May 30, 2011

Central banks provide a mystical approach to solving economic problems although they were initially created to solve short-term financial panics. The first central bank was the Bank of England which was established in 1694. It started out as a private institution but eventually took on a monopoly over all banks in England (all private banks either joined or were forced out). The allure of the system is to even out the panics by centralizing power in one place. The central bank of the United States came over two centuries later in 1913 as the Federal Reserve. The Fed has a mission to help moderate inflation and keep unemployment in check. But what happens when the central bank goes from main protector of the economy and becomes a large reason for the financial problem itself? There is little debate that monetary policy at the hands of Alan Greenspan led to the housing bubble. The subsequent bust is leading to our current financial problems. What people forget is that the Fed is designed to protect the banking system even if this is contrary to the overall success of the economy and most people.

Fed balance sheet expands to record size again

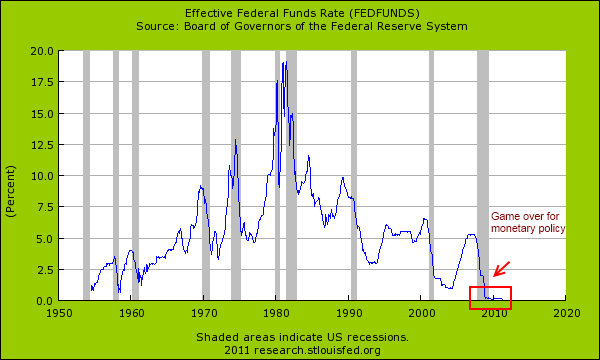

Prior to the current financial crisis the Federal Reserve controlled financial panics primarily through the discount rate and the Federal Funds rate. These two tools of monetary policy were typically enough to even out certain bumps in the road, even it was only temporary. Yet monetary policy is worthless when interest rates hit zero:

Hitting the zero bound renders the discount rate and Fed Funds rate weak or even ineffective in managing banking disintegration. So Ben Bernanke decided to open up an alphabet soup of new programs like the Term Auction Facility (TAF), Term Securities Loan Facility (TSLF), and the Primary Dealers Credit Facility (PDCF) to help the banking system. So how did these programs work? Before this financial crisis the Fed was rather particular in what collateral it would exchange for U.S. Treasuries. The above programs and many others opened the door for member banks to dump their toxic collateral into the Fed balance sheet in exchange for U.S. Treasuries. If this sounds like a suspicious way of doing business, (that is bailing out bad bets from banks) then you would be right. That is why even in recovery the Fed balance sheet is up to a new record:

“(Reuters) The purchase was part of its $600 billion program, dubbed QE2, aimed at stimulating investment and economic activity.

The balance sheet — a broad gauge of Fed lending to the financial system — expanded to $2.759 trillion in the week ended May 25 from $2.742 trillion the prior week.

The central bank’s holding of U.S. government securities grew to $1.519 trillion on Wednesday from last week’s $1.495 trillion total.”

It is nice to see this make a headline in the press, although a very small one and not with much splash. Ironically it is inflation that the Federal Reserve has caused even though it claims that this is something it fights against:

Source: DollarDaze

If you look at purchasing power of a dollar in 1800 and one in 1900 you see that it was relatively stable over time. Only after the Fed took hold in 1913 did we see a steady decline of the purchasing power of the U.S. dollar.

Read the entire article

No comments:

Post a Comment