May 8, 2014

There is a looming retirement crisis on the horizon. Most Americans are ill prepared for a long-term retirement. Back in the early 1980s, over 60 percent of American workers had access to some sort of pension plan. Today, that number is less than 10 percent. Planning for the future is challenging because it takes discipline, a steady source of income, some luck, and support from a rising market. That doesn’t always happen. That is why today, we have a large problem with older Americans not being able to retire. The latest data shows that most baby boomers will depend on Social Security as their primary source of income. Yet this money needs to come from a healthy and ideally, well paid younger population. That is simply not the case. Many younger Americans are saddled with massive student debt and others are unable to find good paying work. A large portion of profits in this recovery have gone straight to the top to a very small portion of the population. Also, a good portion of gains have come from slashing wages, cutting benefits, and squeezing productivity out of workers. This is how we have a nation where 1 out of 3 Americans have no actual savings. For many, Social Security will be the last barrier between them and being financially destitute. Just like saving for retirement takes decades, the current crisis will unfold over decades. Demographics are not looking kindly on the next decade for retirees.

The workforce is simply disappearing

It came as somewhat of a shock that a good jobs report actually sent the stock market down. Why? After digging through the data we saw that over 800K Americans actually dropped out of the labor force. This was the primary reason the unemployment rate falling from 6.7 to 6.3 percent. It is no surprise that the participation rate is falling so quickly with an aging population. But it is falling faster than anticipated. The reasons for this drop do not bode well for the economy and not all of it can be blamed on old age. There are four large trends at play here:

-1. Retirements-2. More on disability-3. Higher college enrollment-4. More discouraged workers

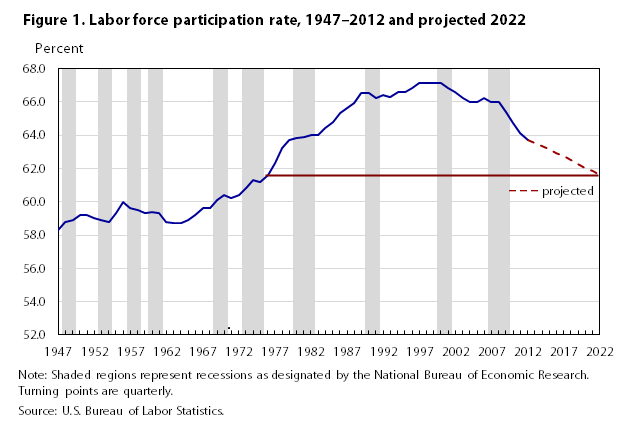

What we know from the data, the large change is coming from numbers 2 through 4. These are not necessarily positive. Higher college enrollments can be seen as positive if students weren’t going into such massive debt. The drop in the participation rate is happening faster than even the BLS had projected. Take a look at the projected trend here:

Source: BLS

In roughly 10 years, we are going to have the same labor force participation rate as we did in the early 1970s. Keep in mind the push up in the labor force from the 1940s to the 1970s was because of women entering the workforce. As we documented in the two-income trap, many had to work because of rising costs from inflation.

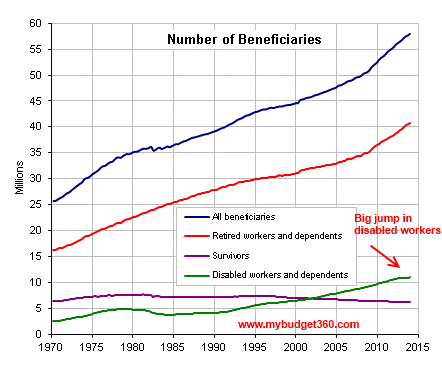

The decline in the participation rate is dramatic. As you have an aging population you will simply have more people depending on Social Security:

Source: Social Security

There are a few major points to be made here:

“The number of total beneficiaries has increased by 28 percent since 2000.However, the number of those on disabled workers and dependents benefits has gone up nearly 100 percent over this same period. In contrast the US Population since 2000 has increased by 13 percent.”

This is so important here because these signify structural changes to how our economy will run. You have many unable to adapt to the current economy and find work. A large portion of our population is relying on these benefits to keep them from abject poverty. This is why we can have a peak in the stock market and a peak in food stamp usage with over 47 million Americans on this form of assistance.

Low wage workers carrying the burden of the old

Young Americans have a heavy burden to carry. They enter a market where a college degree is nearly a prerequisite to a middle class lifestyle since blue collar work is no longer abundant nor does it pay as well as it once did. The ticket to higher education continues to grow as do housing costs, healthcare costs, and food costs. Inflation hurts even if it is moderate when incomes are stagnant or falling.

