January 13, 2013

Gear up those printing presses. You might be thinking that some of the policy talk coming out today is from The Onion but no, the idea of a $1 trillion coin is being discussed. The Federal Reserve is already very willing to become a shadow bad bank and take on all the questionable assets from the latest bubble from member banks. As the middle class is crushed, our nation is becoming more polarized. You have a massively large group of people that are now classified as poor in the world’s wealthiest nation. We have over 47 million Americans on food stamps. Theaverage per capita pay is $26,000 much to the surprise of many people conditioned on only getting their data from the mainstream press. Those that deny inflation are not looking hard enough. The purchasing power for working and middle class Americans is being slowly destroyed. Europe is still facing major headwinds with Greece reaching a troubling new record with their unemployment rate. All this rhetoric means the Fed and ECB will continue on their path of quantitative easing and digital money printing.

Sequestering the working and middle class

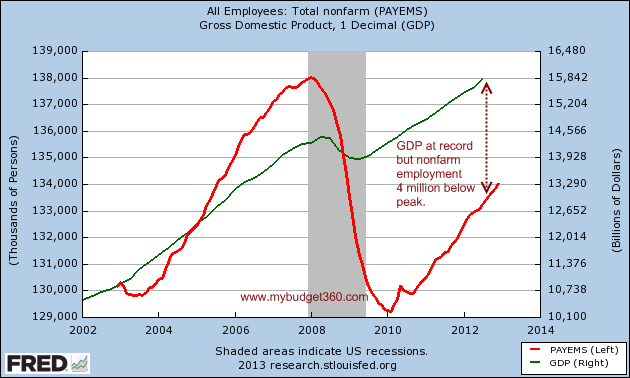

One of the major stories that was not reported during this crisis is that many companies used the economic crisis as a reason to lay off employees or slash wages. Yet by looking at GDP, you will realize that we are at a current peak yet nonfarm employment is down by 4 million from the previous peak:

In other words we are producing just as much with far fewer people. Where are these people now? Many of them are now on food stamps. Over 47 million Americans are receiving food assistance. Their voice is largely unheard and politicians have little incentive to recite their concerns. We are now stumbling from one crisis to another like a drunkard. Only a few hours after the fiscal crisis was diverted for the short-term we were then talking about the debt ceiling. This even inspired the idea of minting a trillion dollar platinum coin to pay off some of our national debt.

It would be comical if it were not so absurd. The GDP equation is rather simple:

GDP = private consumption + gross investment + government spending + (exports − imports)

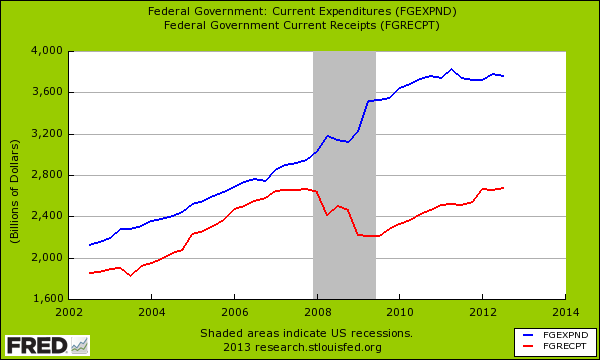

We’ve been going hog wild on the government spending portion recently. Take a look at the current government spending and revenues:

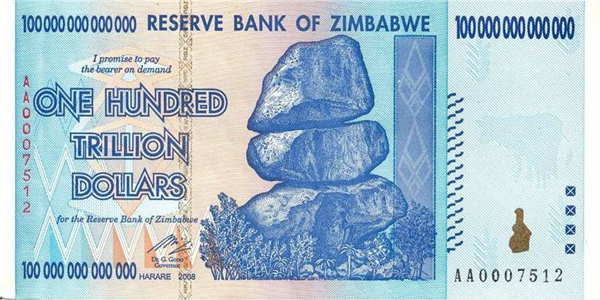

After the recession government spending ramped up dramatically to make up for the losses in revenue. But we are still spending at record levels while not taking in enough. We are running gargantuan trillion dollar deficits for as far as the eye can see. Maybe minting a few trillion dollar coins isn’t such a bad idea. We wouldn’t be the first nation to lead this charge. Zimbabwe already went down this road with a trillion dollar note:

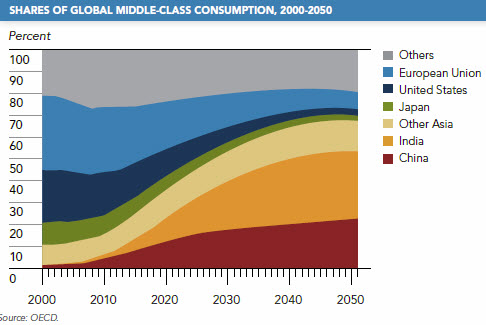

Nothing bad ever came from that right? The problem with the road we are leading in is that the US middle class is being crushed. Even projections for this are highlighted in many reports:

For the very wealthy, they don’t mind pursuing this global low wage system where they can squeeze dollars all around the planet. Do you want to work for $1,000 or $2,000 per year? This is the future for many.

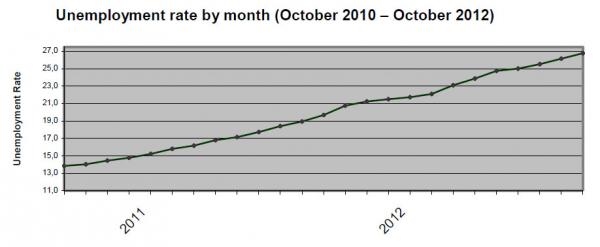

There really are no easy decisions. Take a look at a high wage system with cronyism in their government, Greece. They recently just reached a new peak unemployment rate of 26.8 percent:

Youth unemployment (15 to 24) is now up to 56.6 percent. So much for high unemployment suddenly creating a healthier marketplace and a fertile environment for the middle class. This sequestering of the middle class has been ongoing for a few decades now and has happened under both political parties. People need to wake up and pay attention to what is really going on. These massive increases in debt do come at a price. Maybe a trillion dollar coin is our sale price.

No comments:

Post a Comment