July 4, 2013

There is one charge that can never be leveled against Americans and that would be that we somehow have an aversion to debt. To the contrary, our love with debt has blossomed into a full blow addiction. People confuse access to debt with actual real wealth. However as the foreclosure crisis has taught millions, you really don’t own something fully until the debt is paid off. The problem with this addiction is that we are now going deeper and deeper into a debt filled spiral. The Federal Reservehas positioned us into a market where debt is necessary, but this debt has to come at an artificially low rate. Any hint that rates will rise causes the market to quiver like a teenager at prom. This is troubling because it is a sign of addiction and probably, a belief that there is no longer an out clause. Anyone that has seen the show Intervention realizes how difficult it is to combat a serious addiction. First, there needs to be an acknowledgment of a problem. We are still steps away from recognizing this as an issue.

Has the US lost control of the debt market?

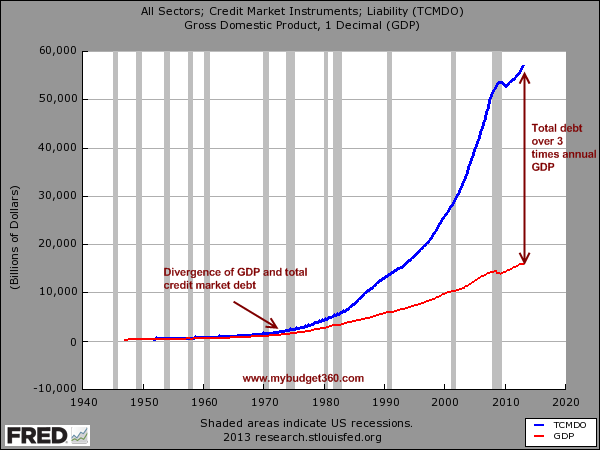

Historically, we are in some deep uncharted waters:

Starting in the 1970s, the total credit market debt owed and US GDP went hand and hand. This was fairly common. After this point, there has been a major divergence between the two as the above chart highlights. All of this has accelerated in the 80s, 90s, and even the 2000s. So today, we are in a position where total debts owed are three times more than annual GDP. Keep in mind that these are payments that need to be made at some point in time.

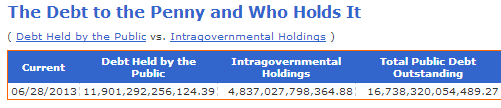

Total public debt itself is now larger than annual GDP:

Source: US Treasury

Total public debt now stands at $16.73 trillion. What is fascinating is the psychology behind this. People do realize that this will never be paid back right? Who is going to pay this back? Americans are back to record low savings rates. Are we going to digitally print our way into economic prosperity? The Federal Reserve seems to think so.

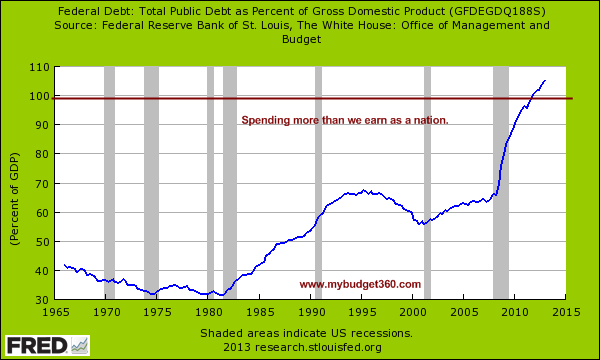

Yet multiple decades of this attitude has led us to this:

For the first time in a generation total public debt is larger than our annual GDP. We are spending more than we earn. Keep in mind the last time we were in a similar position was during a time when the large part of the globe was at full-fledged war in the 1940s. Building a solid credit reputation takes time. Yet how long can we remain in a position where we continually spend more than we earn and simply fuel future spending on additional debt?

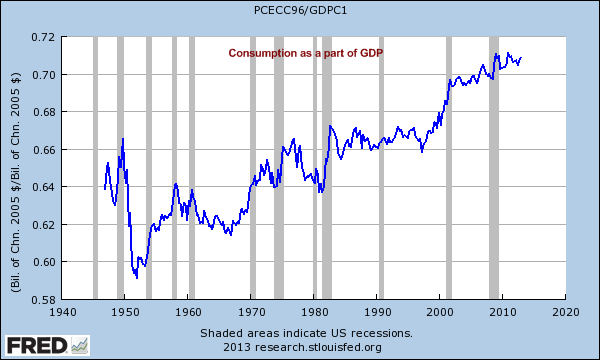

Consumption via debt

Study after study shows that many Americans simply do not save enough money. Half of the country is literally living paycheck to paycheck. Yet somehow, we are massively a consumption based economy:

Consumption is still over 70 percent of our GDP. Most of this is coming via access to debt. Debt to purchase homes, student loans to pay for college, and easy access to debt for banks to speculate in global markets. Yet in the middle of all this consuming and spending Americans are actually falling behind when it comes to building true wealth.

