The American banking industry is trying to convince the public that simply by hiding bad debts in the deep levels of corporate balance sheets that taking on leveraged risk is somehow safe. FDIC insured banks currently have $7.4 trillion in actual deposits, much of it covered by the Deposit Insurance Fund (DIF). Most Americans think that there is a “fund” similar to the “Social Security Trust Fund” to protect their hard earned savings but in reality the DIF is empty. The DIF is running on fumes and inspiration. Banks are trying to fool the public that somehow the Fed and FDIC backed institutions largely of the too big to fail variety, can simply print or hope money into existence like wishing mules would turn into magical unicorns. Most understand even at an instinctual level that something is wrong here. Even the king of the Ponzi scheme Bernard Madoff called the current structure the biggest of Ponzi schemes. He should know.

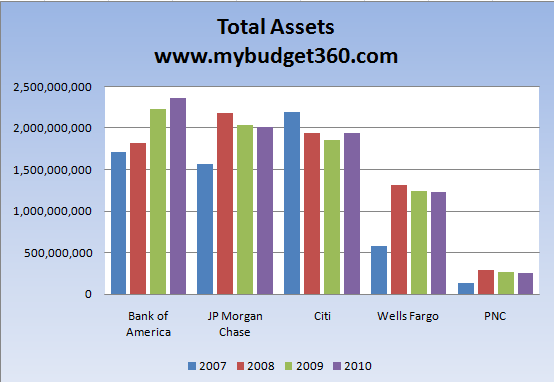

Too big to fail get bigger

Source: Individual 10-Ks

Read the entire article

No comments:

Post a Comment