December 16, 2012

The fiscal issues facing the country are troubling for a variety of reasons but one big reason is the reality that many older Americans simply do not have enough money to retire. The idea of entering your golden years without the need of working is a relatively modern one. In fact, it was the generation that grew up after World War II that enjoyed this middle class ideal. A secure job, a paid off house, and the ability to send your children to a good college. That was the dream. Yet that dream is now largely gone in a puff of smoke. It has been gone for sometime but the ability to access unsupportable debt kept the party illusion going a decade or so longer. Today, Americans are now entering retirement at a time when the stock market has given zero returns over a decade. Government debt is tipping over and we continually spend more than we earn. For millions of older Americans, retirement means continuing to work.

The evaporation of a pension

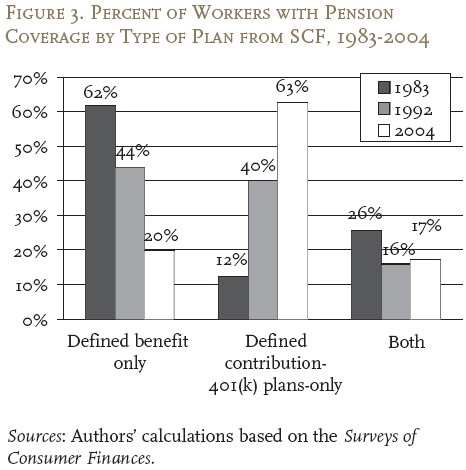

Back in 1983, not too long ago 62 percent of Americans had what we would call a pension. Today that figure is down to 20 percent:

That rate is now much lower if we had data on it since this research was done prior to the 2007 meltdown. The meltdown also brought to the forefront that unrealistic returns of 8 to 10 percent per year were mostly pipe dreams. The 2000s were largely a decade fueled byhigh debt spending. The real estate bubble created a sugar high that really did not add any deeper value to our overall economy. Many in fact tapped into their equity, a thought that would seem sacrosanct in the previous generation, and will now have to pay it back. In the past the ability to have a paid off home provide added security. Many then with a modest Social Security check had the ability to make ends meet. Many today continue to carry a mortgage well into older age.

This becomes even more troublesome because the majority of retirees depend on Social Security as their largest source of income. This ties in with the earlier chart. Even in the 1980s those with pensions likely had a bigger cushion when they combined this with Social Security. That is no longer the case. Today, most have the access to 401k plans and as we have seen, the market is back to levels last seen in the late 1990s. Also, those that built portfolios up during this time will need to sell to withdraw funds to live. Who will buy these funds? Younger Americans? Younger Americans are massively in debt and half are either working at jobs that don’t require college degrees, are underemployed, or have not job. The 401k is the least of their worries.

Less work and more college debt

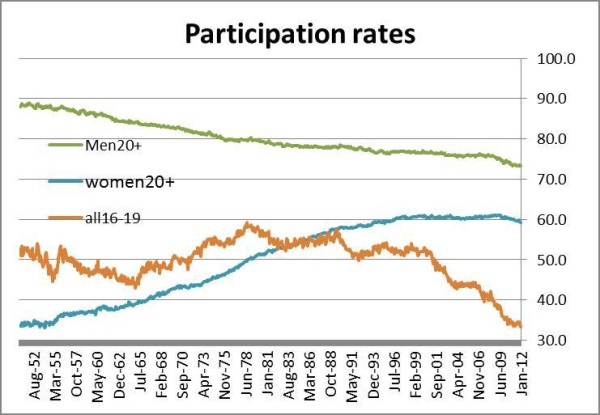

It is clear that education is valuable for many reasons. Yet with tuition costs being so high you have to ask whether it is worth it. Our overall participation rate in the workforce is dramatically lower for younger Americans:

Many are now competing with older Americans for lower level positions. You also have massive numbers of students going to college yet overall, a college degree has been watered down. You might ask, if younger Americans are poorer how can they afford record levels of college costs? They can’t. But what they can do is go into massive student debt. This is why today, total outstanding college debt is well over $1 trillion.

So think about this. You have an older population with 10,000 Americans hitting retirement age each and every day. Many will rely on Social Security at a time when we keep going into deeper debt. You then have younger Americans with a large portion already in deep college debt working jobs that largely do not pay a good wage and the days of a pension are all but gone. It should be no surprise why we now have 47.7 million Americans on food stamps.

How will America adjust to this world with no retirement or with the idea of what we once thought of as retirement? It isn’t a question we need to ponder much since we are going to find out in real-time.

No comments:

Post a Comment