Punishing savers and growing inequality

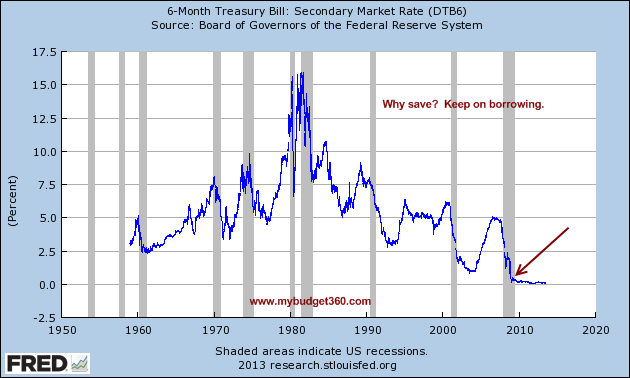

The Fed is fully aware that there is no turning back on this uncontrollable debt train. Interest payments on our debt are growing at a hefty pace. This is why the Fed has enlarged their balance sheet to $3.3 trillion merely to keep interest rates low on a variety of items (primarily loans to banks and mortgages that by the way, are issued by banks and linked into government backed MBS). For savers, this has turned out to be a tough deal:

This is a negative interest rate environment. With inflation tracking at 2.5 to 3 percent annually you are losing money simply by saving it. So the underlying incentive is to spend what you have today or risk losing value as inflation erodes your purchasing power.

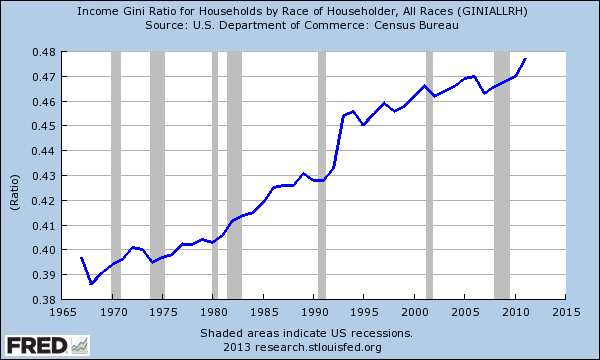

What this uncontrollable growth in debt has done has created the highest inequality in our nation since the Gilded Age:

This is how you can have 47+ million Americans on food stamps and a record high in the stock market at the same point in history. This is how you can have 1 out of 3 Americans with no savings but the typical CEO makes 273 times what the average worker makes. So why has this been the case? Why is this massive expansion in debt causing so much more inequality?

First, you need to realize that most of the large amounts of debt are going to big banks. Many of these banks have wealthy clients like hedge funds. Many of these funds, are now funneling money back into the market by chasing rental properties for example. Yet this low rate environment comes at a cost (depressed purchasing power, crowding out regular Americans, future debts to be paid, etc). This easy access to money is also allowing Wall Street to leverage funding in speculating in global stock markets which don’t necessarily help Americans. It clearly hasn’t helped when it comes to inequality or rising wages for the typical worker. It also protects only a small portion of our population. While inflation adjusted wages are back to 1995 levels, as the CEO wage highlights, a tiny segment is doing exceptionally well in this uncontrollable debt growth market.

As we initially said, access to debt in a debt based economy is similar to access to a large bank account. If you can live in a multi-million dollar home courtesy of easy bank loans, you basically are living this lifestyle even if you are in deep debt. You might not have enough for a European luxury car, but you can lease it. This really is what the system is favoring. Look at the T-Bill rate and tell me who is going to want to save especially when inflation is going to give you a negative rate? So those with little to no savings (many Americans) are left in a paycheck to paycheck cycle losing purchasing power. Those with access to the moresophisticated programs chained to debt, their leverage is increasing on the backs of the many. If growing an economy was as simple as digitally printing money I think central banks would have been on that years ago. Instead, it has become unfortunately a zero sum game where access to debt is used as a pawn to reshuffle real assets in the real economy to a smaller group of people (i.e., foreclose on homeowners, buy at fire sale prices, put it into a hedge fund, sell to Wall Street as a future income stream, rent it back to working Americans etc). It is very likely that we have lost control of the debt markets and those suffering are the people with the least access to it.

No comments:

Post a Comment