July 24, 2011

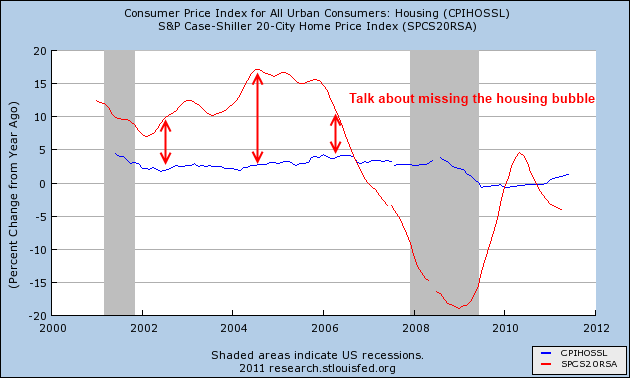

Things seem to be progressively getting worse for the middle class as most of the debt ceiling talks revolve on sticking it to working Americans as if they were financially able to handle any more austerity moving forward. While the too big to fail banks swim around in pools of bailout money like Scrooge McDuck both sides seek to squeeze more pennies out of working class Americans. One way that the middle class has been hammered over the past few decades comes from the way we measure inflation. The CPI measure through the Bureau of Labor and Statistics does not even examine actual home ownership carrying costs and uses a very open method of calculating home costs by using an owner’s equivalent of rent. This is why during the most obvious housing bubble in history home prices seemed to be increasing at a moderate pace according to the CPI while the more accurate Case Shiller Index was registering annual increases of 15 percent or more. This is important because so much rides on accurately measuring inflation in our country and more is trying to be done to stifle information that reflects the real changes to our overall economy.

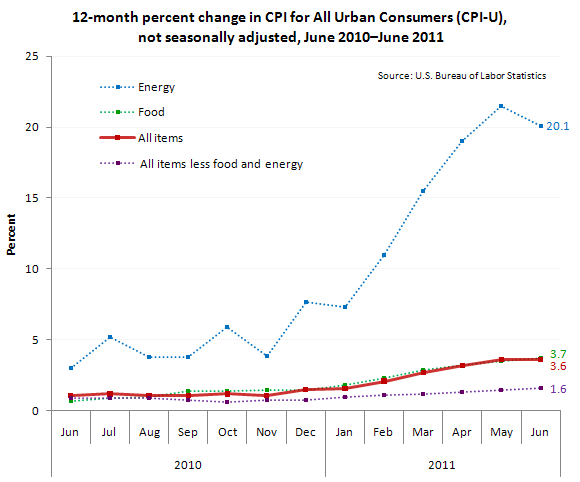

Inflation growing slowly if we exclude food and energy

Click on Image to enlarge

This is such an important item to look at because so much rides on this measurement. The Federal Reserve based much of their low rate Fed Funds policy on the notion that no inflation was occurring in housing that was out of the norm. It was clear that even early in the 2000s home prices were already far outstripping the overall CPI measure. We can say that this was merely a once in a lifetime bubble and we have now learned our lesson. But even with the full acknowledgment of the bubble, nothing has been done to fix the measure! In fact, there is now a push to use a “chained CPI” that will make inflation seem even lower moving forward:

“(WSJ) One proposal in the budget talks that is getting a serious look from all sides would switch the government’s way of measuring inflation and delivering a big impact on tax, spending, and entitlement programs.It should be no surprise that both political parties are onboard on this move since they are simply looking at ways to simply chop at the middle class while protecting the financial elite. All of sudden these people have conservative attitudes toward finance yet were funneling trillions of dollars to banks with no abandon.

How big? It could save roughly $300 billion over 10 years. That big.

The idea of using this different measure of inflation, known as a “chained” Consumer Price Index, has won support from numerous deficit-reduction commissions as well as many liberal and conservative economists.”

Read the entire article

No comments:

Post a Comment