May 21, 2013

The Federal Reserve has created the perfect environment where savers are chastised and debt based spending is glorified. Our economic engine is powered by the fires of consumption. This has been true for many decades. What is different about our current space in time is the punishment savers are taking. Many banks through savings or even CDs offer rates that are hovering around the zero percent mark. Add in inflation of about three percent and you are actually losing money. The system is designed to punish any sort of conservative saving. The stock market continues to move up but it clear that most Americans simply do not have the funds to participate in this party. The current financial environment is really a perfect brew of punishing savers and encouraging debt based consumption. Will the elixir work this time around?

Spending into prosperity

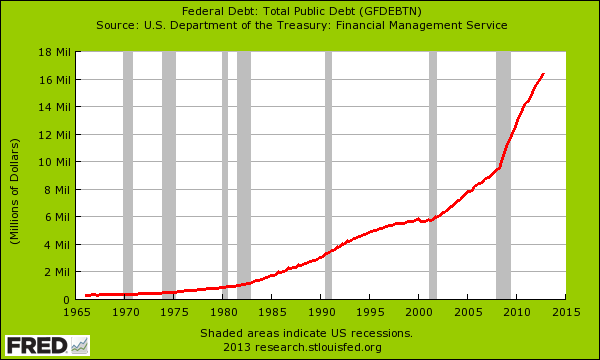

The US public debt is now above $16.73 trillion and continues to grow:

Spending more than is earned is a time honored tradition and it would appear but the Fed this time around has ballooned its balance sheet to well over $3.3 trillion. Banks are the primary beneficiaries here since they can leverage the low rates and speculate in the stock market and now the rental property market.

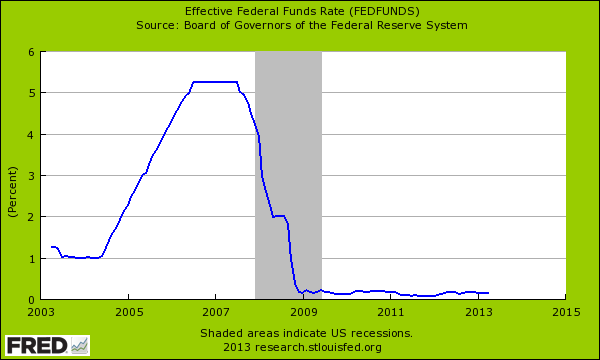

The Fed’s strategy on the interest rate front is rather obvious:

Zero or the highway. Unfortunately many are now accustomed to these low rates and an addiction has set foot. Short-term bursts of euphoria are somehow mistaken for success. For example, the Bank of Japan has taken quantitative easing to the next level by directly investing in stocks and stoking the fires of inflation. The short-term result? A massive stock market rally and inflation emerging. Yet one year or even two does not reverse more than two lost decades all the while quantitative easing was being implemented.

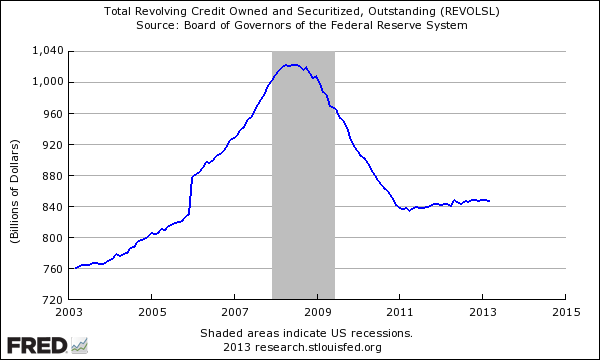

It doesn’t seem that US consumers are taking on much of this newly found cheap debt:

Americans are still pulling back from the recent financial crisis spurred on by our economic system taking on too much debt to begin with. The problem with this approach of course is what we are seeing with Japan. At a certain point, you run out of momentum and need to take things to another level. So in Japan, this has involved flat out stock market intervention by the Bank of Japan. The Fed has provided very easy liquidity to banks and this has filtered into the stock market and real estate once again. It isn’t entirely clear that Americans overall are benefitting. It is very clear however that savers are being punished.

There are few places to save and ride out this structure if you are conservative with your investments. US Treasuries, CDs, and money market accounts are basically losing value each year courtesy of inflation. The Fed wants you to spend whether you have the money or need to go into debt to accomplish the task. It is an interesting experiment since we have never been in this kind of uncharted waters.

There seems to be this idolization of debt based spending. The fact that some people don’t even blink when someone takes on $100,000 in student debt to go to college tells you a deeper story. Debt is the only way out. Saving in a bank is modern way of stuffing money under your tomatoes in your garden. Slowly time will chip away at the value of your dollars since the Fed is printing digital dollars and speculation erodes the “worth” of any money in its present form.

What is problematic of course is that it almost seems impossible for the Fed to move away from this low rate policy similar to Japan. The only course of action would be to continue down this road or to become more aggressive when easy money is played out. One thing is certain and that is we live in a time when debt is idolized and savers are shunned.

No comments:

Post a Comment