October 3, 2013

The US is seeing a dramatic rise in the number of part-time workers. The reason many employers are going with part-time hiring is that they usually forgo any benefit payments but also have more flexibility in firing these workers when they no longer need them. This may also explain the rise in renting households as more Americans are unwilling to buy a long-term asset when their own future is tenuous. This trend is hitting young Americans particularly hard. We can see this shift by analyzing those working part-time for economic reasons. Prior to the recession, roughly 4 million Americans fit this category. Today the figure is above 8 million although at the height of the recession it was at 9 million. This trend demonstrates a shift to less secure employment for many American families. It also highlights a deeper trend of just-in-time (JIT) hiring for US companies. For example, at the same time that Amazon announces seasonal hiring of 70,000 part-time workers Merck announces it will be letting go of 8,500 employees. This trend is only going to accelerate as the government battles mountains of debt and companies look for ways to cut costs.

The rise of the part-time worker

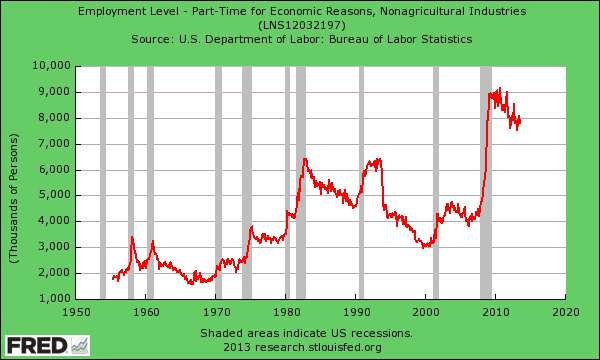

The below chart highlights the massive rise of part-time employment since the financial crisis hit:

Recessions will cause a spike in this dataset as you can see from the various spikes in previous recessions. What is different this time is that the recession officially ended in the summer of 2009, over four years ago. Yet part-time employment is up over 100 percent before the recession hit. Many young Americans are getting hit with a double whammy. First, they are the most indebted generation in history thanks to the unrelenting rise in the cost of college education. A disappearing of blue collar work makes it nearly a prerequisite for many to go to college if they have any hopes of entering the middle class. Many are funding their education with mountains of student debt. Of course this is another bubble that is inching closer to imploding as student debt reaches $1.1 trillion. Once they graduate, many are entering a workforce that is paying less and providing very little in the way of benefits.

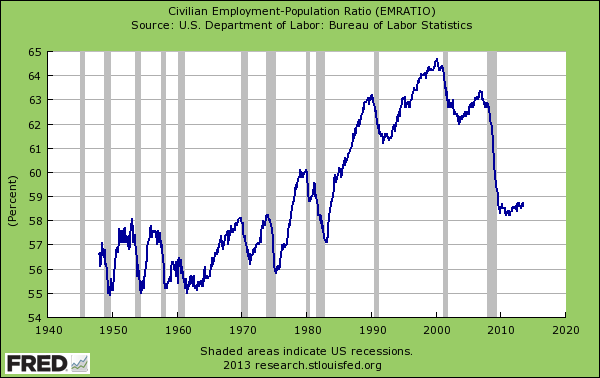

The implications are vast here since we have a less affluent young generation needing to support a growing and older population in the US. We can see this through the actual percent of our population that is employed:

The employment-population ratio is back to where it was in the 1980s. This is problematic since older Americans will be drawing on the system in the form of Social Security and Medicare while younger Americans have very little access to affordable benefits. Combine that with the rise of part-time employment and it is understandable that those 25 to 34 have a median net worth of zero. In all likelihood it is much worse given that this age group is in debt so the net worth figure for many is actually in the negative column.

The announcements of Amazon and Merck are merely a reflection of these bigger changes:

Amazon to Hire 70,000 Workers for the Holidays (WSJ)Merck to fire 8,500 workers (BBG)

This is not uncommon. We have seen these shifts happening for many years now. The rise of part-time work in the US is also a deeper reflection of financial policies driven by theFederal Reserve protecting member banks. It is interesting to note that Japan with their decades of Quantitative Easing have a part-time workforce that amounts to nearly one out of every three workers. While we are not close to that, the trend is unmistakable. The system has been fragile for many years and we are seeing a continuation of trends that take away workers protections and the middle class continues to shrink.

The government may have shut down this week but the true financial pain is being felt by working and middle class Americans.

No comments:

Post a Comment