MyBudget360.com

November 9, 2011

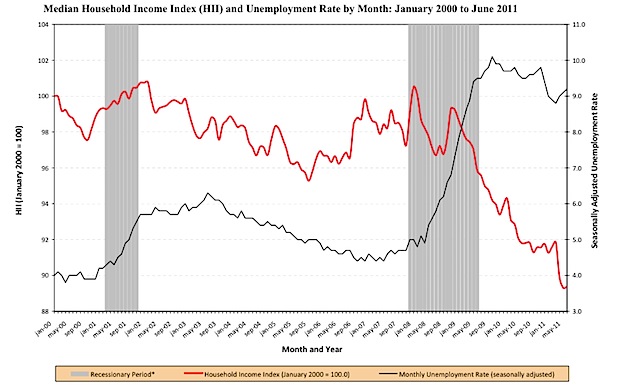

Some incredibly disturbing data was released this week showing the continuing crushing body blow to the American middle class. What was striking was that middle class incomes have fallen faster during the supposed recovery from June 2009 to June 2011 than they did in the actual recession from December 2007 to June 2009. Why? First, the recovery has largely occurred with the top one percent where much of their wealth is derived from the stock market. The market has rallied significantly from the lows in March of 2009. Yet the vastmajority of Americans, those with any net worth, draw a large part of their true wealth from home equity. The housing market is still mired in problems and never experienced any sort of recovery and in fact, is aiming for a second leg down. Two charts highlight this dramatic predicament.

Middle class families take a larger hit during the economic recovery

This chart is probably one of the more telling charts I have recently seen:

Source: Sentier Research

And then the jaw dropping data:

Read the entire article“Real median annual household income has fallen significantly more during the economic recovery period from June 2009 to June 2011 than during the recession lasting from December 2007 to June 2009.”

No comments:

Post a Comment