hands of investors and hedge funds. This has been going on for well over half a decade. At this point, the growth in rental demand is zooming up.

Builders are well aware of this and are focusing their energies on building multi-unit housing:

Rentals and condos. And condos can be easily converted back to rentals should the economy slow down. But this speaks to the fact that many young Americans are having a tougher time pursuing the big box home dream of the suburbs. Why? It is too expensive relative to their wages.

The education dilemma

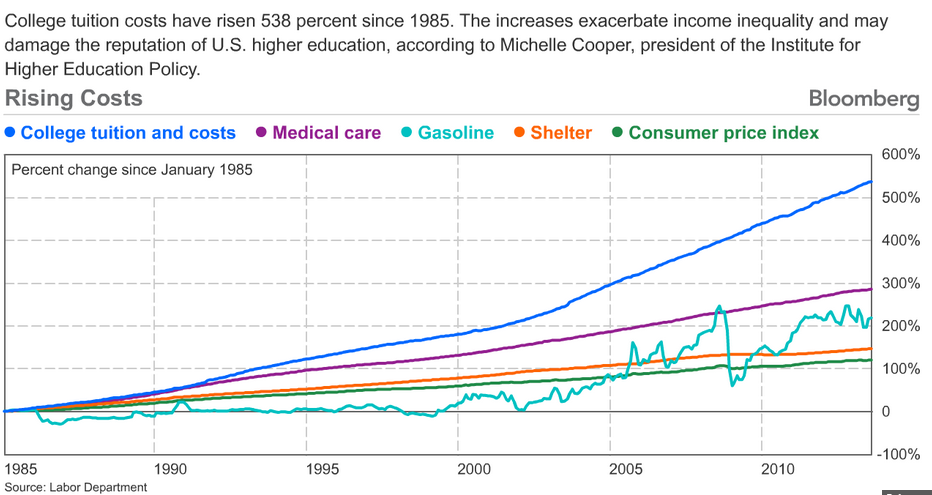

There is mega inflation going on in college tuition. Since 1985 college tuition costs have soared 538 percent. This rate has far surpassed all other large buy areas:

And for middle class jobs like those in engineering, computer science, accounting, and healthcare there is no choice but to go to college. Blue collar work doesn’t pay as well and there are fewer jobs here as well. The bulk of jobs added since the Great Recession have come in the form of lower paying jobs. Yet college tuition continues to go up. The market is still demanding technical skills but many for-profits target lower income households with paper mill like degrees and actually cause more harm than good. Many of these students would be better off pursuing a technical degree or certification at a low cost community college. Yet local community colleges are cash strapped and have pathetic marketing budgets while for-profits spend upwards of one-third of their revenue on aggressive marketing.

But even those going to reputable schools, there is no assurance of a good career or a good paying job once they graduate. The latest jobs report shows a mismatch between jobs being offered and skills in the market. Yet we continue to pump out expensive college graduates and debt continues to pile on.

Low wages

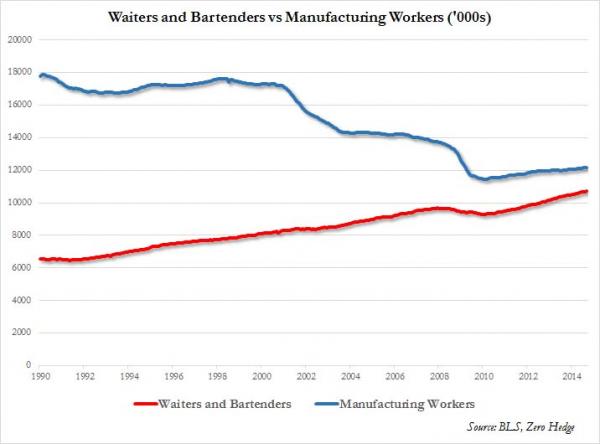

Low wage jobs continue to dominate the open job market. Benefits are being slashed and more of the burden on side benefits like healthcare or retirement planning are being pushed onto workers. For example, we are likely to have more waiters and bartenders than actual manufacturing workers in a short timeframe:

“This is not a good trend for most Americans given how many people occupy each of these fields. Back in 1990 which wasn’t exactly a booming time, we had 3 manufacturing workers for each 1 waiter or bartender. Today, we now have nearly a 1-to-1 ratio.”

And this also highlights why so many Americans are basically winging it for retirement. Many young Americans are actually in a negative net worth column given big college debt.

The future of course is never completely bleak. There is a need for highly skilled workers. If you plan accordingly, you can leverage this to your advantage but it does appear that the massive labor intensive jobs are simply not there. The labor intensive jobs in the service industry pay very little to pursue the American Dream as we once knew it. Renting or living at home is the only option for millions. College will be a very expensive proposition. In the end, this is the new dream.

No comments:

Post a Comment