August 1, 2012

The market is perched on the edge of a chair looking out for what the Federal Reserve and European Central Bank have to say. The almighty Oz is the only game in town. With the Fed, the expectation is of some sort of additional quantitative easing to prime the economy once again whereas the market is looking for some big sort of action by the ECB to keep the Euro together. One thing is certain however and that is we are now in a bailout bubble. The markets are now managed proxy systems of the too big to fail banks. The system has been very effective in siphoning off wealth from the middle class of many countries and creating massive wealth discrepancies that have not been witnessed since the Great Depression. Many in the public are woefully uninformed since rarely is this analysis leaked out in the media. Yet as we go down this road, it is becoming more obvious that to keep this system going, more and more bailouts are required.

Hunkering down

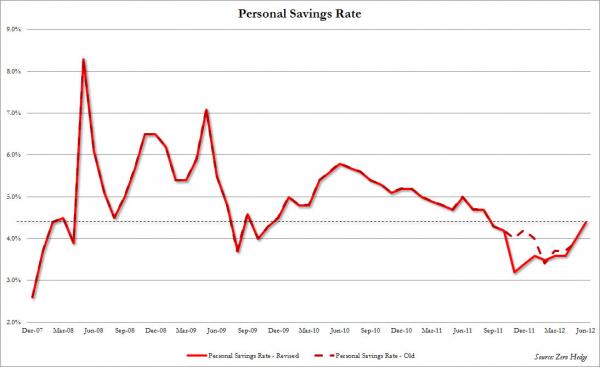

US households continue on the path of deleveraging. The personal savings rate is ticking back up which is not necessarily a good sign for an economy so reliant on spending:

Many Americans are finding their borrowing constrained as due diligence is now performed on the market. You have 46 million on food stamps so it is unlikely this group is a market to lend to. You have a large aging population that is probably a group that is unlikely to receive long-term loans. And younger Americans are already saddled with massive student loan debt. What group is willing to go into massive debt here?

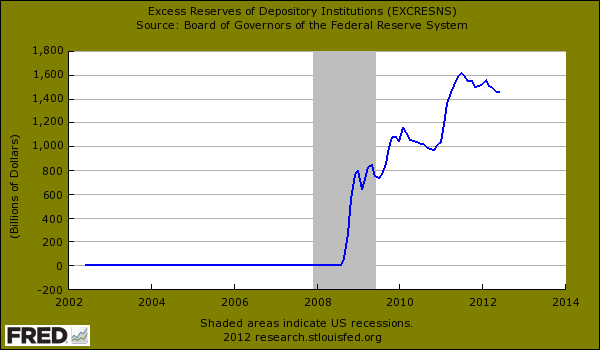

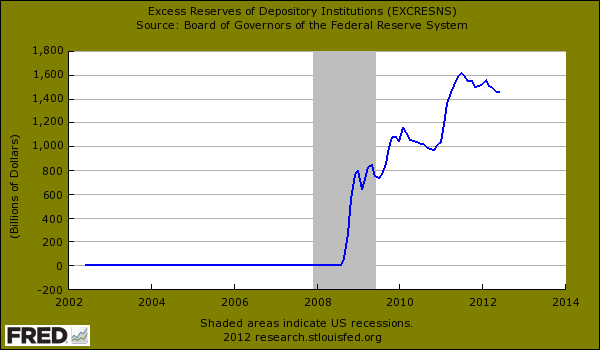

The average per capita income is $25,000 so banks are simply hoarding the money to repair their badly hurt balance sheets:

The irony of the above is the Fed needs to shell out interest on these excess reserves. Now the interest paid is only .25 percent but on a balance of roughly $1.5 trillion it works out to:

$3,750,000,000 annually

This is money that banks can easily put into work by lending to Americans but instead keep them held as excess reserves with the Fed. It is essentially a closed feedback loop that allows these banks to get bigger on the action and work of the real economy. If you look back even just a few decades, banks were set to be a proxy of aiding the real economy. Today, we have a large financial sector that essentially strips profits from the real economy.

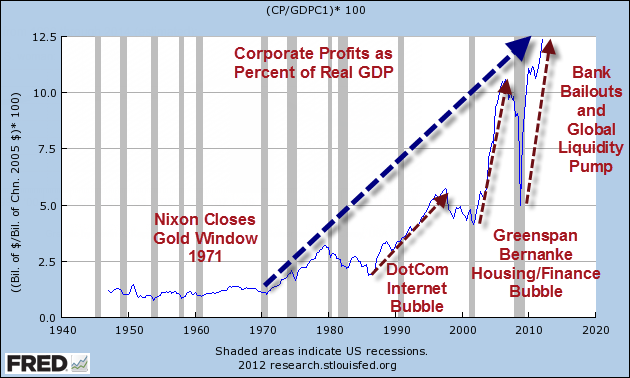

The bubble pathway is rather apparent:

Source: Global Economic Analysis

Corporate profits as a share of GDP are now at record levels while we have high unemployment, lower paying jobs, and a massive number of Americans on transfer payments. So how are these profits achieved? By allowing giant loopholes to avoid domestic taxes, bailouts that provide gambling funds to spend in global markets, and leveraging US Fed power to garner profits in lower cost markets. This is anything but a free market yet the analysis presented to the public is that this is just the way things go. Austerity for you, bailouts for us. The banking system is unfortunately too big and is extracting economic rents from sectors that would actually benefit the public more.

It is likely that there will be no movement on enforcement with teeth in 2012 being an election year. From one bubble to another but the big difference here is that this bubble is targeted directly to the financial sector.

No comments:

Post a Comment