September 11, 2012

All jobs are not created equal. It is unfortunate that last month the drop in the unemployment rate was largely driven by hundreds of thousands of Americans simply dropping out of the labor force. Not exactly a way to build the middle class but to many it gives the false impression that things are getting better when they are largely treading water. Also a more trying sign of the times, a survey showing of the three million people that lost jobs between January of 2009 and December of 2011 with longer-term employment, roughly half that found a new job were making less than they once did. In other words, these people now have jobs but at the lower wage side of the scale. This also helps to explain why so many Americans are living day to day while facing the increasing cost of daily goods. It is hard to believe that for over a decade, the median household income has fallen for Americans. Young Americans are fully aware of the challenges the current economy faces because they are encountering it both in lack of savings and massive debt for college.

Replacing higher paying jobs with lower paying jobs

An interesting article highlighting this dramatic shift to lower paying jobs gives a few examples:

“(MSNBC) Michael Scarbrough, 47, made a six-figure salary for years, selling heavy construction equipment in the Atlanta area. Sales dried up in early 2009 as the housing and commercial construction market plummeted.That’s when the family’s finances slowly began to slip. He and his wife, who have a 6-year-old son, lost their 3,200-square-foot home, their Hummer, their Corvette and most other vestiges of their more affluent life. They eventually were forced to turn to food stamps and government–subsidized housing.”

This also highlights the massive impact on consumption. From making six-figures to being one of the 46.5 million Americans on food stamps. Fortunes can change dramatically and in a hyper consumption based economy, things can turn south quickly caring a profound ripple effect.

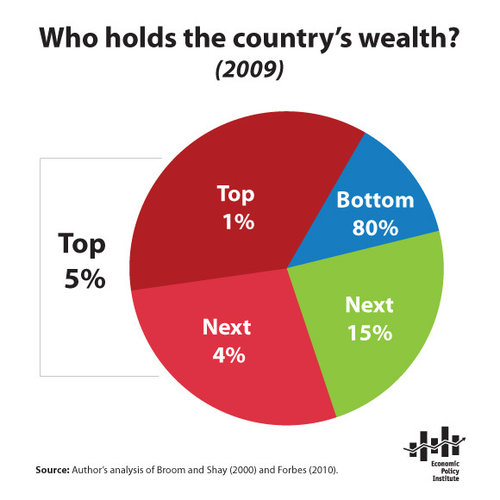

In the last few years it is important to note that the top 20 percent did increase their wealth while the bottom 80 percent dropped rather significantly. Wealth is distributed as follows:

The problem with credit bubbles is that they create an enormous system that misallocates capital. When the bubble pops as they always do, the misallocation becomes painfully apparent. In the example above, it is hard to imagine how someone can make six-figures for many years and then suddenly lose it all in a few years. Atlanta is a cheaper part of the country when it comes to housing so you have to wonder where the savings went. Keep in mind that 1 out of 3 Americans has no savings. Of course the article mentions a Hummer and a Corvette and these aren’t exactly economical cars. So once the bubble popped, the artifacts of the bubble remain and you also see how poorly capital was being allocated when easy access to debt was the main vehicle to growth.

From $70,000 a year to nothing

Another example was given:

“The commute was about to become a memory – Vavrek had just learned that he was going to lose the $13-an-hour contract job he’d landed about a year and a half ago. It had been a big financial step down from when he made $70,000, plus a bonus, several years ago, but at least it was a paycheck.”

This recession has really taken a major hit to the middle class:

The middle class shrunk by 10 percent in the last decade. A bulk of these people went into the lower income category while the other group moved into the upper-income tier. We are starting to lose what many have come to associate with America and that is a strong middle class. Now we have sites like Rich Kids of Instagram that post pictures of rich youth spending $5,000 a bottle on Dom Pérignon champagne while 46.5 million Americans wait patiently each month just to get their EBT cards refilled with funds from the government.

Most Americans are unsatisfied with their government because they realize that there are little good choices ahead. Many are struggling just to get by on a day to day basis and are trying to live out a life that might have been more designed for America post World War II. The baby boomer generation has vivid visions of this and many did not adequately prepare for retirement. While they struggle they also have the employment experience that many younger Americans are fighting to get. It isn’t exactly clear that those positions will be filled with younger Americans. Many of the new jobs being created require an entirely different set of skills.

We discussed in a previous article the resurgence of stagflation and it is certainly beginning to feel that way.

No comments:

Post a Comment