September 8, 2012

If you look around your daily life you realize that your purchasing power is losing value. For a few decades now the middle class in the United States has demonstrably shrunken like clever food packaging. Over the last forty years we have lost 10 percent of our middle class. Most have fallen into the lower income bracket and now with a record 46.5 million Americans on food stamps, you have to wonder what kind of new economy we are entering into. Since household incomes have gone stagnant for well over a decade, any increase in price on one item will definitely impact the cost of other goods. In the end the purchasing power of Americans is falling. Did you notice that in the last few days our federal government debt went over $16 trillion? The media ignored this milestone assuming the public just doesn’t pay attention to headlines with the word trillion in it.

A rise here and a clever package there

As many of you know American household incomes have gone stagnant for over a decade. When the cost of something goes up and disposable income goes sideways, many will need to make the choice to substitute goods or companies will get creative. In a certain degree we are dealing with a modern stagflation. Take a look at this:

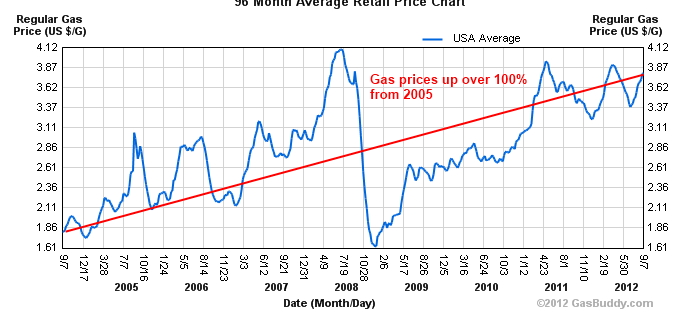

The top contains about 15 percent fewer crackers. So it isn’t necessarily that people are not buying these items anymore but are shifting their preferences. Without a doubt some categories like health insurance and college tuition have gone into a bubble like price rise while incomes stagger along. The cost of fueling up in our car addicted nation? Take a look at what has occurred since 2005:

Gas prices are up over 100 percent in this short timeframe. That household making $50,000 per year in 2005 is still making $50,000 in 2012 but is seeing a larger chunk of their disposable income being sucked into fueling their automobiles.

But stagnant wages means less money for other items and some other items have seen prices cuts like Folgers Coffee for example and Procter & Gamble Company rolled back $400 million in price increases made in the last year. These are simply examples of companies responding to the current marketplace. You also have places like Family Dollar that have done exceptionally well catering to the now massive 46 million customers that receive monthly food assistance. Is this really the definition of success?

Paying more for less

Probably in no other category is the destruction of purchasing power being seen than in higher education. There is no doubt higher education is in a bubble:

“(BusinessWeek) If student loans are good debt, how do you account for the reaction of Christina Mills, 30, of Minneapolis, when she found out her payment on college and law school loans would be $1,400 a month? “I just went into the car and started sobbing,” says Mills, who works for a nonprofit.”

A couple of points. First, when you come out with massive loans by default you are unable to afford your education especially when your initial income can’t even service the monthly minimum payment. The question then becomes, where does this money come from? Since the government and banks are tied at the hip, similar to what occurred in the housing bubble, loans are being made without the thought of how these borrowers are going to pay the money back. The banking industry doesn’t care since this money is federally backed. This is the same formula used in the housing market. What happened to prices there?

“Then there’s Michael DiPietro, 25, of Brooklyn, who accumulated about$100,000 in debt while getting a bachelor’s degree in fashion, sculpture, and performance, and spent the next two years waiting tables. He has since landed a fundraising job in the arts but still has no idea how he will pay back all that money. “I’ve come to the conclusion that it’s an obsolete idea that a college education is like your golden ticket,” DiPietro says. “It’s an idea that an older generation holds on to.”

How is it even possible to get $100,000 in loans for a fashion, sculpture, and performance degree? It is possible because banks, schools, and the government are all part of this giant machine that is essentially allowing young Americans to go into massive debt for degrees that have little merit in the economy. This is no free market but a crony based system that extracts rents from the working and middle class and makes the CEO/Presidents of these schools wealthy while banks skim cash paying out million dollar bonuses and the government (that is the public) serves as the sucker when things go bust.

“So maybe the real problem is that credentialism has trumped learning. That drives people to get degrees simply to displace others who don’t have degrees, says Richard Vedder, who directs the Center for College Affordability and Productivity. He notes that the U.S. has more than 100,000 janitors with college degrees and 16,000 degree-holding parking lot attendants”

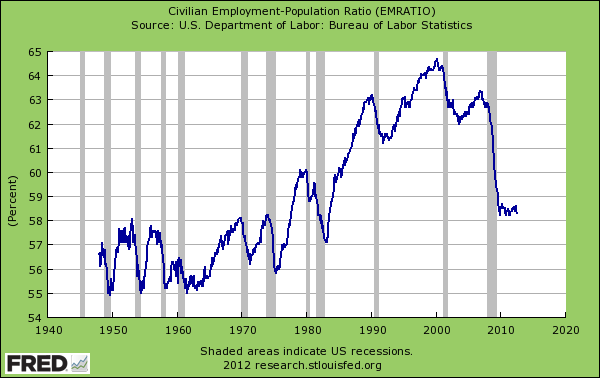

So we continue down this path of inflating our way out of the massive debt we now find ourselves in. The markets are now back to levels last seen in 2007 yet we now have 46 million people on food stamps and our overall workforce participation rate looks dismal:

Do you hear that sound? It is the Federal Reserve gearing up to go into QE3 to inflate our way out of this mess and help their banking buddies. Don’t be confused this political season with the massive number of millionaires in Congress. They work for big money and all you need to do is examine the data to find out what is really going on.

No comments:

Post a Comment