What would happen if home prices remain stagnant for another decade? It is hard to imagine that the cornerstone of the American dream would somehow become a bad investment for the next decade.

For decades every generation was conditioned into believing that housing was the best investment a family could make. For many it provided a stable home for retirement once the mortgage was paid off. One third of all homes in the United States that are owner occupied have no mortgage. Yet this mindset of buying and paying off a mortgage has largely been lost. No mortgage burning parties in the digital age.

It may be making a comeback not because people want this but because there is no other financial choice. Given the current domestic and global trends, it is likely that housing will be suffering another troubled decade from 2011 to 2020 just like it experienced from 2001 to 2010. I want to lay out six charts as to why I believe housing will have difficulty moving up in price in the next ten years.

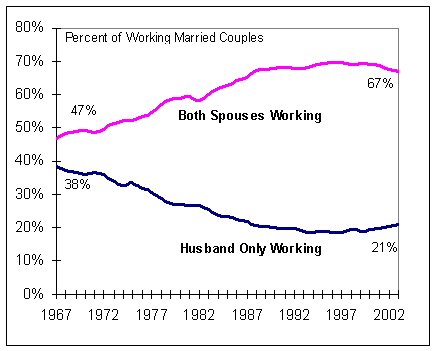

Chart #1 – Dual income households peaking

One of the big reasons many families did not feel the deep pinch from 1970 to 2000 was because of the rise of the dual income household becoming the standard. It should be obvious that with more incomes under one roof purchasing power would increase.

Yet this is really where we start seeing the loss of the middle class. What used to be a path accomplished with one blue collar income now required two incomes. Yet as the chart above highlights we may have hit a plateau in terms of dual income households as a percentage. In the late 1960s 47 percent of households had both spouses working. In the early 2000s it was up to 67 percent.

Read the entire report

No comments:

Post a Comment