The disappearance of the middle class will not be televised. Don’t expect your favorite talking head to relay this information to you. At the core of our economy we have become a consumption nation. This necessarily isn’t negative if we were to balance out the opposite side of the equation with adequate savings. It would be one thing if the working and middle class were consuming with money that they had earned. Instead for over a decade many Americans have used massive amounts of debt in mortgages, credit cards, and student loans to finance things they simply could not afford. Unfortunately this game is up and many are now feeling the financial pangs of a country where the working and middle class are marginalized and government policy is geared to exaggerating the inequality especially in the financial sector. Recent data shows that of current retirees, 60 percent have $49,999 or less saved up in retirement plans. This coincides with other data showing that the average per capita worker makes $25,000. You have those that can save and those that will rely purely on Social Security when they retire.

Debt built economy

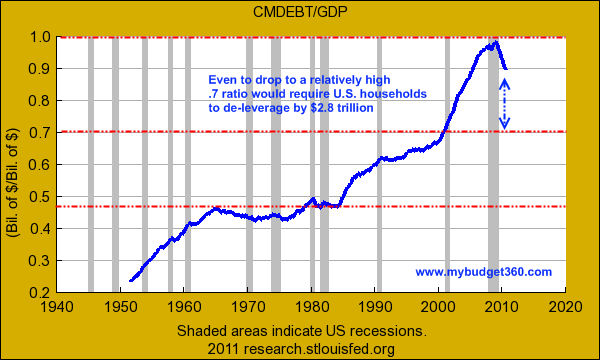

The rather prosperous years of the 1950s and 1960s saw a burgeoning of the U.S. middle class. As the chart above shows, we were producing much more than we were taking on in debt. The above reflects housing debt divided by GDP. A lower ratio is powerful because it signifies more production than debt induced spending. This isn’t to say that all debt is bad because it isn’t but relying on debt as much as we have is financially irresponsible. Keep in mind this does not signify that people are spending less. It merely shows that households starting in the 1980s significantly started relying on debt to make up for the loss in overall production and actually spent more money than they really had. These macro trends take years to play out and we are now seeing the end result with our middle class slowly disappearing like a sunset over the mortgaged horizon.

Read the entire article

No comments:

Post a Comment