May 1, 2012

If you inject money out of thin air into thebanking sector but no quality jobs emerge, is the result a success? The bailout mission statement revolved around keeping credit available for the American public. The absolute opposite has occurred. A massiveinternal credit deleveraging has been taking place but the banks have simply hoarded the money like a squirrel hogging all the nuts. The public is dealing with a great deal of austerity in the form of higher inflation in daily good items and an employment market that is extremely constricted. The issue continues to be that we are treating this crisis as one of liquidity when it has always been one of solvency. What function is it giving a bank billions of additional dollars if there are so few qualified people to lend to? We even see this restriction of money circulation when we examine the velocity of money. We are simply injecting more debt into the economy with decreasing results. Higher energy, food, healthcare, and other daily goods have risen beyond the average paycheck of most Americans as a consequence.

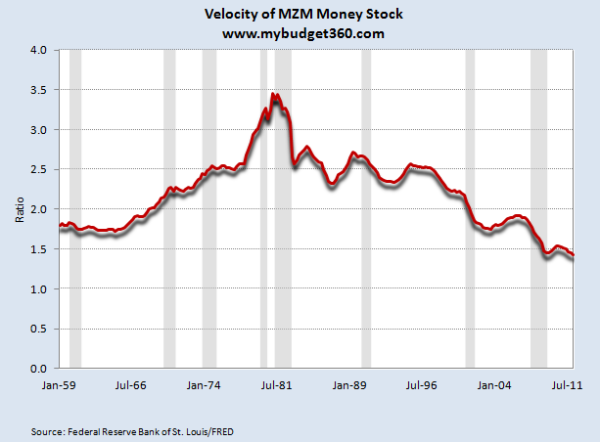

Chart #1 – Velocity of money

We are getting less bang for each buck that is being injected into the economy. Sure, we can promise unlimited amounts of debt to the public but you have to have actual production to back this up. Need we remind you of the people with $20,000 annual incomes buying $500,000 and $600,000 homes? Being able to finance your debts is core to our global economy. You see what happens when this breaks down. Banks are willing to lend in today’s market but they are now performing due diligence. And guess what? Not many are qualified to borrow. So the money sits earning interest for banks while more debt is chasing the same amount of goods. If simply printing money was a good thing the Fed’s trillion dollar spending spree would have made this nation much richer instead of bankrupting the middle class through a hidden tax with inflation. If you examine the above chart, the velocity of money has come to a screeching halt yet here we are bailing out banks only so they can give each other multi-million dollar bonuses for essentially passing on bad losses to taxpayers.

Economist Paul Samuelson was quoted as saying:

Read the entire article“In terms of the quantity theory of money, we may say that the velocity of circulation of money does not remain constant. “You can lead a horse to water, but you can’t make him drink.” You can force money on the system in exchange for government bonds, its close money substitute; but you can’t make the money circulate against new goods and new jobs.”

No comments:

Post a Comment