December 7, 2013

New data from the Federal Reservecontinues to highlight a reemergence of debt based consumer spending. Americans are largely buying stuff they can’t afford with money they don’t have. The Fed’s consumer credit report highlights a troubling trend. Over the last 12 months 95 percent of all consumer debt growth has come from people buying cars and young Americans going deep into debt to pursue a college education. A car quickly loses its value once it drives off the lot and many college degrees are massively over valued only being supported by easy financing. This is a disturbing trend, even more troubling than the last debt fueled bubble. One can argue with housing that at least people are getting an asset that generally rises with inflation. But a car? A for-profit degree? The debt juice is now flowing once again.

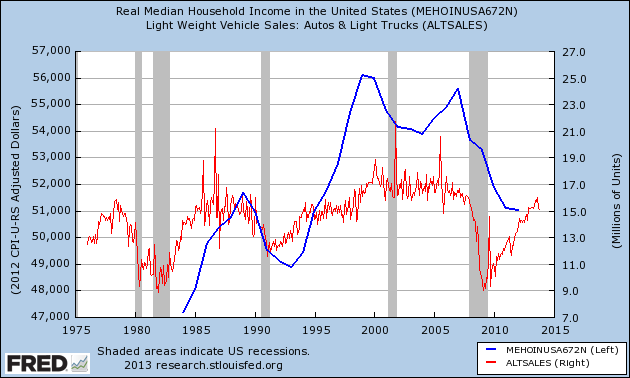

Buying cars while incomes drop

If we look at incomes and car sales we find that households are simply purchasing cars by borrowing from the future:

The Fed consumer credit report merely confirms what we suspect. The dramatic jump in auto buying isn’t coming because households are suddenly wealthier but because consumer debt is booming once again. Cars are not “good” assets and unfortunately, many Americans need to grow their net worth but adding a depreciating vehicle on your balance sheet isn’t exactly a smart plan.

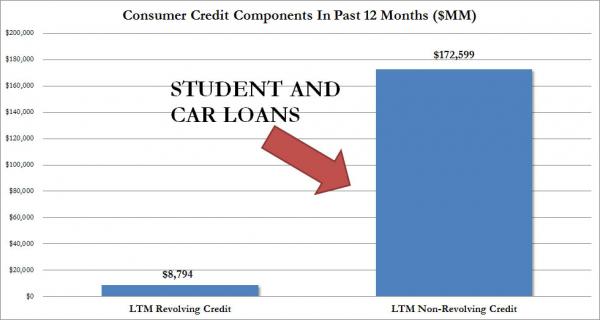

The consumer credit report shows that 95 percent of consumer debt growth in the last 12 months has come in the form of auto loans and student debt:

Source: ZeroHedge, Fed

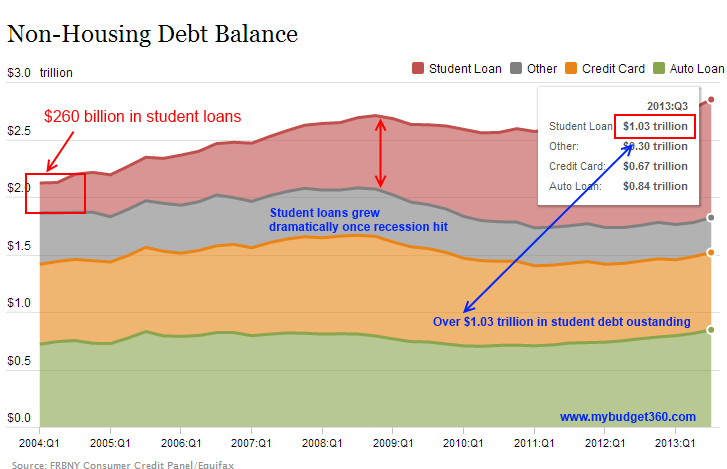

When you factor in the reality that student debt is now the largest debt market outside of mortgage debt, you realize that many young Americans are saddling their lives in the red even before they begin their working careers.

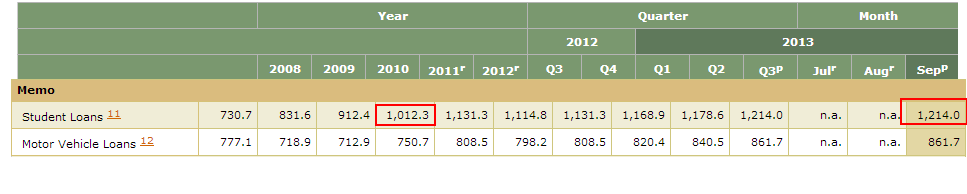

Total student debt in the US is well over $1.2 trillion as measured by new Fed data:

So we are now having another expansion completely based on easy access to debt. For banks, this access never went away in the form of cheap money via the Fed. The Fed’s balance sheet is now quickly approaching $4 trillion. We are told that there is no inflation but real estate values are spiking at a rate last seen during the last bubble but household incomes are not going up. Of course this time the price of real estate is being pushed up byWall Street investors. At least in the last bubble, most Americans had access to mortgages, credit cards, and all other forms of cheap debt to party with Wall Street. Today, it seems like consumers have the option of auto loans or student debt. Good luck trying to buy a home in some of the hot markets where big money is battling it out over what little inventory is available. Credit card rates are still very high even though banks have access to record low rates courtesy of Fed monetary policy. The same policy that is pushing home prices up and keeping household incomes down. The circle of monetary life. Hakuna matata.

Of course the public by getting a little piece of the action suddenly is blinded by the scheme that is taking place. As long as some grease is hitting their hands things are okay. Just wait until this debt fueled bubble pops again. Don’t expect the top 10 percent to bail you out (it’ll be the other way around yet again). The message is, keep on buying those cars you can’t afford and keep going to college via massive student debt.

No comments:

Post a Comment