August 16, 2012

The extremes in the US have gotten more pronounced in this economic crisis. It is hard to imagine a country where 46 million people are living with the assistance offood stamps while 6 of the 400 top income earners pay no federal tax. I’m sure that just like most Americans you pay your fair share of taxes. Of course the real burden has fallen on the middle class since the recession hit in 2007. Most of the ultra-wealthy have their money vested in the stock market and since the lows in 2009, the market is up well over 100 percent. The number one asset of the middle class in housing is still down over 30 percent from the peak and is trying to squeeze out a gain in 2012. So you ask who in reality is paying for all these bailouts and transfer payments? A massive amount of the burden is falling on the middle class and debt.

How are we paying for all this?

As we have mentioned, we are running trillion dollar deficits since we don’t have the money to pay for all of our expenses in defense spending, interest payments, Medicare, Social Security, food stamps, banking bailouts, and all other large ticket items. In interesting data released by the IRS, it was noted that more than a quarter of people that earned an average of $200 million or more in 2009 paid less than 15 percent of their adjusted gross income in taxes. The odds are you pay a much higher rate once you include payroll taxes and all the other taxes you pump out through daily expenses (i.e., sales tax, etc).

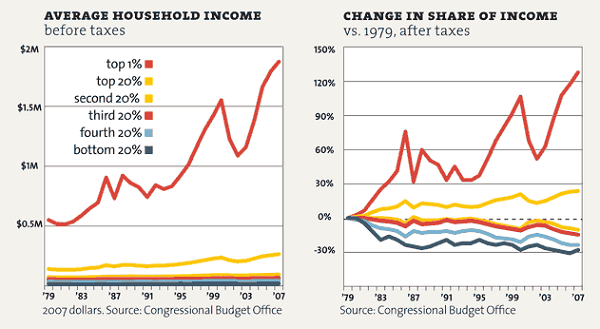

One thing is rather apparent and that is in the US the extremes are getting even more exaggerated. Take a look at the number of folks on food stamps:

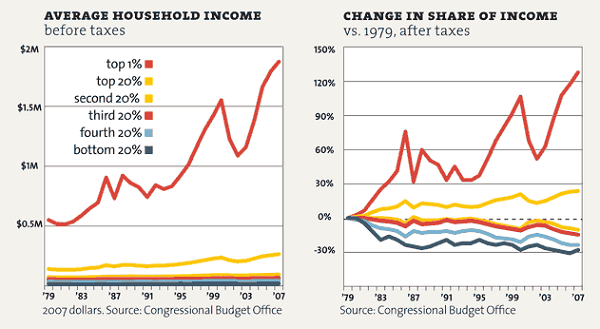

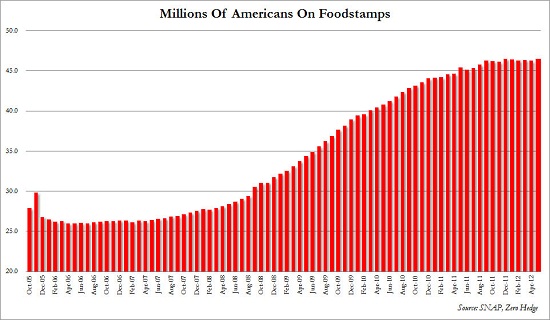

You are not looking at the 100 percent stock market rally since 2009 but the massive increase in people on the verge of poverty. Is this really a recovery? This group of course does not have the organizational power or money to fund media campaigns but they do exist. There are even industries that have boomed because of this trend. At the same time income inequality has reached incredible levels:

Source: Mother Jones

The very wealthy have grabbed the bulk of the income gains in the last three decades. A large part of the “new” economy has come from the finance, insurance, and real estate side of the economy that has largely operated as a spigot to siphon off funds from the productive side of the economy. The major bailouts to the financial institutions cost taxpayers trillions of dollars in direct and indirect costs. The direct cost was the trillions of dollars in lost home equity as the bubble popped but this did little to alter the financial bonuses many on Wall Street received even as their banks imploded in front of our eyes. Those bonuses and paychecks kept flowing thanks to the bailouts while many middle class Americans lost their jobs.

Worker productivity has risen but little of the gains have gone to workers. Most have used the economic crisis and high unemployment to become more competitive by creating a culture of low wage capitalism. That is, the vast majority of Americans need to compete through fierce competition taking what they can in a system of predatory capitalism while those in the connected financial sector merely use politicians as a line item expense on their crony business models. It is no coincidence that we now have a rise of millionaire Congressmen. In other words, the very poor have food stamps while the ultra rich have welfare bailouts. The only difference is the price tag.

We largely created a stifled system. The Federal Reserve is shifting the cost of the financial crisis on the backs of the middle class. Do you really think the wealthy bankers that created many of the products that destroyed the system will be paying for the bailouts? Of course not. The growing pool of poor Americans by definition rely on transfer payments so the money has to come from somewhere else. Even with the current system, we are unable to meet all these payments so we simply run massive deficits. Does this sound sustainable?

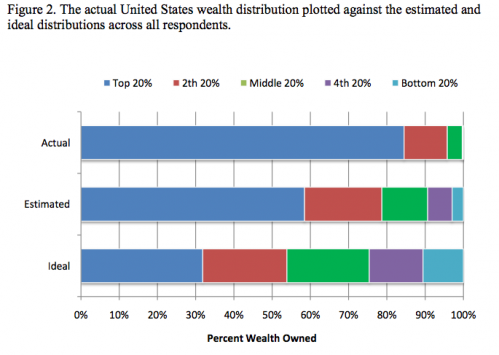

Interestingly enough most Americans when surveyed from both political parties would rather have a more balanced system:

Most Americans realize that wealth will be divided unequally. In a recent survey many Americans stated an ideal situation would be where the top 20 percent owned over 30 percent of all the wealth. The estimate was that this group held nearly 60 percent of the wealth. In reality over 84 percent of the wealth is held here. As you see from the chart above, the bottom 20 percent don’t even register (and likely show up on the food stamp chart).

Is this really the kind of recovery we want? Low wage jobs, rising college costs, expensive healthcare, costlier food, and uncertainty for Social Security. This is what happens when you have extremes at both ends of your economic system. Americans overall are strongly in favor of having a strong middle class yet the message is distorted by those trying to keep the status quo going. A good rule to go by is follow the money.

No comments:

Post a Comment