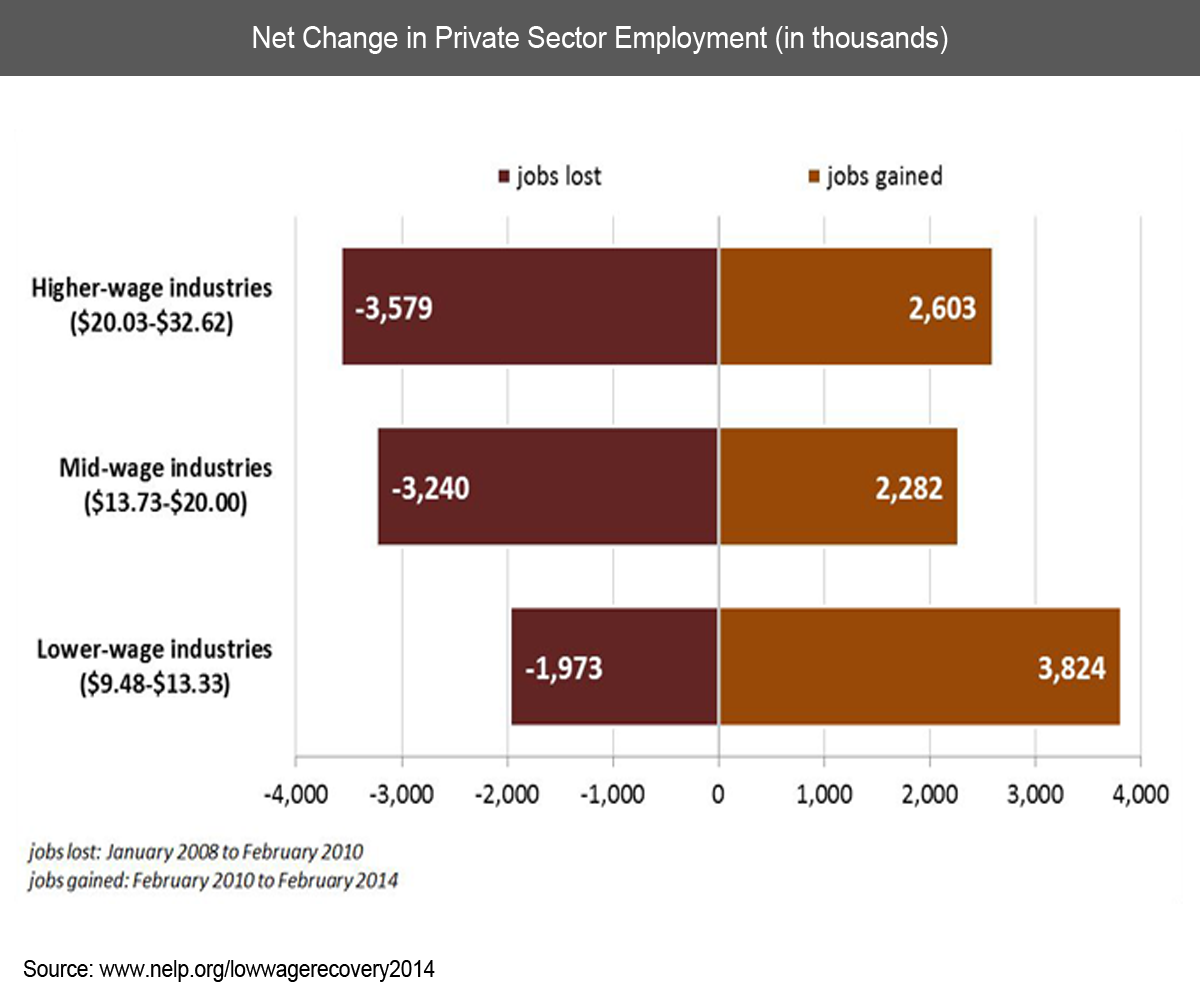

Many good paying jobs were lost during this recession and we have yet to recover those. However, we have done well in adding lower paying jobs:

Source: NELP

“For example, 3.6 million higher-wage jobs were lost due to the recession and only 2.6 million jobs in this segment have been added back. We are in a net-deficit of good paying jobs by 1 million. On the other hand, we lost 2 million low-wage jobs during the recession but have added 3.8 million lower-wage jobs during the recovery. A net add of 1.8 million lower-wage jobs.”

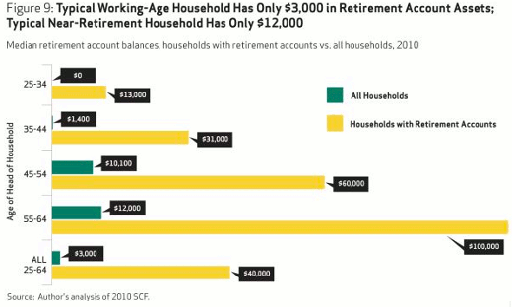

This is the labor force that is going to support a larger class of citizens fully unprepared for retirement. Most American are completely unprepared to face what is likely to be a long journey into old age. Take a look at how prepared Americans are for retirement:

The typical working-age household has only $3,000 in retirement accounts while the typical near-retirement household has only $12,000. So we have basically one big housing expense or one minor healthcare emergency to put these families in the negative. This burden is only going to grow since age does not care about politics. Biology will not stop just because we have an ineffective Congress or Wall Street running amok turning our entire economy into one tradable casino. So far, the standard of living for many Americans is in full-on decline.

What can you do? The most important thing that you can do is not follow the herd. Prepare for retirement and save. Plan and set money aside. The government and Wall Street do not care about you and will not save you when it is too late. Keep your brain sharp and keep your skills updated. Unfortunately for millions of Americans, this impending retirement crisis is going to hit them like a ton of bricks especially when they see how little that Social Security check will go as inflation erodes the standard of living.

No comments:

Post a Comment